Apple poaching Google AI talent, tech's return to being "mission-focused" and the latest in the Chip Wars

Last Week's News #1

Hi folks, Patrick Ryan here from Odin.

We build powerful tools for VC’s, angels and founders to raise and deploy capital seamlessly.

I’ve decided to try something new. I’m calling it “Last Week’s News” (working title).

Think of it as the lazy way to find out what’s happening in tech… with enough analysis thrown in to ensure you sound smart at dinner parties.

I’ll continue to publish longer-form pieces periodically, but I’m aiming to make this a regular weekly piece.

Headlines

Raiding the sweetie jar

Apple appears to be poaching top AI talent from Google at quite some pace (the FT). Of the big tech companies, it has been quietest on the AI front.

This approach to hiring is unsurprising on the one hand, and the way the data is presented can be misread.

I’d imagine Google have waaaay more AI talent than Amazon, Microsoft, Netflix, etc - they’ve been investing in this sector for far longer than other big tech firms (via the acquisition of DeepMind, plus internal teams like Google Brain) - so it isn’t surprising that they’re a top source of AI talent for Apple.

At the same time, it is interesting to see, especially given Googles’s recent blunders in AI (racially diverse nazis etc.). It’s not like OpenAI, Anthropic, Mistral, etc. are bleeding talent.

Winds of change

Google does, nonetheless, appear to be quietly making moves the market likes.

They recently announced record profits, their first dividend, plus a share buyback, all of which saw their share price jump 10% in a day.

And, perhaps more interestingly, they may have “finally grown a spine”, in the words of Mike Solana at Pirate Wires:

“Earlier this month, after a dozen employees locked themselves inside a manager’s office and refused to leave until their company ended the war in Gaza, Google called the cops and had them all arrested. Then, along with dozens of their friends, who also considered it perfectly acceptable to perform various acts of “civil disobedience” within the halls of the actual company where they “worked,” the degenerates were fired. But the real surprise came last week, at the end of another one of CEO Sundar Pichai’s nothing-statements on AI, in which he introduced the company’s new “mission-first” philosophy. Google, he wrote, “is a business, and not a place to act in a way that disrupts coworkers or makes them feel unsafe, to attempt to use the company as a personal platform, or to fight over disruptive issues or debate politics.” While a relatively benign statement to the untrained eye, this was in fact a stunning departure for the House That Built Crazy, and so we arrive, some seven years after its clownish incarnation, at the conclusion of tech’s “bring your activism to work arc,” in which a silent majority of kind, hardworking idealists were bullied into submission by a minority of actual psychopaths clawing for workplace power behind a cloak of virtue.”

This is part of a broader trend that has been underway for a couple of years, famously initiated by Coinbase’s Brian Armstrong. Tech leaders are increasingly asking employees to leave their politics at home, and focus on the company’s mission at work.

It seems to be a change most employees are welcoming. Nature is healing.

Chip Wars

US chipmaker Micron has secured $13.6 billion in government funding and loans to build memory chip factories in New York and Idaho. This is all part of the US government’s plans to reduce dependency on Asian chipmakers and slow China’s progress on AI, introduced with the 2022 CHIPS Act. The Act provides capital for domestic chip manufacturing, R&D, workforce development and supply chain security.

The global microchip industry and supply chain is dangerously, insanely concentrated. It revolves around less than ten companies. This tweet pretty much sums it up:

For the uninformed, here’s a quick primer:

OpenAI runs on Nvidia chips (as does every other AI company raising billions right now).

All Nvidia AI chips are made by Taiwan’s TSMC, which fabricates about 61% of the world’s microchips and as much as 90% of the high-end ones. They’re often designed by other firms (alongside Nvidia there are firms like Intel, AMD, Qualcomm, Samsung and Apple), but they’re mostly made by TSMC.

In turn, TSMC is extremely reliant on ASML, a Dutch company, who are the only producer in the world of the machines TSMC uses to fabricate its chips. These machines use light to print on silicon wavers atom by atom through a process called photolithography, and cost about $380 million a pop. Unsurprisingly, the US government is restricting ASML’s ability to supply new machines to Chinese chipmakers, and also wants to prevent it from servicing broken machines.

ASML are in turn extremely reliant on a number of suppliers for specific parts, including a German high-end lens manufacturer called Zeiss (they actually own a significant equity stake in its tech subsidiary).

And, to bring things full circle, the entire industry is reliant on rare earth metals, the mining and refinement of which is largely controlled by China (60% of mining, 85% of refinement).

The key risk in this house of cards is TSMC. China has been sizing up Taiwan, which sits 100 miles off its coast, for invasion for many years. TSMC is an increasingly significant factor in whether an invasion will happen. As the AI race heats up, things are certainly going to get interesting. The US government has been making overtures to TSMC about building a plant on US soil, but the Taiwanese company has found it far easier to build in Japan than the US.

If you want to dig deeper, I strongly recommend this book on the subject. The Chip Wars seem likely to be one of the defining political and technological battlegrounds of this century.

Compound Companies

Workforce management unicorn Rippling has agreed to facilitate $590m in employee and early investor secondaries, as well as raising a further $200m in new shares. The fresh capital and secondaries value the company, founded only 8 years ago, at $13.4B. The company turned over an estimated $350m in 2023

Rippling are an interesting case study. CEO Parker Conrad’s company-building philosophy is as attractive as it is challenging to execute on. It all revolves around the concept of intentionally building horizontally rather than vertically, shallow rather than deep.

Conrad calls this a “compound company” - you ship B2B software across multiple verticals, bundle your services, charge much less than competitors, and gradually create very strong customer lock-in and excellent gross margins. So rather than just building payroll and other HR-related services, you also build out spend management & corporate cards, IT and security tools, etc. Every new product area compounds your ability to attract new users and cross-sell them services, and so your growth and competitive advantage accelerates over time. He is also a strong believer in building new products in-house rather than acquiring companies, since it is so much easier to integrate services you’ve built yourself, and so fast to ship new software nowadays. This interview is good if you want to dig deeper.

It runs directly against the wisdom you’ll often hear of “doing one thing very well”. Instead, Rippling aims to do lots of things quite well.

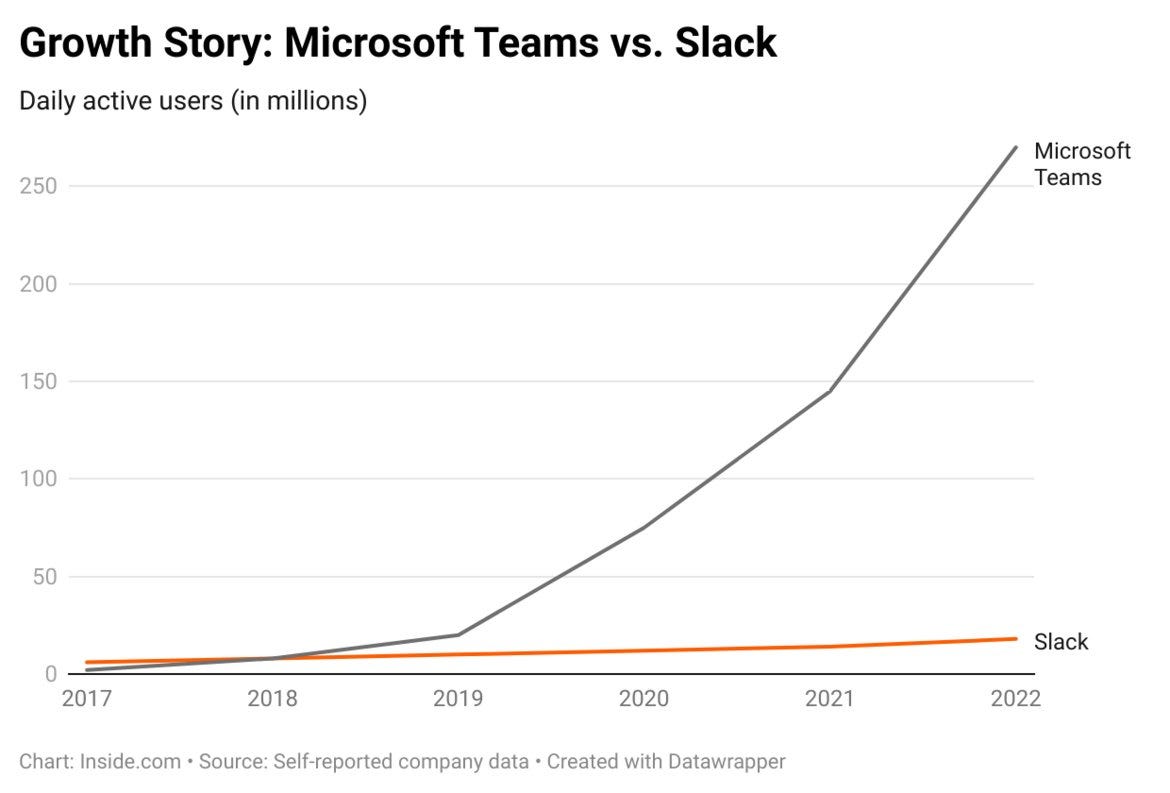

Microsoft is the classic example of this strategy in action - they’ve been doing it for years, and continue to nail it. Think about the adoption Microsoft Teams (meh product sold via bundling) vs. Slack (good product sold on its own).

Other bits

Tesla shares jumped 17% after Musk inked a deal with Baidu in China that could eventually allow Tesla’s fully autonomous driving technology to be rolled out in the world’s largest car market. They’re still down overall for the last few months, with global EV demand cooling and increased competition, not least from China’s Byd, which is backed by Warren Buffet’s Berkshire Hathaway.

Elon was also in the news after Sequoia confirmed they are backing xAI, his OpenAI / Anthropic competitor, as part of a $6B round.

Meta stock tanked after they announced significant investments in AI with no promises about when the increase in capex would pay off for investors. The pitch is pretty straightforward: AI image editing for Insta and “Creator AIs” -chatbots for businesses and leading influencers that allow them to speak with their customers / fans at scale. Sounds a bit like Foxy AI, which has to be my favourite company we’ve structured an SPV for recently (NSFW).

Bytedance is exploring selling Tiktok’s US business without the algorithm. Sounds like the CCP would prefer the company go to zero than see it in US hands.

Darktrace, the UK cybersecurity firm listed on the London Stock Exchange, has accepted a £4.3b acquisition from US tech PE firm Thoma Bravo. The new owners see an opportunity to roll up smaller cyber firms in a highly fragmented market, and to open doors for sales via their deep network in US tech. Darktrace has had a turbulent three years as a listed company, with significant volumes of short selling and its cofounder Mike Lynch on trial for fraud in the US. The UK continues to struggle to retain the value it creates in tech. In a parting shot, Darktrace announced that the UK public markets had undervalued its business.

It will be interesting to see how Rubrik fares after their recent IPO. They listed in New York on Thursday. Operating in the same sector as Darktrace, their current share price makes the unprofitable company worth ~$6.5B, albeit with higher turnover and stronger YoY growth.

Samsung’s profits are up 10x year over year, after a reduction in spending and AI tailwinds.

Fundraising

Dry Powder

🇺🇸 General Catalyst is close to completing on a monster $6B fund, hot on the tail of a16z’s recently announced $7.2B vehicle. According to Pitchbook, these two funds alone represent 44% of all capital raised by US VCs so far in 2024. The trend of LP “flight to safety” certainly appears to be well underway.

🇺🇸 Eniac (New York) has raised $220m across two vehicles (a $60m follow on fund and $160m of fresh capital).

🇺🇸 Palo Alto based Maven Ventures has raised a $60m fund IV to invest in “massive consumer tech trends”

Secondaries are everywhere, with 🇺🇸 Cendana raising a fresh $100m to buy LP stakes, 🇮🇳 Piyush Gupta leaving Peak XV (fka. Sequoia India) to start a secondaries fund and 🇬🇧 Isomer announcing the first close of a £100m secondaries fund

🇫🇷 Paris-based Ternel will invest €120m in 30 startups at seed and series A with their new fund, across a range of themes including climate change, biodiversity, circularity, health and education

🇬🇧 Seraphim Space has announced the first close of a new Spacetech fund (size tbd). Their last fund was £70m

🇨🇭 Swiss solo GP Edoardo Ermotti has closed a $30m fund to back B2B SaaS startups

🇳🇬🇰🇪 TLcom capital announced a $154m fund 2 to invest in startups across Africa

Big Startup Rounds

Half of Silicon Valley is betting big on AI drug discovery by backing Xaira Therapeutics, who have launched with over $1B in funding.

Tether, the issuers of the dollar-pegged stablecoin of the same name, have invested $200 million in Blackrock Neurotech, a maker of brain-computer interface technology competing with Elon Musk’s Neuralink. This investment apparently means Tether is now the majority shareholder in the company. Seems like a weird move for the corporate venture arm of a crypto firm, but ¯\_(ツ)_/¯

UK neobank Monzo are reportedly topping up their recent £340m round to £500m. The round values Monzo, who are now profitable, at £4B (~$5B). They are the UK’s seventh largest bank, and are planning an IPO some time in the next couple of years. Not bad for a company started 9 years ago by a bunch of twenty somethings in East London! It will be interesting to see where they choose to list the business…

Augment, a competitor to Github’s copilot (AI assistant for software engineers) have come out of stealth and announced a whopper $250m in funding. TechCrunch reports.

Best of the Internet

The dark side of your dinner

I recommend the full thread - it’s a great read.

Last time this happened, Earth got plants

The future is bright

According to data from Dealroom, Energy was the top sector for VC funding in Europe for the last four quarters.

Go do the thing

Never mind Van Gogh, Colonel Sanders didn’t franchise KFC until he was 62. Whatever the thing is on your list, you should go do it.

And enjoy yourself

If you enjoyed this, drop it a like. If you didn’t feel free to add comments / feedback on improvements you’d like to see :-)

PR

Love the topic selection, it helps me save time to be on top of the tech news, thank you very much 😀