Asset Management Legos

Announcing modular Institutional SPVs. Plus interesting & funny stuff from the internet.

The Odin Times is brought to you by Odin - the seamless way to raise and deploy capital in private companies, used by over 10,000 VCs, angels and founders globally.

Good morning!

Today I’m announcing our launch of modular institutional investment vehicles, or as I like to call them, Asset Management Legos (please don’t sue me Lego).

If the thought of reading about this sounds about as enjoyable as running barefoot down a corridor full of Legos, fear not. You can skip straight to the “Best of the Internet” section at the bottom for some politics, memes and cultural commentary.

Today we’re launching a brand new product - Modular Institutional SPVs

They’re aimed at larger VCs and private equity firms.

With Modular Institutional SPVs, you get all of the below in one place, together with Odin’s best-in-class technology and customer service:

Legal Structure: use one of our off the shelf structures (English Limited Partnership, BVI Limited Company), or use your own legals. Our structures work for any asset - companies, real estate, wine, crypto, etc.

Multi-currency bank account, with interest rates of 4%-5%

Investor onboarding, KYC & AML

Regulated management company and Appointed Representative arrangement

Multiple closes, including calculation of equalisation interest

Maintaining entity accounts & statutory records

International tax compliance filings (FATCA, CRS, etc.)

Ongoing monitoring (KYC)

Audit

Registered address

Annual compliance monitoring and review

What’s more, since it’s modular, you can pick and choose which parts you want from us vs. someone else! Want to use your own legal structure? Just slot it in. Want to use a different banking partner? We can integrate with them.

Here’s the structure chart for our English Limited Partnership (ELP).

This particular “Lego block” works for managers anywhere, and the regulated manager of the vehicle does not need to be in the UK.

We’re launching with the ELP and a BVI (offshore) Limited Company as our first off the shelf legal structures. Other jurisdictions will be fast follows.

If you’re a VC or PE investor and you’re interested in setting up an SPV or running your fund with best in class technology and top-quality customer service, get in touch.

Why this product?

Our mission is simple: allow more people to vote with their money on what the world looks like.

To get there, it is necessary to tackle the root problem - the plumbing that the private markets run on. You see, it sucks:

Fund managers hate their fund admins. Almost universally. As an industry, it has a serious customer service problem.

90%+ of fund admin has barely changed since the 90s. A lot of back and forth over email, lots of duplication of work, lots of spreadhseets, lots of data errors. We can definitely improve this with software. LLMs are going to be a massive unlock too.

Customisation & flexibility are important. Whilst a lot of the core workflows are the same (onboarding, KYC/AML, tax), specific user needs can vary a lot from customer to customer. Larger asset managers that we speak to feel that current digital providers tend to try to sell you a “one size fits all” solution, when really you’d like flexibility. Things like LP familiarity with a jurisdiction, tax treatment of the local jurisdiction, handling reporting a specific way, accounting, tax-efficient treatment of carried interest and more become much more important tradeoffs (worth paying extra for) when you’re doing bigger deals. You want a digital provider who can do it all.

Our vision for what can be built on top of this plumbing - a way for people to discover and invest in private deals and funds seamlessly (think Blackrock for the private markets) - is only realisable if these problems are addressed.

The “dirty work”, so to speak, needs to be done really, really well.

This is the first of several products we are building that target institutional asset managers.

We’re excited for the next step in the journey!

Best of the Internet

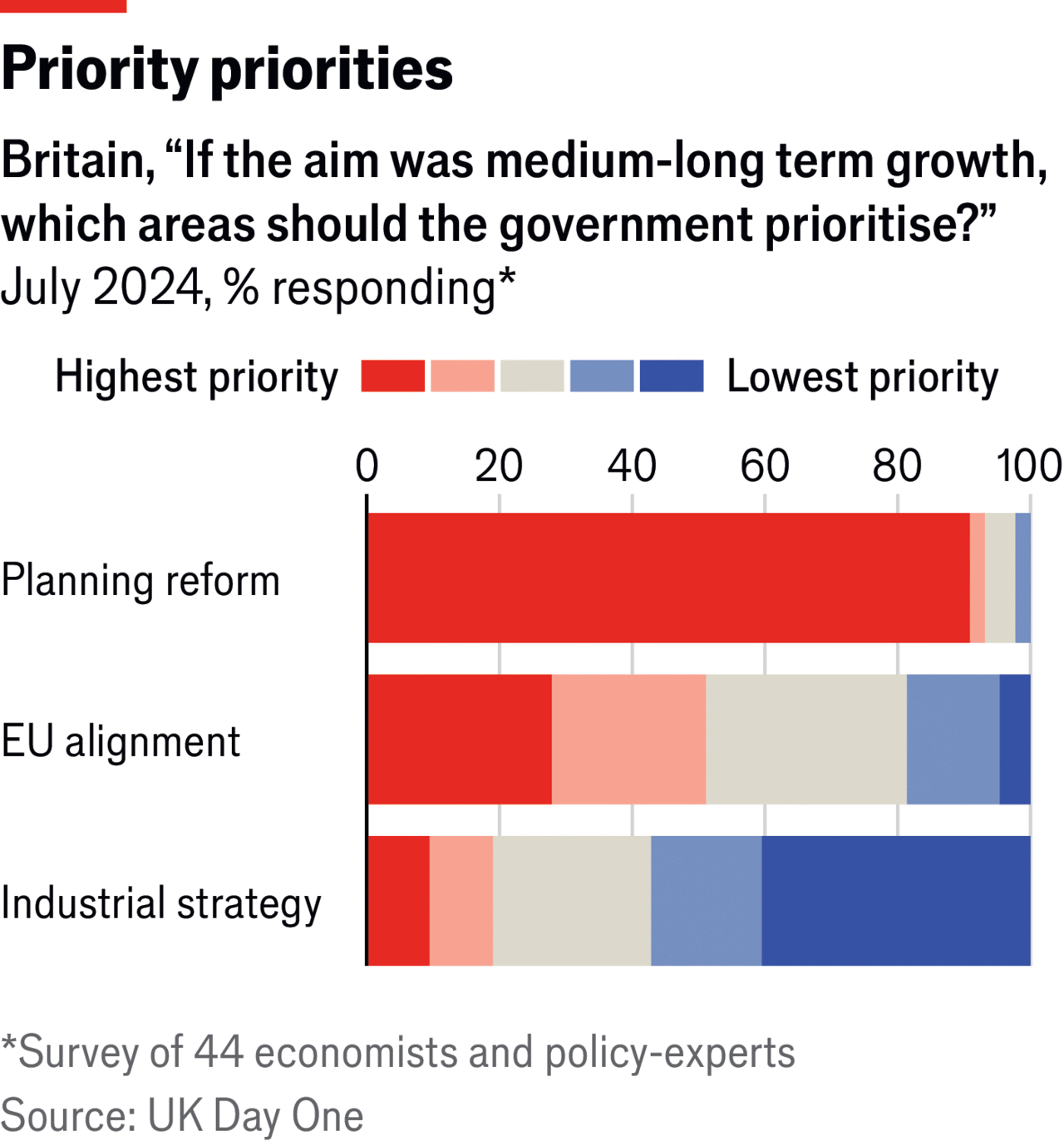

Foundations - why Britain is stagnating

Excellent piece from Ben Southwood, Sam Bowman and Samuel Hughes on the reasons for the UK’s stagnation. The tl;dr is that Planning Permission (specifically the Town and Country Planning Act, introduced by Clement Attlee), dated infrastructure and rising energy costs are massively hindering Britain’s potential. The upshot is that reform is actually not that difficult if the right people make some big decisions.

Here are some choice datapoints that will blow your mind

Tram projects in Britain are two and a half times more expensive than French projects on a per mile basis.

At £396 million, each mile of HS2 will cost more than four times more than each mile of the Naples to Bari high speed line. It will be more than eight times more expensive per mile than France’s high speed link between Tours and Bordeaux.

Britain’s last nuclear power plant was built between 1987 and 1995. Its next one, Hinkley Point C, is between four and six times more costly per megawatt of capacity than South Korean nuclear power plants, and four times as expensive as those that South Korea’s KEPCO has agreed to build in Czechia.

The planning documentation for the Lower Thames Crossing, a proposed tunnel under the Thames connecting Kent and Essex, runs to 360,000 pages, and the application process alone has cost £297 million. That is more than twice as much as it cost in Norway to actually build the longest road tunnel in the world.

The planning document, if the pages are laid end to end, is far, far longer than the tunnel will be.

Planning is the root issue. You can’t build anything any more, so people can’t live affordably close to where they can be most economically productive, and companies can’t invest in new opportunities that create growth.

What I really like about this piece of research is that the changes necessary will, I imagine, appeal fairly equally to young Tory and Labour voters.

If we do not reform planning, houses in the UK will remain stupidly expensive, and GDP per capital will remain unnecessarily sluggish.

The UK’s economists almost unanimously agree it’s the country’s biggest problem.

Feeding the world

I thought maybe this was Nikola Tesla - it isn’t.

He is a big part of the reason you’re here today though (click the image to read on).

And did those feet, in ancient time

Great thread on some of the norms, habits and systems that make England what it is.

Renting an old man in Japan

You can literally buy anything these days can’t you. Surprisingly wholesome.

Asking Russians what they know about Americans

Mostly pretty accurate in fairness

Harry McLovin

That’s all for today. Don’t forget to get in touch if you’re in VC/PE and want to run your back office with the best in the game.

See you soon!

PR