🎧 Podcast: Biosphere Consciousness

A conversation with Jordan Wolfe about climate finance and zero carbon supply chains

Hi folks, Paddy here from Odin. We are making it 10x cheaper and easier to launch & invest in syndicates and venture funds. We are now live in private beta. If you’d like to get involved, share some more information with us. If we think you’re a fit, we’ll get you onboarded soon.

Happy Sunday guys!

I recently sat down with exited entrepreneur and full-time angel investor Jordan Wolfe.

We chatted about Jordan's background, and then dug into his thesis on biosphere consciousness: investing at the intersection of life sciences, financial services and climate technology.

You can listen to our conversation here, or read on for some of my favourite insights.

Not a Spotify user? Go here.

Part 1: Buying Boxes, Reimagining Systems

00:00 - 29:00

Jordan cut his teeth at a growth equity firm in San Fran, before deciding to move back to his home town of Detroit, Michigan.

This was around 2008 / 2009.

As a child of Detroit, he had witnessed the decline of the city from the 60's onwards. The financial crisis had further ravaged the local economy.

The city needed fresh ideas, and new places for small business owners and makers to congregate. After launching some nonprofit projects focused on free office space, small business loans and job creation, Jordan became an "accidental real estate developer".

In the doldrums of post-2008 Detroit, Town Partners acquired property at rock bottom prices and rented it out at low cost to entrepreneurs.

The long term vision was to reinvigorate the small business ecosystem around two pillars: food production, and production of physical goods. This would be achieved through a private-public partnership with government bodies, similar to the model for the Brooklyn Navy Yard in New York. Spaces for founders were to be located near the Farmer's Market and at the old site of the Ford manufacturing plant - culturally significant locations for new beginnings.

As the business evolved, Jordan faced a problem familiar to many founders; he felt that Town Partners was losing its spirit. The business had become more about "owning and renting boxes". At the same time, the portfolio had gone up 6x in about 4 or 5 years - venture returns in real estate.

There was an opportunity to cash out and do something new.

Whilst the business didn't turn out exactly how Jordan had hoped, there is a really important learning here for founders. To do big things and have impact, a smaller or more "boring" exit - probably not the outcome you hoped for when you started the company - can really liberate you.

Tyler Tringas has a great thread on this with some excellent examples.

Part 2: Investing in the Biosphere

After selling the majority of the Town Partners portfolio in 2019, Jordan moved with his wife to her native France and began focusing full time on writing angel cheques in the climate tech space.

This was inspired, in part, by Jeremy Rifkin's work on the third industrial revolution.

Rifkin takes a bird's eye view of industrial revolutions, and makes a case for clean energy and the "clean economy" as key drivers of economic growth over the next 50 years. This is based on the belief that radical economic growth always occurs at the intersection of three forces:

A new communication network: 19th century telegraph & radio; 20th century telephone & TV; 21st century the Internet.

A new transportation system: 19th century railways; 20th century motor cars; 21st century autonomous vehicles

A new source of energy to fuel the revolution: 19th century steam; 20th century electricity (mainly fossil fuel based); 21st century clean electricity (solar, wind, nuclear, biofuels, etc.).

Jordan's Thesis

Tl;dr, the key macroeconomic trend over the next 50 or so years will be "bioshpere consciousness". Because the world is now a connected global community and the climate is in trouble, our collective consciousness will become more and more oriented towards fixing it.

There are many areas where this creates upside potential, but we will focus on two.

1. Climate finance

1.a) Funding decentralised, clean, digital energy infrastructure

There is a need to figure out smart ways to fund and build the "missing middle" in clean, digital energy infrastructure: smaller, more flexible, more localised sources of energy.

20th century energy sources were large and centralised (power plants), and pushed out energy through distribution networks that were typically government-owned (grids).

With software, connected devices and 5g, we have potential to build decentralised energy infrastructure that is more flexible and efficient. Rather than building gigantic solar farms in deserts and then sending the energy over long distances (which causes power loss), we can localise energy production and storage through things like residential solar, batteries and maybe even nuclear microreactors.

Surplus energy can stored in large batteries (think of the Tesla Powerwall) and then used or pushed into the grid for a profit when there is high demand nearby.

But funding this stuff is tricky. Almost all of the companies in this space have a hardware component. They're not always highly scalable. Traditional VC dollars won't typically work (the market lacks increasing returns to scale), traditional project finance dollars won't work (most projects are too small to be worthwhile) and traditional sources of public financing won't be enough (subsidies help, but don't get us all the way).

This creates opportunities for companies with novel ideas in consumer lending, revenue based financing and other areas. These fintech companies, unlike the assets they help to finance, do have venture return potential.

1.b) Climate-focused consumer investment products

On the consumer side, there are also trillions of dollars in both passive and managed investments (ETF's index funds, pension funds, etc.) that are supporting heavily carbon-emitting companies.

Divesting from this and investing in green / clean alternatives is a simple thing everyone can do to drive change. Companies like Carbon Collective, Ando Money, Tumelo, Circa 5000, Clim8, Abundance and many more doing interesting stuff in this space.

2. Zero carbon supply chains

This is the bit that really excites me.

Have a look around you, wherever you are right now.

What are you sitting on? What objects are in the room? What is all this stuff made from? Chances are, a lot of it contains petrochemicals.

Oil is in everything.

To reimagine manufacturing for the 21st century, we need to create carbon-neutral chemicals, materials and products.

Many believe this will be achieved with manufacturing plants powered by bioengineered living organisms. This sounds like witchcraft, but it is fast becoming reality, driven by innovations in the field of synthetic biology.

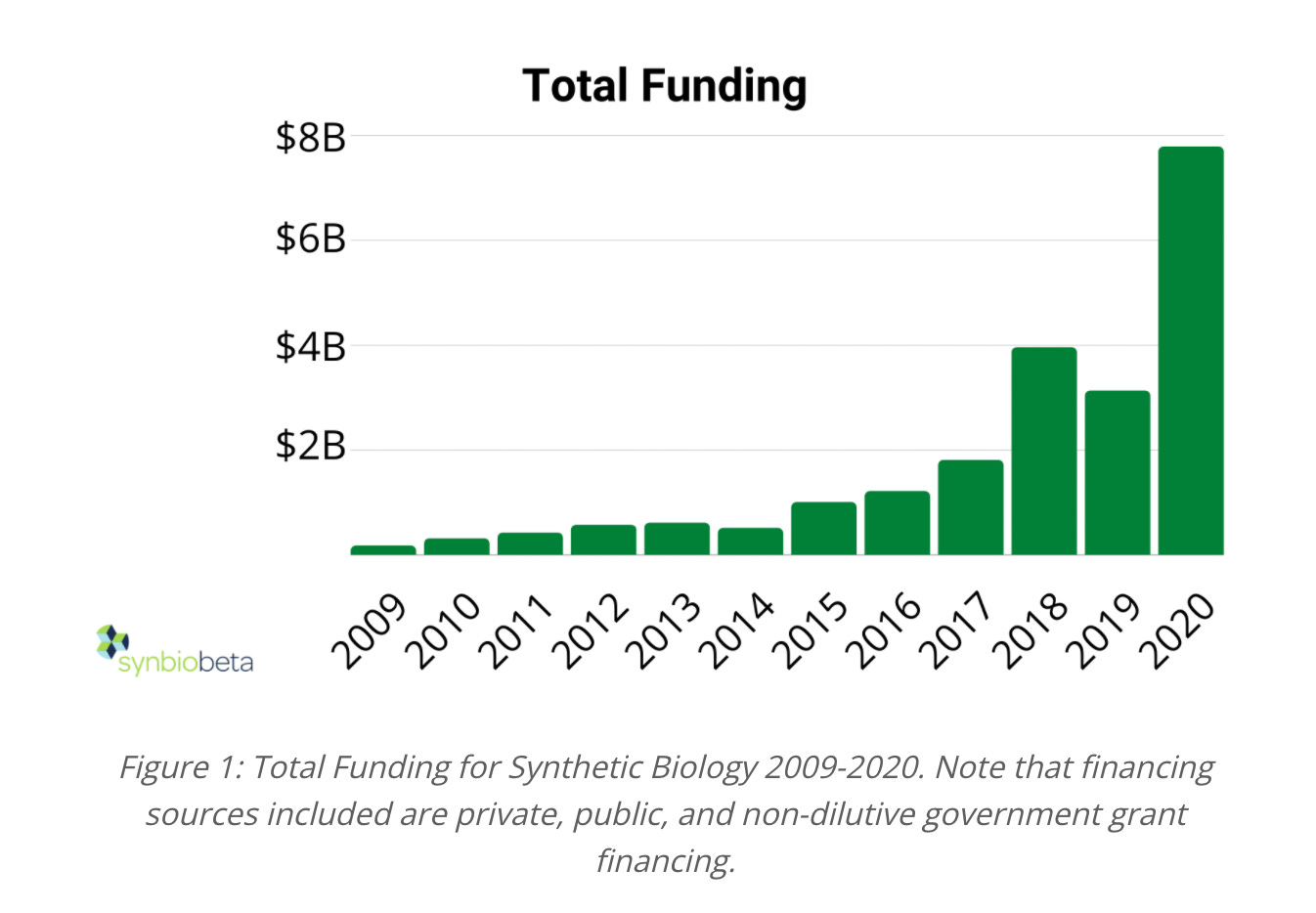

Synbio is hot (and contentious). Funding for startups in this space has exploded in the last couple of years.

There has also been a flood of public listings and mega-rounds of late.

The hype is arguably at pretty dangerous levels. Since Gingko Bioworks' recent SPAC merger, it has come under fierce attack.

This is not without precedent. Check out the fascinating story of Zymergen's August 2021 implosion after raising $500m at IPO, shedding 75% of its value in a day. This is Gingko’s closest competitor…

Why all this hype?

As is often the case, the frenzy is, to some extent, justified:

We need novel ways to make stuff - from clothes to jet fuel - that are carbon neutral or negative.

Plant and animal cells are basically nature's little manufacturing plants. These biofactories can potentially be engineered to create almost anything you can think of, provided you can figure out a cost-effective way of doing it. They are also incredibly effective ways to store chemical potential energy. Remember, oil and coal are just dead plants.

The costs of genome sequencing are plummeting in a fashion that makes Moore's law look like child's play.

This means:

a) We are gaining a much clearer understanding of the codebase these little biofactories run on, and;

b) with lower costs, access is opening up for way more people to work on this stuff, compounding the rate of innovation.AI is allowing us to do years of research in days in almost every industry. In biology, it means we can predict answers to complex questions much faster. For example, DeepMind’s AlphaFold is able to figure out how proteins (nature's molecular building blocks) will fold up and then interact with each other based on their 3D structures.

Recent advances is gene editing technology like Crispr / Cas9, built on top of over 50 years of breakthroughs in molecular biology, mean we can do more than just understand all this stuff. We can take action. We can rewrite the code for life and build new stuff more effectively than ever before.

A timeline of key advances in molecular biology, full of words I don't understand. Source

This is creating a blue sky of opportunity limited only by the scope of our imaginations.

The future for synbio is bright. If you can separate the wheat from the chaff, there is gold in them there hills. In my heavily biased opinion, this is best achieved by investing in syndicates or funds alongside experts ;-)

Jordan’s Investment Strategy

Pre-seed and seed. Ideas on napkins allowed.

Good unit economics that can deliver significant upside (i.e. a strong case for a 10x plus ROI, and preferably much more).

Great team:

Deep sector knowledge

Obsession, tenacity

Constant learning and iteration

Good understanding of milestones and capital necessary to get to where they need (especially for more than technical businesses).

Particularly in synbio, a novel insight or approach to the technology they are creating that is an order of magnitude better than what is currently available

A preference for picks and shovels - facilitators of other companies, which can become platforms for value creation.

Currently, Jordan is writing angel cheques himself, but is considering formalising things and launching a small fund vehicle.

If you want to get in touch, reach out on LinkedIn or Twitter or drop me an email and I can make an intro if appropriate :-)

I really enjoyed this conversation, which was wide-ranging and inspiring.

I've been curious about synbio and biotech for a while but, to be perfectly frank, know next to nothing about it. Writing and interviewing experts is a fun way to learn.

Once you dig into this stuff, you realise it is still very early doors. A lot of the scaffolding, infrastructure and tools still need to be built and refined to really unlock the potential of biotech.

It’s sort of analagous to building a software company in the 70's or 80's. The bio equivalent of mainstream open source programming languages and libraries haven’t been created yet. And nobody has built AWS for bioengineering...yet.

It already seems pretty clear that many founders and investors will make a ton of money and do a lot of good for humanity in this area in the next 10 - 15 years.

We are especially interested in supporting people doing interesting stuff in life sciences, biotech and material sciences at Odin. If you meet this description, hit me up.

Go Deeper 🕳️🐇

The Inside Story Of How SoftBank-Backed Zymergen Imploded Four Months After Its $3 Billion IPO - Forbes (Amy Feldman and Angel Au-Yeung)

The Coming Age for Tech x Bio: The ‘Industrial Bio Complex’ by Vijay Pande

Molecular Biology of the Cell by Bruce Alberts

Some useful reading resources here from Laura Deming

Want to invest in science and engineering focused syndicates led by experienced angels and VC’s? Apply below…