Free Money, or How SEIS and EIS Tax Relief Work

Adding leverage to your angel investments for free

Hi folks, Patrick Ryan here from Odin.

We build powerful tools for VC’s, angels and founders to raise and deploy capital seamlessly.

What if I told you there is a way to get free money, invest it in startups, and pay no tax on the profits?

This sounds hard to believe, but it is exactly what government schemes in the UK allow you to do.

Under SEIS (the seed enterprise investment scheme) and its big sister EIS (the enterprise investment scheme), UK taxpayers can invest in UK-registered startups and claim back as much as 50% of the value of their investment in tax relief courtesy of His Majesty’s Revenue and Customs.

This means a £10k investment actually only costs you £5k. The government gives you the other £5k for free.

Not only that, you do not pay capital gains tax on any profits and you also get additional loss relief (i.e. a tax rebate) if the company goes bust.

Let’s take a look at these two schemes and see how they de-risk the downside, and improve the upside potential for investors:

Assuming you’re a top-rate taxpayer (which affects the level of loss relief you can claim), you’re only risking ~20% of your capital on SEIS-qualifying investments, and ~40% on EIS-qualifying investments.

Pretty cool, right?

Startups can raise up to £250k in SEIS funding over their lifetime, and up to £12 million in EIS funding (more if they’re doing something R&D heavy and highly innovative).

There are a few rules for companies to qualify. There are also some limits to the amount of tax relief investors can benefit from. Here’s a brief overview:

If you’re interested in investing in S/EIS-qualifying startups, set up an account on Odin. Soon, you’ll be able to invest alongside top angel syndicates and VC’s in EIS and SEIS qualifying opportunities.

If you’re a founder, and you’re thinking about raising funding under S/EIS, you can use Odin to pool money from tens or hundreds of investors in your network quickly and easily.

They can invest in a few clicks. You end up with one line on your cap table, not hundreds, so there’s no problem raising smaller cheques as part of your round.

The SEIS and EIS schemes have been powerful drivers of the UK startup ecosystem’s growth.

They help make the UK without a doubt the most angel investor friendly country in the world, at least from a tax perspective.

The UK accounts for ~15% of Europe’s GDP, but ~35% of European investment in startups. SEIS and EIS are an important part of this outlier performance, supporting a thriving pre-seed and seed ecosystem, and generating supply for VC firms.

However, there are still many ways we can make the UK a better place to start and scale technology companies.

In an upcoming series of posts, I’ll outline how we can improve.

Stay tuned 📺

Event in London this Thursday Evening

Join us for a conversation with Kiana Sharifi (ex-Head of Portfolio Talent at Balderton) and Mandeep Singh (exited founder of Trouva) on how to hire for success, what to look for in your earliest hires, and how to build culture as you scale.

Founders and angels welcome - time set aside for networking and drinks afterwards!

Best of the Internet

Britain - the new Crypto-libertarian Paradise?

Andreessen-Horowitz, one of Silicon Valley’s most storied venture firms, have opened a UK office, led by their crypto team.

This is interesting news.

Policymaking independence with respect to matters like crypto, big data, biotech and AI was something Dominic Cummings and other Leavers highlighted as a good reason for Brexit.

Leaving would mean the UK could remove EU regulations that are seen as burdensome or unnecessary, and set its own standards for policy.

It would also, in theory, be easier to make trade deals with other countries outside of the EU (such as the US).

Whether this will become a reality or not, and the extent to which the benefits will outweigh Brexit’s costs, remains to be seen.

But the arrival of a16z’s crypto team in London, led by Sriram Krishnan, is a promising sign that the Conservative government under Rishi Sunak is serious about becoming a progressive, "tech friendly" nation.

It indicates that the FCA (the UK Financial Conduct Authority) is approaching crypto regulation, which it announced as a priority in February, with an open mind. The same cannot be said for the SEC, the US financial regulator, who have recently come down hard on Coinbase and others.

No prizes for guessing who is one of Coinbase’s biggest backers.

Marc Andreessen, cofounder of a16z, sits on the company’s board, and was once the largest single shareholder in the company (I was unable to find public data on his current holdings). Companies and fund entities controlled by a16z still own ~2% of the crypto behemoth.

With so much capital still locked up in crypto, and Silicon Valley’s elite continuing to see Bitcoin as a viable alternative to fiat currency, the SEC’s hard line on crypto and the FCA’s openness are interesting developments. Coinbase CEO Brian Armstrong has previously indicated that the crypto exchange will consider moving away from the U.S. if the regulatory environment does not improve.

a16z follow in the footsteps of Sequoia, Bessemer, Lightspeed, Leftlane, Coatue, General Catalyst and others by setting up an outpost in London.

Winds of change in AI

“A French start-up founded four weeks ago by a trio of former Meta and Google artificial intelligence researchers has raised €105mn…

Mistral AI’s first round of financing values the Paris-based concern at €240mn, including the funds raised, according to people close to the company. The record amount raised highlights the growing frenzy surrounding AI and Europe’s desire to create a viable alternative to Silicon Valley companies such as Microsoft-backed OpenAI and Google’s DeepMind.

The FT reports on a pretty chunky seed round

It is worth noting that this is not an “ordinary” seed round.

These guys are trying to build a “foundational” large language model, to compete with the likes of OpenAI, Anthropic, Stability AI, Google and others.

Many VC’s see AI foundational models as the “next big platform technology” (like smartphones), and believe that there is an opportunity for a new “platform owner” to emerge with trillion dollar valuation potential - the same way Apple dominated the smartphone age.

This platform will license its AI models to app developers, who will build new AI apps on top of it, and pay rent to the platform operator.

So the opportunity is potentially very big.

The problem is that getting there is very expensive. If you want to build and run a foundational model you need this sort of cash just to train and deploy it. OpenAI, for example, is losing ~$700 thousand dollars A DAY at the moment

Server farms are expensive, and the market is competitive.

The question of whether any of these firms become the next “great platform” remains unclear.

The real beneficiaries in all of this seem to be the chipmakers.

NVIDIA, who manufactures the GPU’s powering most top AI companies, saw their share price increase 25% in a day off the back of record revenue forecasts in late May. The company’s valuation has tripled since the start of the year.

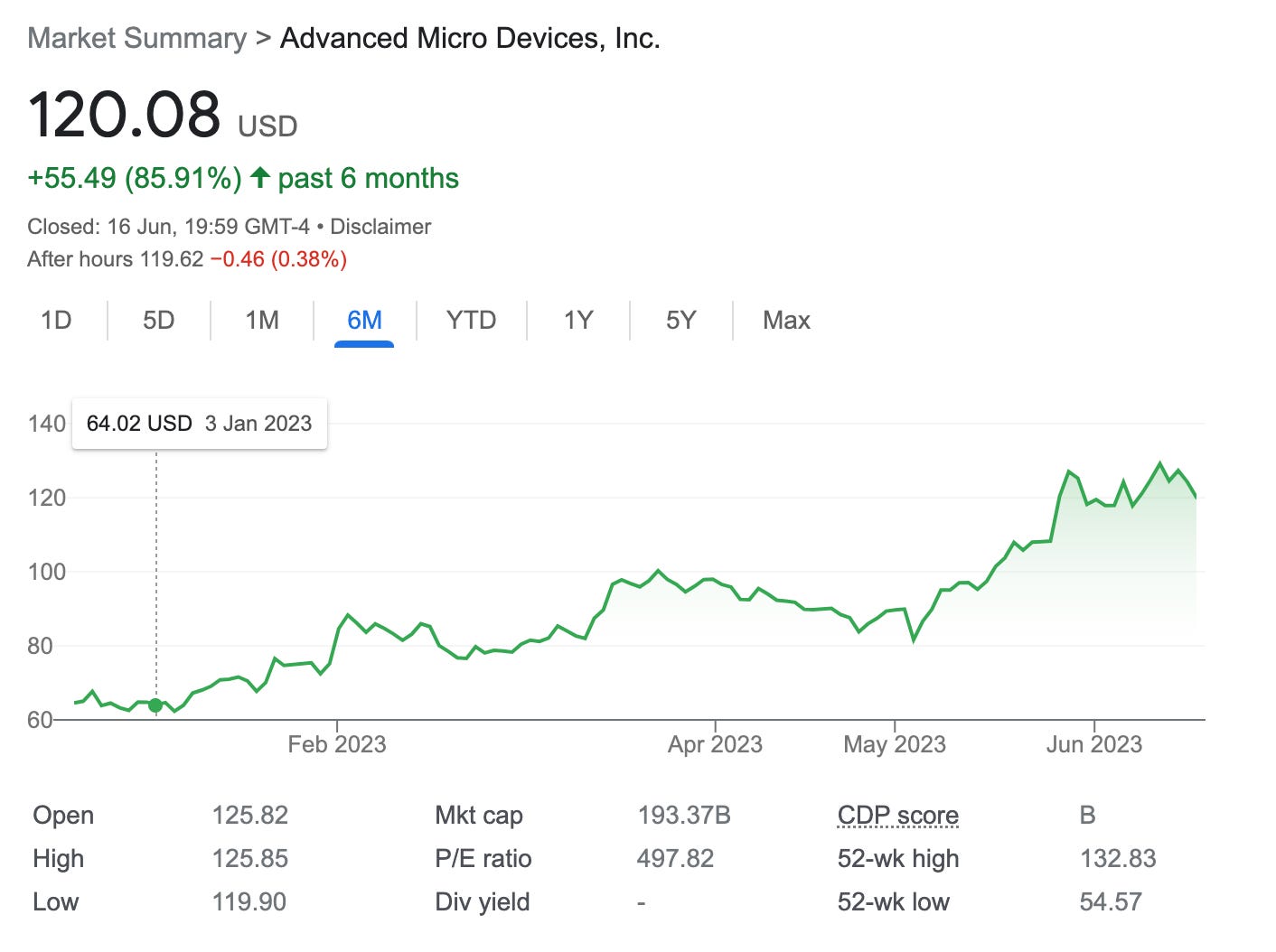

It is now one of the world’s most valuable companies, with a market cap in excess of $1 trillion. Other public chipmakers, like AMD, have also seen a sharp uptick in share price, despite analysis arguing that they will struggle to compete with Nvidia.

As has always been the case, in a gold rush it reliably pays to be the company selling picks and shovels.

State of the future

This is a cool database of deep tech investment themes, ranked according to whether they are overrated or underrated. They’re currently ranked by a selected panel of experts. You can also read interviews with the experts about the themes. Great work from Lawrence and the team at Lunar Ventures!

That’s all for today. I hope you’ve enjoyed the sunshine over the past few days - long may the summer last! 🌞

PR

Risk Warning

Investing in start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. Odin is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via Odin once you are registered as sufficiently sophisticated. This content is for informational purposes only and should not be considered investment advice.

Join Odin Limited is an appointed representative of Aldgate Advisors Limited, which is authorised and regulated by the Financial Conduct Authority (No. 763187). Join Odin Limited is registered in England (No.12849405). Registered office: Hermes House, Fire Fly Avenue, Swindon, Wiltshire, England, SN2 2GA