Good Reads for Startup Investors

Some of my favourite pieces of writing, all related to the world of investing in startups

Hi folks, Patrick Ryan here from Odin.

We build powerful tools for VC’s, angels and founders to raise and deploy capital seamlessly.

Great investors read. Voraciously.

And they read widely - business, philosophy, fiction, biographies, science, economics, finance.

In a world of information overload and low attention, I believe this is becoming a more important and useful thing to do.

Great books and long articles are written thoughtfully, and they force you to focus and to think too. I’ve also noticed I can read much faster than I can listen to things (even sped up), and the ideas seem to sink in more, because your can’t do other things while you’re reading.

In this post, I’ve collated a selection of my favourite articles and books that touch on the subject of building and investing in startups.

Most are classics. If you read a lot you’ve probably read almost all of them.

Others may, I hope, be new.

Articles

Sam Altman – How to invest in Startups

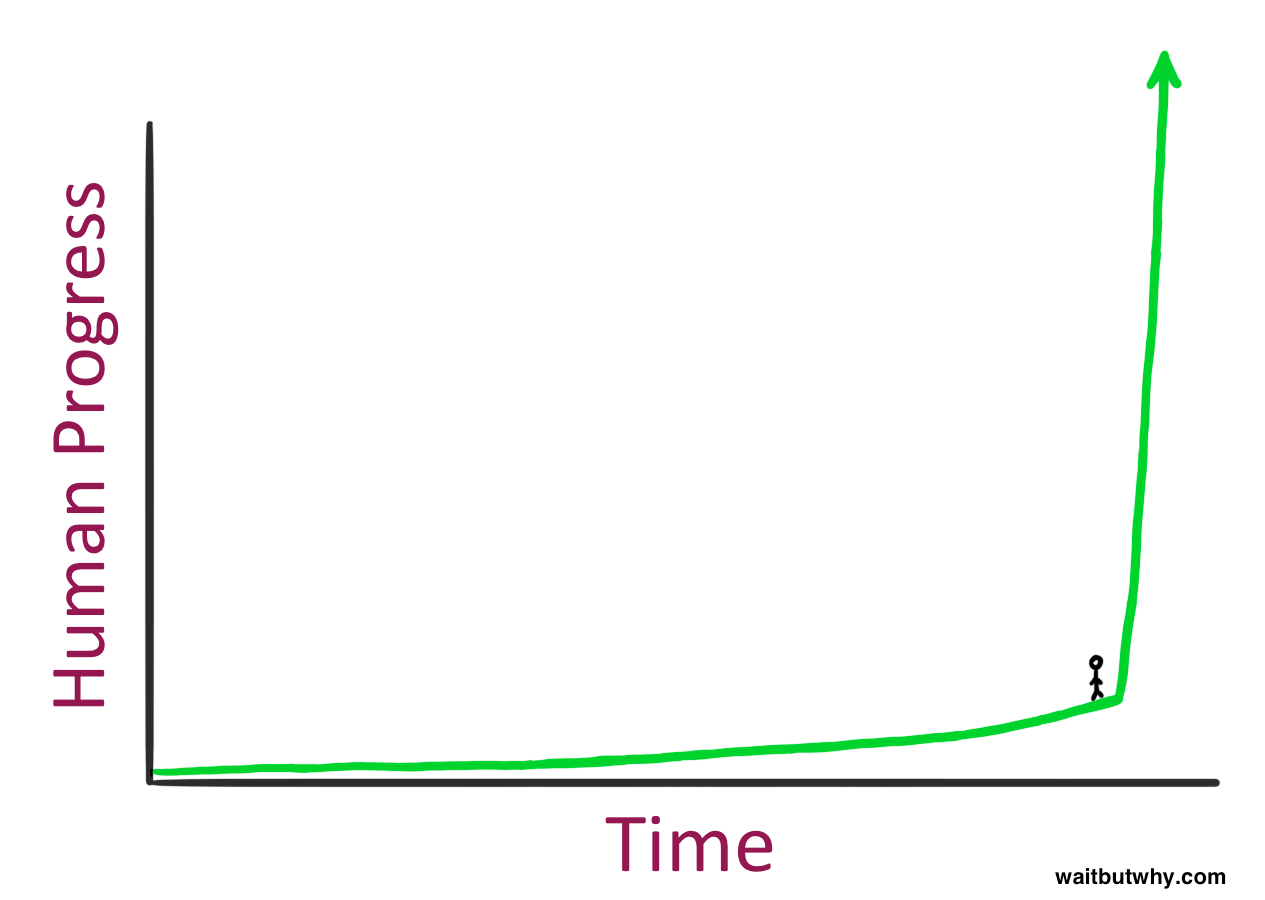

If you read one thing from the list, read this. An excellent little playbook on what to look for as an angel investor. Also great to read as a founder - it explains where the bar sits for greatness very clearly and concisely.Tim Urban (Wait But Why) - the AI revolution

Written in Jan 2015, this piece was well ahead of the curve. It’s very long (and in two parts), but well worth the read. I love his animations, and how simply he explains very complex concepts.

This piece explores how AI is going to change the world, the risks it could all go wrong, and what it will mean to be human in the near future.

Exciting, convincing and terrifying in equal measures.

That Marc Andreesen piece - Software is eating the world

This is probably one of the most famous pieces of tech journalism ever written, and was for a long time the slogan of a16z, one of the biggest VC firms in the world.Paul Graham - Black Swan Farming

“The two most important things to understand about startup investing, as a business, are (1) that effectively all the returns are concentrated in a few big winners, and (2) that the best ideas look initially like bad ideas.”

You should really just read everything PG (one of the founders of YCombinator) writes. But this is a good place to start. That second nugget of wisdom around bad ideas is brilliant. To some extent it’s the same concept as the idea of “non consensus bets”:

Credit: Joel Modestus Jeremy Heimanns & Henry Timms - Understanding New Power

I’ve mentioned this article in the past - it had a big impact on my decision to build Odin.

Heimans and Timms discuss the shift from "old power" to "new power" in society and business, a phenomenon driven by the internet. Old power is held by few, zero-sum, closed, inaccessible, and leader-driven. New power, on the other hand, is made by many, is open, participatory, and peer-driven. Old power is about secrecy, hierarchy, and control. New power is about collaboration, transparency, and accountability.

Some fascinating insights here, and a piece that is prescient of the world I believe we are moving towards, driven by the internet and the way it is changing human culture and economics.W. Brian Arthur - Increasing Returns and the New World of Business

Written in 1996, this article discusses the concept of increasing returns, which is the tendency for that which is ahead to get further ahead. This is in contrast to the traditional economic theory of diminishing returns, which states that the more of something you have, the less value each additional unit has.

In an information-based economy, the value of a product or service often increases as more people use it, thanks to data and network effects. This is in contrast to physical product such as coffee, for example: once you reach a certain scale, the quality of beans you are able to grow decreases because you run out of decent land, so although your cost per bean decreases, your top line value per bean also starts to decrease.

You can of course see that the market understands this idea very well in the performance of the Nasdaq (tech stocks) vs. the S&P 500 (tech and traditional stocks)But I think is a very important concept to think about again today as AI (fuelled by big, specific datasets) comes online. Increasing returns and network effects mean incumbents potentially have a significant (possibly insurmountable) advantage, even over new tech companies.

James Currier – 70 Percent of Value in Tech is Driven by Network Effects

I’m a fan of network effects, as you’ve probably gathered. This concept gets discussed a lot and the term gets thrown around, but I am convinced most founders and investors don’t think about it deeply or understand it as well as they should. If you want to dig even deeper, I also recommend NfX’s Network Effects Manual, which digs into the 16 different types of network effects they’ve identifiedThe other Marc Andreesen piece – Product-Market Fit

Andreessen’s argument is an interesting one - the market always wins. In essence:Great team, great product, bad market - the market wins.

Bad team, bad product, great market - the market wins.

Great team, great product, great market - something special happens.

"If you ask entrepreneurs or VCs which of team, product, or market is most important, many will say team. This is the obvious answer, in part because in the beginning of a startup, you know a lot more about the team than you do the product, which hasn’t been built yet, or the market, which hasn’t been explored yet….

Personally…I’ll assert that market is the most important factor in a startup’s success or failure.Why?

In a great market—a market with lots of real potential customers—the market pulls product out of the startup."

Books

Books on Startups and Tech

Peter Thiel & Blake Masters – Zero to One: Notes on Startups, or How to Build the Future

A classic everyone refers to, but it is really great.

Lots of interesting frameworks and anecdotes from Daddy Thiel, plus funny graphs like this.Kevin Kelly - The Inevitable: Understanding the 12 Technological Forces That Will Shape Our Future

Kevin is the founding executive editor of Wired magazine, and has written a lot of good books - you may also have heard of / read “1,000 True Fans” (I haven’t).

He is something of an oracle. This book is a fascinating exploration of incredibly broad technological themes that are going to change the way the world looks.

I’m constantly referring back to this book, it’s like a prediction machine for every company that ends up getting big.Chris Miller - Chip War: The Fight for the World's Most Critical Technology

Chip Wars is a history of the semiconductor industry, from its origins in the 1950s to the present day. The book argues that semiconductors are the most critical technology in the world, and that the battle to control their production is a key geopolitical conflict. It’s brilliantly written and gripping. It is very hard to argue with Miller’s conclusion: control over the production of silicon microchips will decide the sway of power in the world in the 21st centuryAntonio García Martínez - Chaos Monkeys

I threw this one in because it’s such a fun read. Shout out to my cofounder Mary, who first lent it to me! Chaos Monkeys is a memoir of García Martínez's career in Silicon Valley. The book chronicles his time as a quant at Goldman Sachs, his experience as a startup founder backed by Y Combinator (in the accelerator’s early days), the hectic story of the company’s acquisition, and his experience as an engineer at Facebook. It is a hilarious emotional rollercoaster of a bookPeter Lynch – One Up on Wall Street

This is an absolute classic, written in 1989, and still has lots of valuable insights. Lynch argues that the average investor can beat the pros by keeping it very simple - investing in companies that they know and understand.

Thank you for reading!

It’s a short list - I’ll maybe do another one in future.

What do you think is missing here? Would love to hear your recommendations.

PR