How to Run an Angel Syndicate: Part 1 - The Syndicate Tech Stack

The software tools you need to run an angel syndicate

Hi folks, Patrick Ryan here from Odin.

We build powerful tools for people to connect, collaborate and invest together.

There is a lot of information out there about how to build a startup. There isn’t so much on how to build a VC firm.

We see running an angel syndicate as the logical first step.

Guidance on running angel syndicates is thin on the ground. This is kind of surprising; syndicates deploy ~$10B of early stage capital each year.

Today we launch a new series of guest pieces written by Jed Ng, founder of AngelSchool.vc. We discuss both the practicalities and some of the trade secrets you need to be successful in running an angel syndicate.

This 3-part series is a must-read for any angel looking at scaling their investing via syndicates. It builds on the previous 4 part series we released - How to Start an Angel Syndicate - which is a great place to begin if you’re thinking about going down this path.

Now, over to Jed.

AngelSchool.vc and Odin teaming up again for the next cohort of the Syndicate Program!

In 8 weeks, you get all the tools to build your own Angel Syndicate. Cohort 7 begins June 10th

Part 1: The Syndicate Tech Stack

Running an angel syndicate is a heavy lift when you’re starting out. You are building investor relationships and nurturing deal flow at the same time. You’re busy, and decisions around your tech stack are often put on the back burner.

You can get away with hacking it together for a while, but you don’t want to put it off too long. Legacy workflows give investors a suboptimal experience and affect your fundraising success. They don’t scale well, making syndicate operations a nightmare. You’ll eventually have to deal with the pain of migration anyway, so it’s better to set yourself up for success from the start.

What Are We Optimising For?

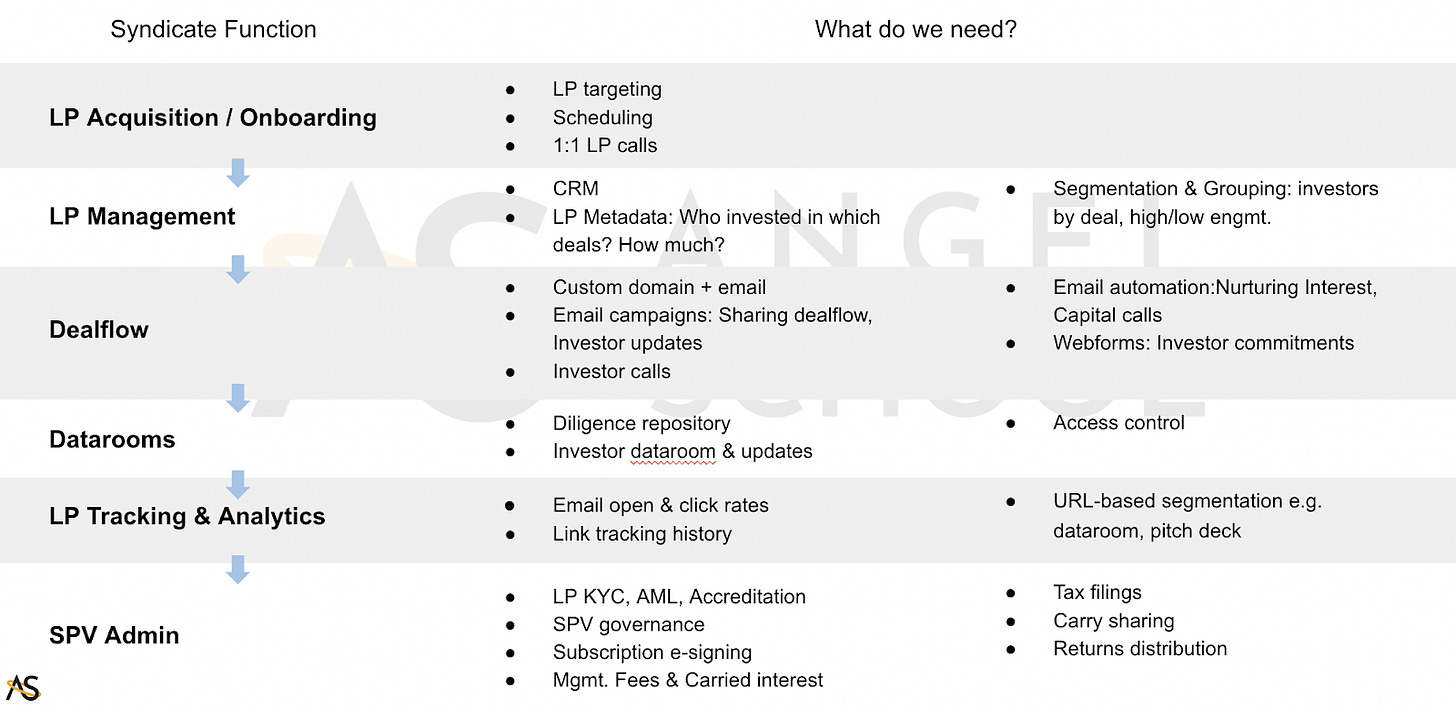

Before getting into the tech, let’s start by understanding our key needs:

Low running costs:

Venture is a high risk, illiquid asset class with a long lifecycle and uncertain return profile. Cashflows materialise in a future liquidity event- if at all.Syndicates typically don’t have ongoing management fees. Any ongoing costs need to be paid for out of pocket. This falls on the syndicate lead. You may opt to charge investors a membership fee to help cover this, but it isn’t that common.

Maximum utility per tool:

Syndicate leads tend to be operators by day and run their syndicate as a secondary activity. You are time poor - so operational efficiency matters a lot. We want to get the broadest features from every tool.Minimum number of tools:

Building workflows between tools requires a way to connect them. Zapier is great, but the more tools you have, the greater the risk that integrations don’t exist or a particular edge case isn’t supported. These points require manual intervention which is tedious and time consuming.

The tools of the trade

The great news is that many of these tools are free, and you are probably already using many of them. It’s just about making sure you are getting the most out of them, and linking them together properly.

LP Onboarding

When targeting LP’s (investors), it’s helpful to understand professional experience, since it strongly influences investment thesis.

Relationship building with LP’s is key. That’s the difference between a mailing list and a network. As a first principle, I make it a point to speak with every single LP (and so should you). You can accomplish a lot from a 30 min call. People need to trust you to invest with you.

Recommended tools

Targeting & Research: LinkedIn (and soon Odin!);

Scheduling: Calendly;

Video Calls: Zoom or Google MeetLP Management

A CRM catalogs your LPs into a structured data format and helps you track past interactions.

As you share deal flow with them, engagement insights are helpful. You’ll want to know who is checking out your deals, and what they’re responding to.

Finally, it’s helpful to segment LPs. Being able to identify engaged LPs for a particular deal lets you know who to nurture and where to focus your fundraising efforts. Post-close investors for deal X need to receive investor updates going forward (you can handle this part yourself, or via a platform like Odin).

Recommended tools

CRM: Hubspot or MailerLiteDeal flow Distribution

LPs need a way to access your deal flow. We recommend email, since everyone has an email address. We put the basic content for a deal in the email. It removes the friction of directing investors to a notion page or some other platform.

Emails can also be scheduled, automated, and tracked. This provides granular insight on which information is generating interest, allowing you to iterate. You can’t improve what you’re not measuring.

Side note: it’s worth mentioning that sharing deal flow is about getting LPs interested in a company, not closing capital. Thoughtful copywriting is essential. What you say is more important than how you distribute it.

A common mistake at this stage is information overload. Many Angels share too much upfront. If your deal copy for a first email looks like an investment memo and takes more than 2 minutes to read, you’ll want to re-evaluate your approach.

Recommended tools

Email Marketing: MailChimp, HubSpot, MailerLiteData Room

If distributing deal flow is about generating interest, data rooms are where interest is nurtured and converted to investment.

Data Rooms are a repository for all documents received from the target company during the diligence phase. We recommend building a checklist for consistency.

Once the company has passed diligence, you’ll want to create a separate folder to share selected information with your LPs. Sensitive information such as customer contracts and signed investment docs should not be shared. Anything you share with LP’s will need to be done with the permission of the founders.

Your data room solution should have access controls to restrict deal information

Recommended tools:

Data Room: Google Drive, CanopyAnalytics & Tracking

You’ll want to know at the LP level who is opening your emails and what they’re clicking on. Ideally your solution captures when users click on specific links. When an investor clicks on a link to a pitch deck, demo video or your investment memo, it’s a clear indicator of engagement.

Recommended Tools

Analytics & Tracking: MailChimp, Hubspot, MailerLiteSPV admins

These service providers are in the business of aggregating and deploying capital in an efficient, compliant way. They help you with KYC and AML, investor accreditation, bank account setup, subscription and e-signing of legals, tracking LP transfers, and SPV governance.

Self managed SPVs are certainly an option. You might be able to do it at marginally lower cost but it comes with significant operational load that will detract from getting deals done.

Any difference in costs are passed through to LPs from their capital contributions anyway. In our view, it simply isn’t worth it.

That said, SPV admins are custodians for the life of your investment. This reliance comes with counterparty risk so you should see SPV admins as a partner you can rely on.

Odin is a great option 😉

This has been a guide on the tech and service stack for Syndicates. There are many off-the-shelf tools that are readily available at low cost (or even free). In fact, I spend $60 each month on tech to support 1000+ LPs.

Event - Scaling Your Syndicate

We are also launching a series of webinars and podcasts for solo GP’s!

The next one is Tuesday at 1200 GMT. You can tune in live, or bookmark it and give it a watch/ listen whenever suits.

Best of the Internet

Patterns

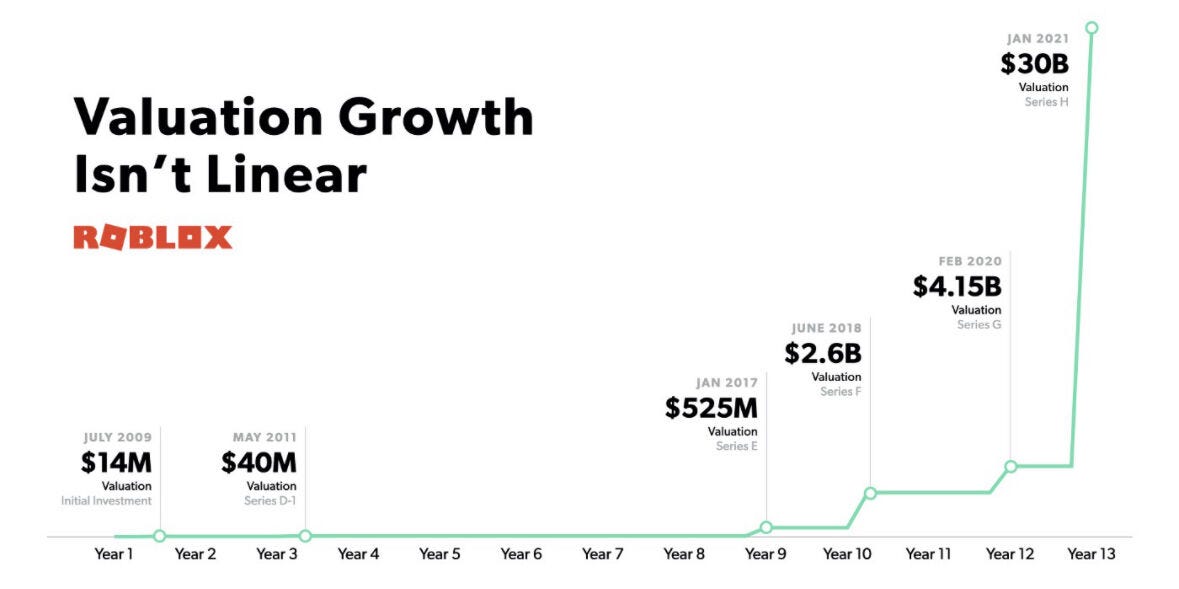

Your brain likes to see them, even when they aren’t there.

Markups

Some angellist data has been doing the rounds that indicates that companies who don’t raise up rounds on short time horizons tend to be losers.

I enjoyed Alex Macdonald’s response on this. Do you baby.

You speak for us all, Marty

AI just got better! Here’s a thread on 10 ways you can use chatgpt to remove threads about chatgpt from your newsfeed 🧵

In case you missed it

We announced raising $3m almost entirely from our own community of angels.

A short thread here on our “why” and our plans.

We are hiring!

We have open positions, across product, engineering, investor relations, bus. dev. and customer success.

That’s it for today - thanks for reading.

Quick note, since you’ve made it all the way here. I am interested in bringing in more people as guest writers for this blog. If you have an idea for a piece and want to reach an audience of over 6,000 people working and investing in tech, mainly in Europe, drop me an email and we can discuss.

PR