Ideas for angel investors #3 - Marcus Exall

Learnings from Marcus Exall, ambient superconductors, why Britain is a developing country and more...

Hi folks, Patrick Ryan here from Odin.

We build powerful tools for VC’s and angels to raise and deploy capital seamlessly. We take care of legals, fund admin, payments & banking, so you can focus on investing. Founders can also use Odin to raise capital from their network in a few clicks.

A few months back, I started collecting insights from experienced angels & VCs.

I was planning to compile these in a long-form essay, but I think it’s better to share them bit by bit.

Today we hear from Marcus Exall. Marcus is the co-founder of start-up advisory firm Up and to the Right, and has been an angel investor since 2013, after selling his first business in digital advertising.

He has invested in over 20 companies, including the first round of Improbable (last valued at > $3B) and Monese (raised > $200m), where he was also on the Board. More recent investments include Odin, Dream Factory, Worldr and Jennis

Marcus always aims to take a ‘founder first’ approach as an investor, adding value beyond capital. We have certainly seen this at Odin, and I couldn’t recommend him more as a shareholder.

Now, over to Marcus :-)

1) Be clear on your reasons for investing

Angel investing is a slightly crazy asset class - highly uncertain, illiquid. There are plenty of other ways to invest that are less likely to lose you money, and that allow you to get at your funds quickly if you need the cash. We have all heard the stories of 1,000x returns for people who invested early in companies that made it huge - so the returns can be there - but what are the chances you can pick the winners?

I know a few angel investors who place a lot of bets and operate a little bit more like a VC, basing their potential on a power law distribution where a few investments provide outsized returns.

That is never how I have approached it. I'm certainly trying to make good bets and achieve outsized returns, but mostly I am trying to pick interesting journeys with great people. If I do that, no matter what the financial outcome is, I will always feel like I have got a good overall return from my investment. I think it is good to work out why you are investing (purely financial, interest in the sector, learning from early stage tech etc), so that you can optimise for the return you want - whether purely financial or otherwise.

2) The things that seem the craziest at the time are often the biggest ideas

Compared to lots of angels I am not really a prolific investor, so my data on this is limited, but I can say from the last 8-9 years of investing that the companies that seemed like wild ideas have provided my best returns to date. Whether that was a solo founder trying to take on a massive market, beset by all kinds of complex regulation, with what at the time was a 6 page word document, or a founder taking on a hugely technical challenge that had never been achieved before.

I can say this with hindsight, as I am not sure that at the point of investing I expected this outcome from these businesses. There’s one of them that I don’t think I even truly understood at the point of handing over my funds.

3) Work out how you can help

It's unlikely, based on my average investment, that my funds alone are going to make a material difference to most rounds. I try to ensure the founders believe that I can offer the kind of support that will help them grow their business (right advice, connections, experience, values/cultural fit).

It's at least partly for this reason that I like to get to know a founder over a slightly longer period of time, to make sure that I am a good fit for them as well as them being a good investment for me. I know this means that I may sometimes miss out on good deals where a quick decision is what's needed, but it has come to form part of making, what I see, as a good decision.

Mary and I have known Marcus since the earliest days of Odin, when we were just a Slack community with about 50 members. He would check in for a catch up every 3-6 months. We were disappointed that he didn’t join our pre-seed round in 2021.

He finally invested in our seed round a few months ago.

I understood that Marcus was quietly watching and listening, seeing how things evolved. He told us explicitly that this was how he invests.

As he alludes to above, Marcus was assessing whether he could add value. But I think he was also doing what Mark Suster famously called investing “in lines, not dots”.

Who were we as people? Did we do what we said we would? How was the product evolving? Were customers buying? Was there positive sentiment / media around the business?

I think investing like this is one of those things that is very easy to talk about, and very hard to do.

It is difficult not to get swept up in FOMO on a hot funding round. But you sense that having this discipline is important. As Suster says, “If you invest in dots, don’t be surprised when the trend isn’t in the direction you would have hoped. Pattern recognition requires a pattern.”

Superconductors

Probably the biggest tech news this week was a research paper that came out about an ambient temperature & pressure superconductor.

Yes, I’m with you, what the hell does that mean? Allow me to try to explain.

Imagine you have a toy car that runs super fast on a special track with no bumps or friction. It can go round and round almost effortlessly. Well, a superconductor is a bit like that, but for electricity.

Superconductivity enables lossless electricity transmission at high voltages and currents. When electricity flows through a superconductor, there is close to zero resistance. This means that no energy is wasted, and everything works super efficiently. Super.

But historically, there was a catch. For this magic to happen, the superconductor had to be very, very cold. Like -250 degrees celsius cold. Alternatively, it needed to be kept at a pressure more than 100,000 times ordinary atmospheric pressure.

Cooling stuff to these temperatures requires a lot of energy, and makes many of the potential applications of superconductors financially unfeasible.

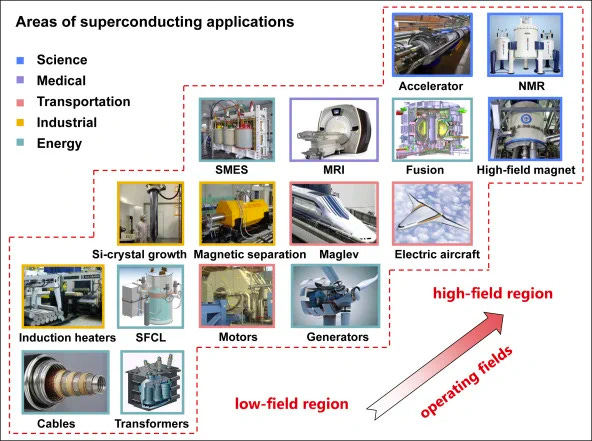

What are these potential applications?

Highly efficient magnets that unlock a step change in what we can do with maglev trains, MRI machines and other magnet tech;

Plasma confinement in nuclear fusion reactors (the ones using the same type of nuclear reaction that happens in the sun). We still haven’t cracked making fusion efficient, but if we do we can potentially create infinite free energy;

Creating the best batteries known to mankind (we’ll need them to store all that infinite free nuclear energy, plus renewable energy (solar, wind), which is produced very intermittently);

More efficient generators for things like wind power;

Long distance energy transmission. A tenth of energy is lost in the grid. This number is higher the further you send the power. Another issue with renewables, alongside intermittency, is you can’t decide where the wind blows or the sun shines. So sending the energy further is useful;

Preserving coherence in qubits (basic units of information in quantum computers - the holy grail of computing). I don’t know what this means but it sounds important.

According to the South Korean authors of this paper, the new material they’ve discovered has incredible superconducting properties without the need for cooling. It can be prepared in about 3 days of work with extremely basic lab equipment (a mortar & pestle, basic vacuum, and furnace).

In simple terms, the unlock here is energy. Energy is the base currency of everything. Almost every problem you can name - clean water, food, shelter, plastic recycling, AI compute, getting out of bed in the morning - is in some way downstream from the energy problem.

So this is kind of a big deal.

However, so far there is skepticism in the scientific community about the replicability of the results. The team at Varda Space (a Founders Fund company) have spent the weekend trying to replicate them.

Let’s cross our fingers.

Credits for the insights here: Alex Kaplan, Andrew Cote

Britain is a Developing Country

This was a sobering read from Sam Bowman.

Americans could stop working each year on September 22nd and they’d still be richer than Britons working for the whole year.

By GDP per capita, adjusted for purchasing power, the US ($76,399) is 39% richer than the UK ($54,603). GDP growth since 2010 has been 47% faster – nine percentage points – in the United States (28% growth) than the UK (19% growth), despite being from a much higher level.

By productivity, or how much we produce per hour worked, the US was 38% more productive than the UK (UK $54.3/hour, USA $73.7/hour) in 2019. France / Germany were much closer to the US than to the UK at $69/hour.

Between 2010 and 2019, productivity growth was twice as fast in the US (8% growth) as the UK (4% growth).

How does Britain get its sh*t together?

According to Sam, it’s about the basics - building more housing and better energy infrastructure - but a combination of complacency, Nimbyism and bad political leadership means they haven’t focused on these issues.

Sinister Joe’s

I love hearing about the quirky ways some founders hire for the sort of culture they want to build.

Lefties get a bad rap. The word “sinister” comes from the Latin for left. If you call someone “gauche” (French for left), you mean they are awkward or clumsy.

Only about 10% of people are left handed. Interestingly, Isaac Newton, Benjamin Franklin and Leonardo Da Vinci were all lefties. Albert Einstein, contrary to popular belief, was not. However, weirdly his brain looked more like the brain of a left-handed person than that of a right hander. So he was with them in spirit!

Research indicates that left handers are more likely to develop schizophrenia. But they are also significantly more likely to be musicians, painters and writers. What gives? Apparently it’s about the way they process information - in left handers, information moves more frequently between the two hemispheres of the brain. This can create more room for error, but it also can sometimes lead to very novel solutions.

That’s all for today! Enjoy your Sunday. I’m at a wedding this weekend, so unfortunately I won’t get to check out Barbie or Oppenheimer. If you do, let me know what you think.