Investing in AI Rollups

Software is finally eating services - what does a successful investment in this space look like?

For years, the best way to put a VC off your company was to say it had a significant “services element”.

That is all changing.

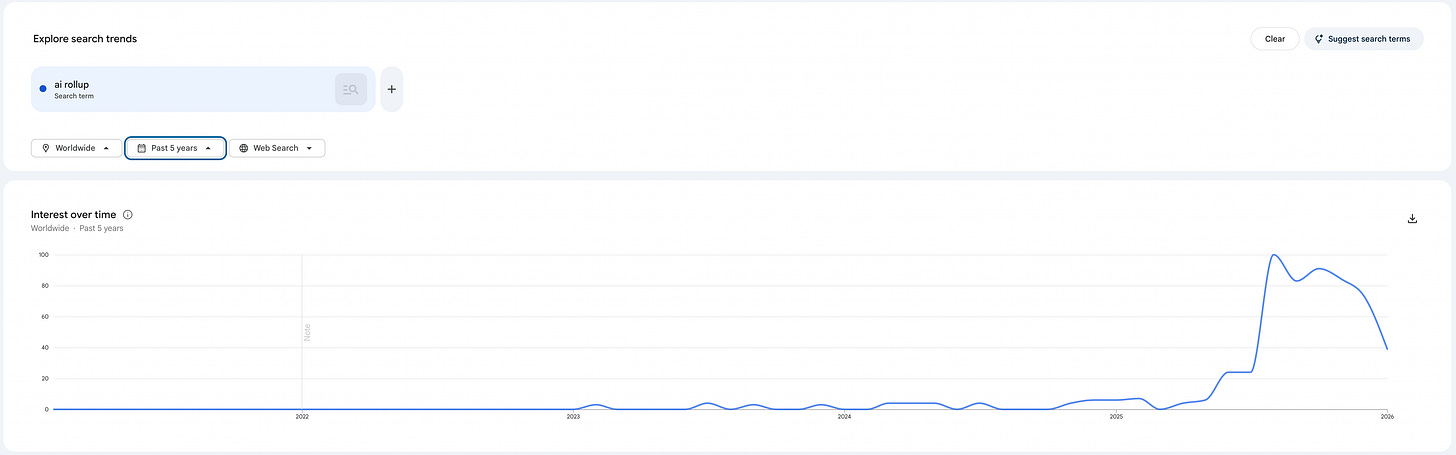

Venture is borrowing hard from the private equity playbook. “AI rollups” of services-heavy businesses with complex human-in-the-loop workflows - law, accounting, financial services, medical services - are in vogue.

They have been the talk of town for the last 12 months in particular.

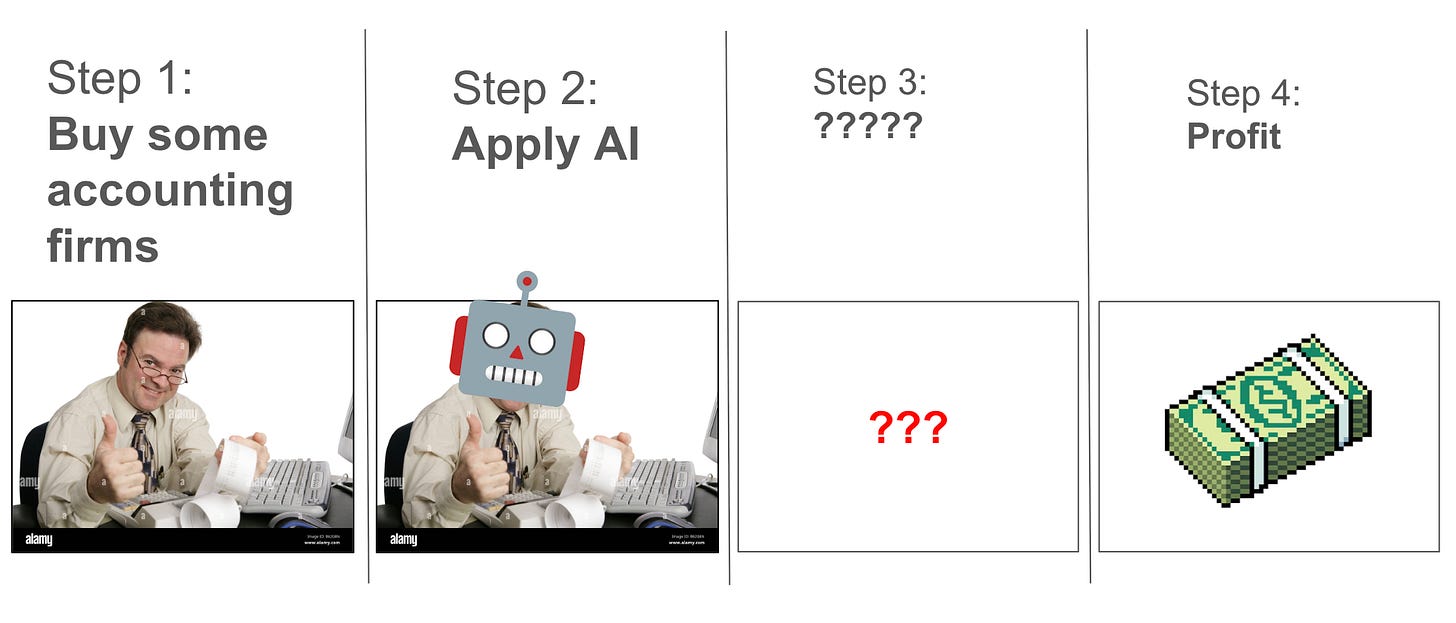

The core idea is pretty simple. You find services businesses with repetitive workflows, buy a bunch of them and automate everything with AI. This makes them more efficient & improves customer experience. Ergo, you make lots of money.

A number of prominent VC firms - General Catalyst, Thrive, Lightspeed and 8VC in particular - are pouring billions into this space.

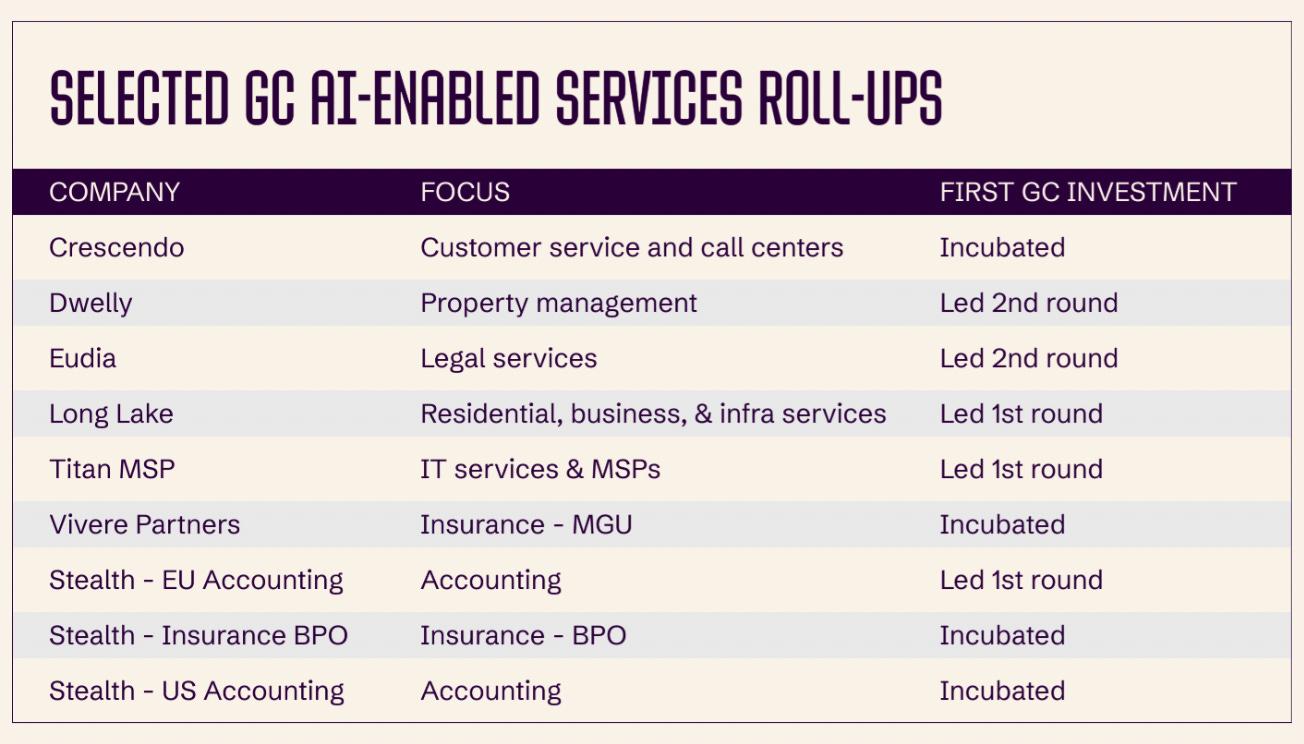

General Catalyst have been pioneers of the AI rollup strategy, having cofounded or invested early in at least 10 companies.

Thrive have a $1B dedicated vehicle called Thrive Holdings just to roll up services businesses. They announced a partnership with OpenAI in December last year under which OpenAI researchers will work closely Thrive Holdings engineers to build custom models and products for the services businesses they’re acquiring. OpenAI will also gain deep insight into better ways to develop their agents as part of the partnership.

Firms in the space are taking various strategies - sometimes partnering with founders who build the tech holding for the services acquisitions, sometimes creating the holding themselves. It’s a fascinating hybrid of the VC & PE playbooks.

In today’s guest post, Alex Prokofjev, the founder of RollUpEurope - the world’s largest community for Acquisition Entrepreneurs - will briefly cover :

The Thesis: What AI rollups are - and why they should work in theory

Execution: The 3 types of rollup, the metrics they target, and the skillsets required to run each one

Investing: How to spot early winners among wannabe AI rollups

Let’s dig in. Over to Alex.

For the majority of my 20-year career, small-time M&A was decidedly uncool.

Now all of a sudden, everyone is chasing $0.5M EBITDA technical services contractors and accountancies.

The usual buyers - lower middle market PE and search funds - are competing for deal flow with Silicon Valley’s brightest minds.

Is this just another instance of the “AI” buzzword attracting capital, or is there more to it? What are “AI rollups”- and which ones should you be backing (if any)?

You’ve come to the right place to figure this out. Since 2023, at RollupEurope we have published 100+ deep-dives on serial acquirers of just about everything, everywhere. Software, car washes, coffee shops, anaesthesiology practices, e-commerce brands.

We’ve developed a deep understanding of the “DNA” of successful buy and build strategies. Whilst AI rollups have their nuances, I believe many of the patterns are the same, and we can learn a lot from the successes of others.

1. The thesis: what are AI rollups - and why should they work in theory?

Not long ago, I posed this very question to two thought leaders in the AI rollup space: Cyrus Hessabi from Shore Capital (back then at OpenOcean) and Sahil Patwa from Unbound. Cyrus’ and Sahil’s answers informed my article Missed out on crypto, tempted by AI rollups?

You can dig into the details there, but TL;DR:

AI rollups are technology holding companies that grow by acquiring distribution through M&A (rather than through sales). In theory, in the markets they target, it is cheaper and faster to grow this way - rather than to sell tech to incumbents that are often SMBs

AI rollups work best in stable, regulated industries where customer relationships are sticky and switching costs are high

The two-step playbook goes like this.

One, find industries with

a) high quality revenue (recurring, high cash generation) and

b) high volumes of repetitive, labor-intensive workflows.Two, automate these workflows with AI, in order to unlock genuine productivity gains for human employees (more customers served per FTE etc.).

For me, the distinction between “AI enabled” rollups and the traditional kind lies in the extent to which the operating models of the acquired businesses are disrupted.

If you’re ripping up the tech stack, re-educating (or firing) the workforce etc. - then chances are you’re running the AI playbook to justify the mayhem.

Some examples of this from a few different industries:

Property management:

Lettings agencies:

Dwelly 🇬🇧 - recently closed series B led by General Catalyst

Marketing agencies:

2X 🇺🇸 - Insight Partners led a growth round announced March 2025

Accountancies:

Crete 🇺🇸 (backed by Thrive) is planning to spend $500m on acquisitions in the coming years.

Integral 🇩🇪 - raised €12m from General Catalyst & Cherry Ventures

Bhub 🇧🇷 - raised $55m from Valor Capital, Hedosophia and others

Wealth Management:

Call Centres:

Crescendo 🇺🇸 - secured a $50m series C from General Catalyst

There are many more, from the above industries and others.

You can access the full list here - kudos to Sahil for maintaining it!

What makes AI rollups, in theory, a smart approach for these industries?

The incumbents have a poor understanding of technology;

They’re extremely fragmented markets, and;

There is a large volume of fairly repetitive “human in the loop” workflows that LLMs - in theory - can eat.

However, make no mistake, an AI rollup is not a normal startup. Executing on the AI rollup playbook requires a unique set of people and skills.

The Odin Times is brought to you by Odin.

We let anyone, anywhere launch and run a private investment firm online, and work with over 10,000 VCs, angels and founders globally.

You can launch an SPV or fund vehicle in less than a day.

2. Execution: the 3 types of rollup, the metrics they target, and the skillsets required to run each one

When I worked for a ride hailing platform, the most impressive individuals I came across were city launchers.

These people were like paratroopers. They would land behind the proverbial enemy lines, mount surprise assaults, plant the flag and, after 100 days or so, fly off to the next operation.

In the rollup world, dealmakers are city launchers. They develop the equity story. They raise money. They source and close deals. And then exit.

They tend to come from investment backgrounds and excel at Type 1 - aggregators.

Focus on a single industry - think dental practices or HVAC

Acquire multiple businesses fast

Have a clear and relatively short (3-5 years) exit strategy

Charles-Henry Beglin, the man who built Simago, strongly believes that the founding team (he doesn’t believe in solo founders) must include at least one person with a PE or Corporate Development background.

Why? Two reasons:

At its most basic, rollup success = scale = number of acquisitions. Synergies between acquired businesses are secondary to scale.

If you target a successful exit in 3 years’ time, you need to understand potential buyers’ investment processes from day one.

Type 1 aggregators target Multiple on Invested Capital (MOIC) in the 3-5x range over a 5-year horizon. This is not enough to get VCs excited, but there are plenty of investors interested!

Type 2 Rollups are the so-called “permanent equity” compounders:

Buy businesses to hold them indefinitely (or at least over the very long term)

Reinvest profits into more M&A whilst minimising dilution

Deliberately avoid industry concentration; prioritise asset quality instead.

In this category you will find enduring compounders like Berkshire Hathaway, Constellation Software, Roper, Danaher, and Lifco. Their portfolios are filled with mission-critical, highly resilient, cash-flow-rich companies.

Type 2 aggregators do not interfere with day to day management. They introduce the acquired businesses to proven playbooks (“operating systems”), but otherwise just let them keep building. These knowledge-based operating systems govern everything from decision making to working capital management. Think Danaher Business System.

Type 2 aggregators swear by Return on Invested Capital, or ROIC - how effectively a company generates profits from its total capital (debt + equity). They like efficient, profitable businesses with clear moats (the term “economic moat” is in fact often attributed to Buffett) that can compound over long time horizons.

Importantly, for Type 2 founders, disciplined capital allocation and operational excellence > deal-making experience. The goal is not speed or volume, it is quality.

Now, let’s look at Type 3: AI rollups. Very different from the above!

As Dan Lifshifts, a co-founder of Dwelly, a General Catalyst backed British lettings rollup, said at our recent conference:

“In order to succeed, you need to reengineer entire workflows. To do this efficiently, you have no choice but to completely scrap the existing systems… Fundamentally how we create value is taking this customer base, putting it on our tech platform, and running the business the way we believe it should run”.

If you break this down into daily workflows, a successful AI rollup must excel at three things:

Sector Expertise

Know their industry well enough to identify what can be automated and where to create valueDealmaking

Find good companies and acquire them quickly, on favourable termsRadical Change Management

Completely rebuild operations on their tech platform, and maintain service quality throughout this transformation so customers don’t leave.

Unlike Type 1 or Type 2 rollups, there isn’t a catch-call KPI for AI rollups. They look for efficiency gains across the board. Some examples from a General Catalyst report on the topic: gross / EBITDA margin uplift; reduced customer response / service times; and team productivity.

Essentially, you need the skill set of both Type 1 and Type 2 rollups, plus a shit-hot software & operations team that can completely redesign the operating model of every company you acquire.

Sounds intense! How many people do you know that can do all three?

3. Investing: how to spot winners among AI rollups

The investment case for AI rollups is compelling. There are millions of small businesses with stable revenue and margins, and repeatable workflows that can be optimised with the help of the latest technology.

Where things tend to break down is in the execution. People forget that companies are run by human beings. They have unique cultures that are often very resistant to outside forces.

Do not underestimate the operational burden and risk of re-engineering day-to-day processes across multiple acquired companies whilst buying, buying, buying!

My advice is threefold.

1. No Solo Founders - team must have all the key skills

You’re highly unlikely to find everything you need in one person You need to look for founding teams that tick all the below boxes:

Great at acquiring at pace

Great at operational transformation

Have AI capabilities in-house

Have an industry edge

2. It has to be a good investment for more than the immediately obvious reasons.

There are a number of characteristics of target companies and industries to think about here:

Low competition for acquisitions will help keep prices low and drive better returns. Ability to acquire at relatively low P/E multiples is a very significant success factor in rollup strategies generally. If every lower mid market private equity firm is also competing for deals and an AI rollup company ends up overpaying for acquisitions, even great operational improvements won't generate strong returns. Thrasio is an interesting VC-backed case study in this exact problem from the 2020 Amazon brand rollup craze. They raised $3.4B in equity and debt, acquired over 200 brands and eventually went bankrupt prior to a planned IPO.

Strong existing evidence gross / EBITDA margin can be improved with AI - it is all well and good talking about this, but can they prove it?

Relatively young employees OR customers at acquired companies, meaning willingness to change and adopt new tech is likely to be higher

Regulatory moats - industries with licensing requirements, compliance complexity, or local regulations create natural barriers to entry that make the rollup more defensible.

Fragmentation depth - it's not enough that a market is fragmented; you need to know there are enough targets to build meaningful scale. A market with a couple of hundred potential acquisitions hits a ceiling fast. Thousands of potential targets gives much more runway.

3. Avoid obvious red flags

Thirdly, after researching 100+ serial acquirers, I will leave you with a couple of things that that are likely to cause trouble (tbh, these apply to all types of rollups, not only AI ones):

Founders of software companies that lack PMF - it’s unlikely that pivoting to an AI rollup strategy is going to magically produce that PMF. AI rollups are a way to accelerate GTM for software that already has PMF;

Founders with little interest in the actual workings of industry XYZ. In particular, avoid folks who invest all their time into developing new revenue streams - instead of upgrading existing operations (see e.g. Teamshares / fintech). You want teams that are obsessed with process optimisation for their chosen industry, not trying to turn the business into something else.

Good luck - happy investing!

Best of the Internet

Welcome to the Roaring Twenties

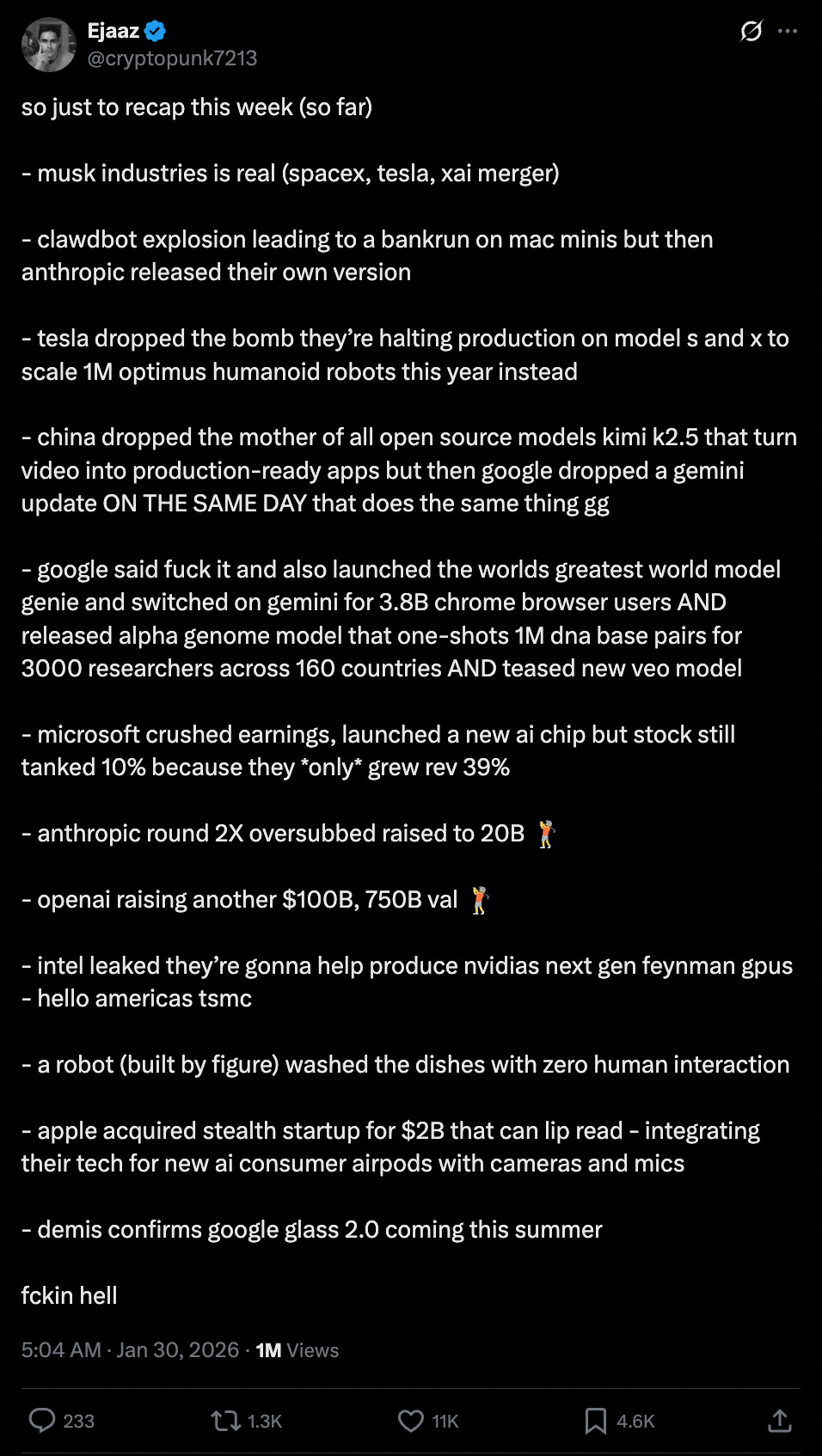

It’s been a pretty insane week in tech.

The singularity beginning as a bunch of AIs shitposting on an AI version of reddit was not on my bingo card to be honest.

I can’t really begin to summarise it, but this tweet does a good job.

Enough internet for me - I’m going to the park with the kids!

Take care out there.

PR

PS - as always just reply to this email or check out our website if you need SPVs (UK or Delaware) or a better, more digital fund admin.

Fantastic deep dive into AI rollup execution. The Thrasio comparison is brutal but necessary becuase it shows how easy it is to blow up on overpriced acquisitions even with solid operations. I've seen a few SMBs in accounting get approached by these rollups and the ones that actualy had good margins rejected buyout offers, which makes me wonder if adverse selection becomes a real problem at scale.