Last chance saloon

There has never been a better time to start building an investment firm or a company. In fact, everything you hold dear depends on it.

The Odin Times is brought to you by Odin.

We let anyone, anywhere launch and run a private investment firm online, and work with over 10,000 VCs, angels and founders globally.

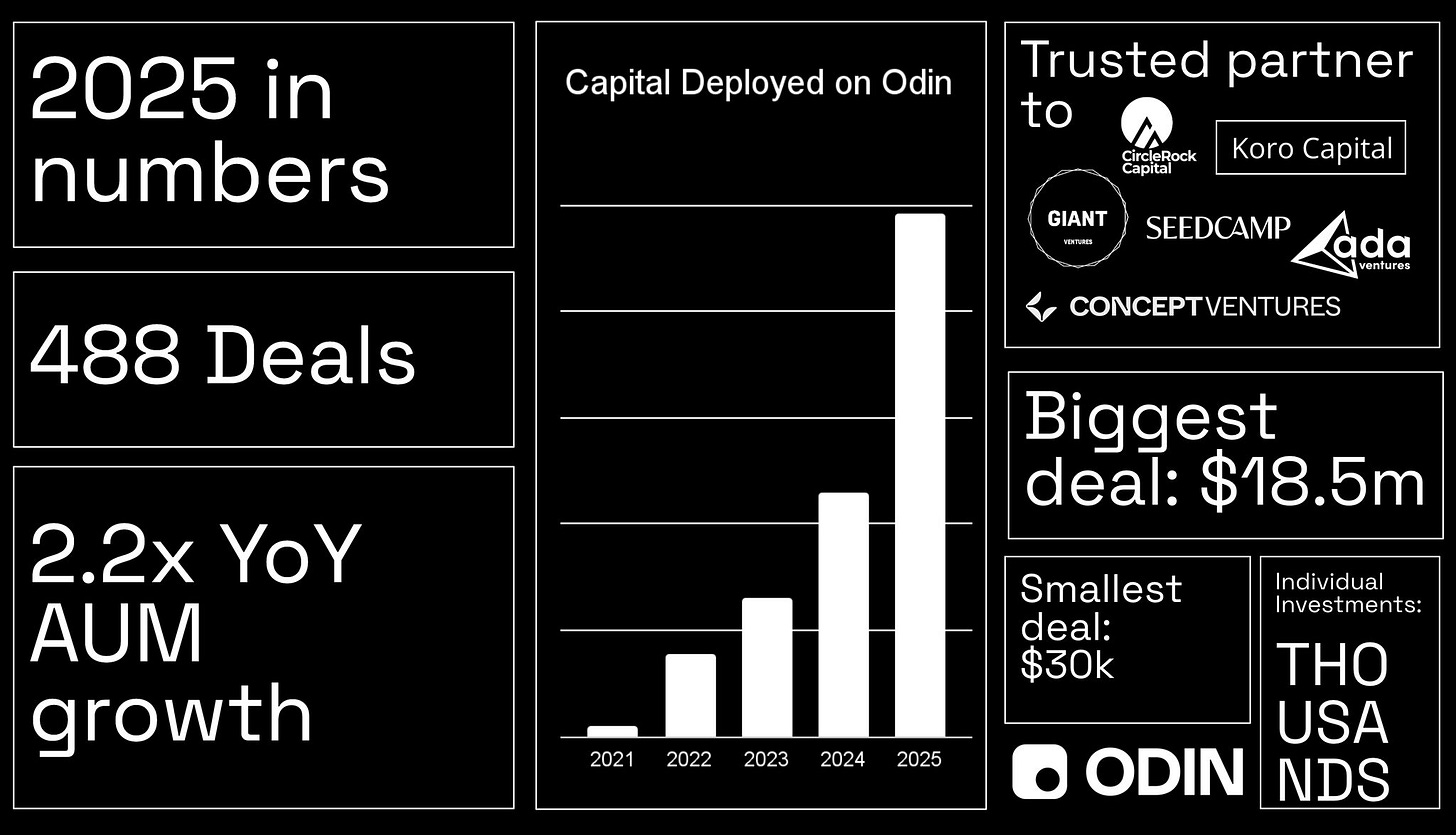

2025 was a big year for Odin. We:

Processed more investment than in the previous 4 years combined.

Hit $500m in assets under administration, with individual deals as small as $30k and as large as $18.5m.

Completed KYC and AML checks on 5,517 individuals & companies

Processed 488 deals (run rate closer to 600 / annum now) and over 6,500 individual investments.

We now administer over 1,500 investment vehicles globally, primarily in venture capital but also in private equity & real estate, made up of over 12,000 individual LP investments, from as little as $1,000 to as large as $10m.

But what’s the point of any of this? Why do it?

If you’re not doubling down on a career in either public service or the private markets in 2026, I believe you’re missing out on a once in a century opportunity.

In fact, I think the future of everything you hold dear might well depend on it.

Let’s dig into why.

Western Capitalism is a pretty good invention.

I like it.

The combination of

A robust “operating system”, with a focus on the rule of law, sound financial & social policy, individual freedoms;

Capital (modern money, securities and physical assets like machines and warehouses)

has been the primary engine for every single thing that has fundamentally reshaped our species’ trajectory over the last 300 or so years.

Whether you are an investment banker, a musician, a biotechnologist or a schoolteacher, the life you lead and the work you do would not exist were it not for capitalism.

Capitalism allows humanity to manipulate the rules of time & space to shape our environment to our will. By coordinating a fundamentally selfish species at scale, capitalism lets us build things our caveman ancestors - genetically and intellectually indistinguishable from modern humans - could never have imagined in their wildest dreams.

Some examples of this:

The Transcontinental Railroad (1860s):

By granting land and issuing government bonds to private companies to build the railroads, the U.S. government coordinated the labour of thousands to stitch the American continent together. Building the railroads turned a 4-6 month long journey into one that took just one week - an order of magnitude improvement.

OK, we can get places a bit faster - big deal. But the downstream consequences of this change were much, much bigger than you may realise.

Suddenly we were able to move not just humans but big, heavy things across incredible distances (without slaves - shoutout to the Ancient Egyptians). This changed the way we were able to shape the landscape, and in turn our reality.

It is no coincidence that soon after the railroads came industrial agriculture, mass manufacturing, electricity, the telephone, the motor car, kitchen appliances, mass information (and with it mass literacy). These things are all direct downstream consequence of the railroads.

The acceleration of mechanisation meant that child labor became less necessary, and over time women were (partially) liberated from their household / carer role. The suffragette movement gained more momentum in the 50 or so years after the railroads were built than the 50 thousand years before it.

Fast forward to today. There are many more examples of capitalism’s ability to create technologies that change what it means to be a human being. A modern semiconductor manufacturing plant (a “fab”) is perhaps my favourite. It is arguably the single most complex and capital-intensive thing humanity has ever built.

A single leading-edge fab (like those built by TSMC or Intel) now costs upwards of $20 billion to $30 billion.

This capital is used to coordinate a global supply chain of extreme precision - specialised chemicals from Japan, ultra-pure lenses from Germany, and “extreme ultraviolet” (EUV) lithography machines from the Netherlands (each costing $200M - $400m. ASML’s core product is the most expensive mass-produced machine tool in history).

Without this massive concentration of capital, the compute required for everything from video calls with your parents on the other side of the planet to this AI-generated video of Trump singing Childish Gambino’s “This is America” would not exist (make of that what you will).

Capital here is being used to “force” the laws of physics at the atomic scale - the thinnest chips we are making are now just three atoms thick, and we’re running into quantum interference with the way they work.

In essence, semiconductors have further compressed space and time. They allow us to be anywhere instantly.

They also now allow us to scale our own intelligence, helping us to solve hard problems that even humans cannot.

But continued progress is not guaranteed

The machinery that got humanity here faces existential threats. The barbarians are at the gates.

There is a nasty confluence of political, cultural and economic division that is making everyone quite pessimistic about the future. Put another way, the vibe in the West right now isn’t great.

Our institutions are decaying. You simply cannot get shit done. You can’t build anything, and the state can’t seem to get its act together to fix this problem. Same story in Britain, France, Germany, USA, etc.

Meanwhile, in China, an authoritarian-techno-capitalist-communist superpower is outcompeting everyone and building an actual robot army. We risk a situation where we are all watched over by machines of not so loving grace.

Finally, there is also a significant risk that as machines do more and more of the work historically done by human labour, the delicate relationship between labour & capital that has sustained human progress for the last ~300 years collapses.

People who own productive AI assets get wealthier and wealthier, and they don’t need to employ humans to make money. Everyone else fights in the dirt for scraps.

In this case, regardless of whether it’s China or some Western power in the driving seat, we end up with some sort of AI-powered neofeudal dystopia.

Both Sam Altman (in 2021) and Philip Trammel (a few weeks ago, via Dwarkesh Patel) have written interesting pieces about this. Of course there are gaps in the argument - “If people don’t have salaries, who buys all the stuff the AI makes?” - but regardless, shit’s about to get real.

In short, the stakes couldn’t be higher.

This is also an opportunity.

The future depends more on where talented Westerners put their time than at any moment since WW2

If you want to fight for the values and the world you hold dear, you have two options:

Go into politics or public service (work on the operating system)

Build a startup or investment firm (work on the application layer)

If you’re thinking about option 1, I salute you. You’re trying to do the hardest and most valuable thing.

If you’re thinking about option 2, I’d like to talk to you.

How Odin can help

Our product lets anyone, anywhere launch and operate a private investment firm online. We work with fund managers and angel syndicates in London, New York, SF, Dubai, Helsinki, Singapore, Sydney and Hong Kong. They can run their VC fund or handle their angel deals from their phone. We take care of the admin, they coordinate capital.

We are firm believers that many of the best capital allocators - the founders, fund managers and investors seeing round corners and leveraging capital to shape the world to their will in new and incredible ways - do not have “traditional” backgrounds.

They may have spent a long time doing something weird or niche, and for this reason they see the world differently. This is what gives them their edge - to paraphrase Big Daddy Thiel, they understand a fundamental truth about the world that others do not.

Often, at least until they build a track record, these are not the people that mainstream VCs or LPs get excited about working with.

They have audacious visions for the future - often great ideas that look like bad ideas - and a willingness to invest their time and money in turning these ideas into a reality.

People like

Warrick - probably the best VC you’ve never heard of, an investor in everything from Great British defencetech to emerging markets neobanks. A man who goes to war for his porfolio founders and gives it his all to help them grow faster;

Chris - one of the the biggest backers of Rodolfo and Hannah - who are aiming to make computer chips 4,000x more energy efficient with a radical new paradigm - reversible computing;

Harvey - who is pulling CO2 out of the air and turning it into carbon-neutral rocket fuel;

And many more - too many to count!

We do something unsexy - the plumbing, the paperwork, the KYC and AML, the payment processing, the legal structuring of investment vehicles, the tax documents and reporting - but this is what allows our customers to coordinate capital to solve humanity’s hardest problems as fast as possible.

The early results for our customers have been…promising. Big visions produce big results (when they work).

We’ve processed over 50 liquidity events. Our most successful investor is sitting on a ~500x markup on an investment they made only 2.5 years ago. Many more are sitting on markups or cash exits of anywhere from 3x - 250x their money.

No, this time you really should hop on a call

In 2026, we want to speak to you if you’re:

A new or established fund manager looking for a service provider to handle your SPVs and/or fund admin. You’ll like working with Odin if you like digital-first, self-serve products that just work, but also want to be able to pick up the phone to a human being to solve trickier admin problems (more info).

A deal by deal investor (merchant bank, angel syndicate, secondaries broker, multi family office) looking for similar service (more info).

A founder looking for a seamless way to raise capital from tens or hundreds of smaller angel investors and bundle them all into a single entity on your cap table, simplifying both your fundraise and ongoing governance (more info).

You’ll be joining a community of over 1,500 founders, deal sponsors and fund managers like you - maniacs on a mission looking to solve hard problems quickly.

We’ll continue to scale geographically and work with both smaller angel syndicates and institutional partners.

We’re ramping hiring in both our engineering and commercial teams (see live roles here), and laser focused on shipping great products our customers need much faster than in previous years.

We will also publicly launch our E2E fund administration offering (currently beta testing), which will be compatible with multiple legal structures and regulatory jurisdictions.

We’ll keep doing the admin - so you can build the future.

We’re counting on seeing you at the Last Chance Saloon

PS - We’ll be publishing more regularly this year - I’m very excited to be bringing on board a regular partner on our content. More on that in our next post!

Best of the Internet

Fuck it, why not, everyone’s doing it now

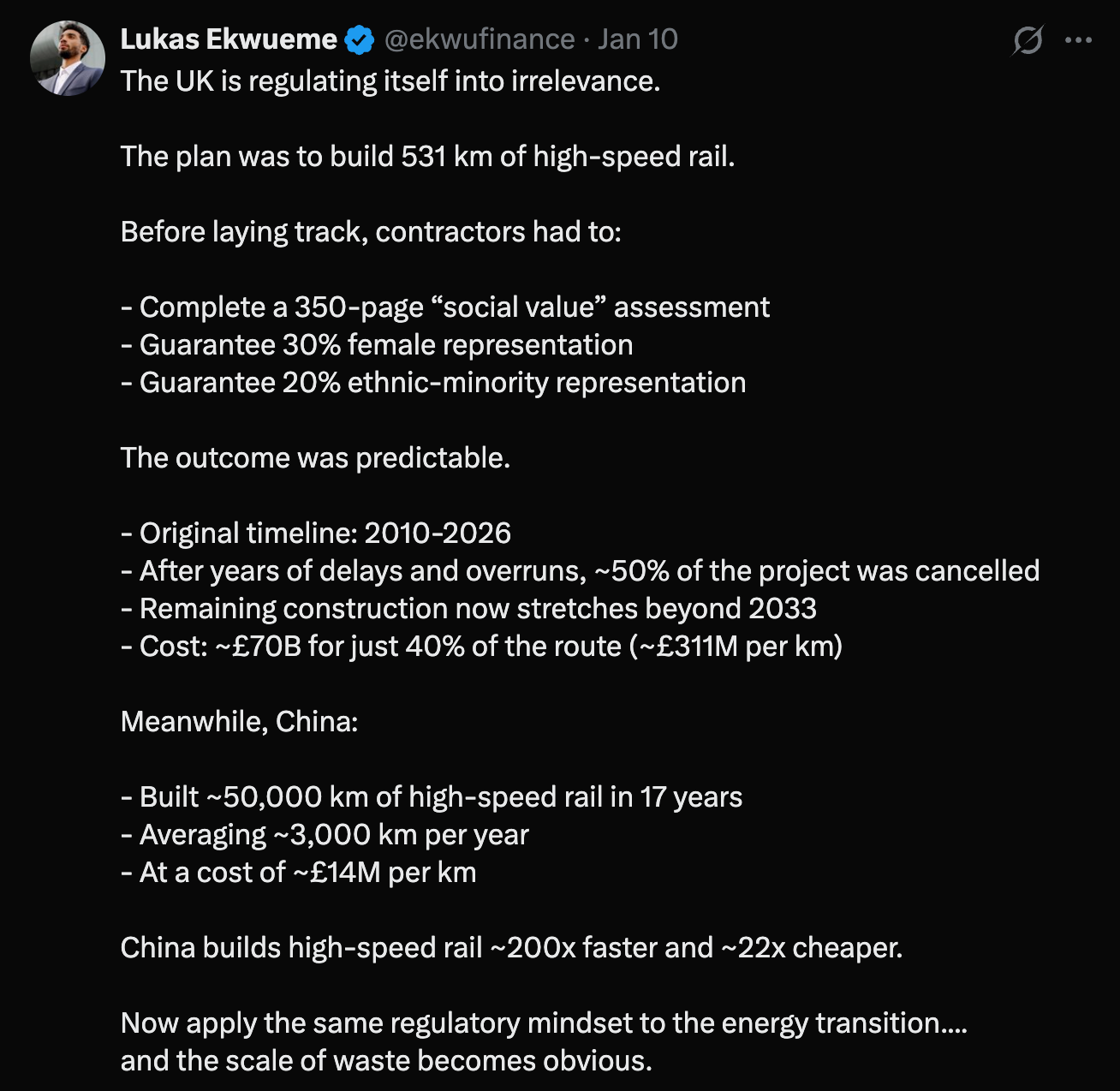

Harsh, but he has a point

Perspective is everything

Motivational speech to round things off

Chat soon!

PR

Powerful framing on the urgency of capital allocation right now. The analogy between historical infrastructure moments (transcontintal railroads, fabs) and today's AI/robotics transition makes the stakes clear. The part about labor-capital dynamics collapsing when AI scales is something I think about alot, most people havent grasped that we're not just automating tasks but potentially entire income streams. Building now or watching from the sidelines isnt just a career choice.