Memecels

Myths about VC, new power and funny stuff from tech twitter

Hi folks, Paddy here from Odin. We are making it 10x cheaper and easier to launch & invest in syndicates and venture funds. We are now live in private beta.

Want to set up an SPV? Learn more here, or click below to get started. ⬇️

Guten Morgen,

I had a lot going on last week. Consequently, I didn’t find much time for the newsletter. However, I am a huge believer in the compound interest of doing stuff consistently over an extended period of time. Plus, like the wordcel I am, I just love writing this thing.

So you’re still getting your Sunday order. You lucky bugger.

Whenever the Simpsons had this problem, they used to do flashback episodes.

This week, I’ve decided to do something comparably lazy, but hopefully still fun to read:

Three of my favourite pieces on tech and VC, which I’ve added to the Startup Investor’s Almanac. I’ve provided a tl;dr of each, but recommend you read them in full.

The three past articles from this newsletter that I’m most proud of. Because why not?

The usual round up of funny and interesting stuff I’ve read on twitter.

Vamonos.

From the Archive

Three of my favourite pieces of writing on tech and VC

Six Myths About Venture Capital

Diane Mulcahy manages the global private equity portfolio for the Kauffman Foundation, one of the world's most prolific fund investors.

In this short, informative piece, she debunks a number of common myths about VC's, and presents some very interesting truths:

Angels fund almost as much innovation as VC's in dollar terms, and significantly more in terms of number of companies.

VC's are fairly insulated from risk by management fees - they're not really risk takers.

Many don't offer the great mentoring / advice they sell to founders.

Most don't even return their fund, let alone beat public market indices.

Smaller funds actually outperform larger funds.

VC's are not particularly innovative and their business model has changed little in the last 40 years, in spite of the fact they invest in innovation.

If you want to dig deeper on the subject of VC fund returns, investment data, and the amount of bullshit that exists in this industry, check out Diane’s seminal piece of research “We Have Met the Enemy…and He is Us: Lessons from Twenty Years of the Kauffman Foundation's Investments in Venture Capital Funds and the Triumph of Hope Over Experience”.

Trigger warning: Shots Fired

How to Invest in Startups

“There is a lot of advice about how to be a good startup founder. But there isn’t very much about how to be a good startup investor.”

Sam Altman (ex Y Combinator president, now CEO of OpenAI) gives his view on how to be a good early-stage investor and outlines what attributes define a successful startup. There’s a big focus on working hard (lots of investors are lazy, so it gives you an edge), and identifying good teams that are mission-driven. But in short, it’s about looking for scrappy, tenacious, smart people building products that are 10x better than whatever else is out there, with network effects, in fast-growing markets. Sounds easy.

The one nugget that I really like in this piece is the idea of assessing the humans involved (the hardest part) by tracking change over time, rather than looking at this as something absolute or finite:

“If you meet someone three times in three months, and notice detectable improvement each time, pay attention to that. The rate of improvement is often more important than the current absolute ability (in particular, younger founders can sometimes improve extremely quickly).”

Understanding New Power

If you read this newsletter frequently, you’ll know I talk about this piece of writing a lot. Published in 2014, it was very prescient of the Web3 movement.

To me, new power affects the near future of almost everything.

New power is the power of the "crowd" in the online world, vs. the power of hierarchical institutions in the more traditional, offline world.

"Old power works like a currency. It is held by few. Once gained, it is jealously guarded, and the powerful have a substantial store of it to spend. It is closed, inaccessible, and leader-driven. It downloads, and it captures.

New power operates differently, like a current. It is made by many. It is open, participatory, and peer-driven. It uploads, and it distributes. Like water or electricity, it’s most forceful when it surges. The goal with new power is not to hoard it but to channel it."

This concept has had a big impact on my career decisions, and definitely informs my investments too.

From Yours Truly

The three pieces I’m most proud of from the last couple of years. Thank you for indulging me.

VC’s are marketers, not Financiers

Why storytelling is more important than financial acumen in Venture Capital

Hacking Venture Capital

What r/wallstreetbets says about the future of VC, and an open source playbook for building a community-driven investment firm

Private

Thoughts on the opportunities, as well as the technical and human challenges that Odin faces in opening the private equity and venture capital markets to retail investors

Best of the Internet

The usual collection of miscellany I’ve seen in the past week that made me laugh or go hmmm.

Memecels

Twitter teknopriest Roon breaks down the wordcel vs shape rotator meme he birthed, and explains why it struck a chord with people.

“Vast portions of society that in a prior age might have been organized by government bureaucrats or private sector shot-callers have been handed over to cybernetic self-organizing systems designed and run by mathematical wizards. We have been witness to the slow, and then rapid transfer of power from the smooth-talking Don Drapers of boardroom acclaim to the multi-armed bandits of Facebook Ads.

Great piece. Mastery of both “shape rotation” and the written word is the obvious thing to aim for.

Fake News

A bunch of musicians nobody cares about threatened to take their music off Spotify if Joe Rogan wasn’t deplatformed for saying some misleading stuff about Covid vaccines. James Blunt’s take made me chuckle.

Check out his twitter if you haven’t, he is hilarious.

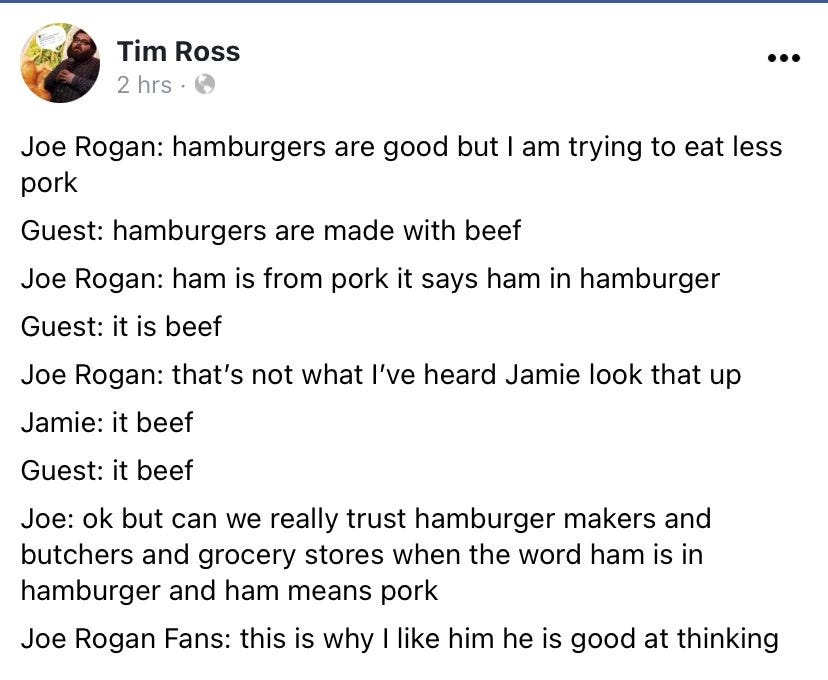

To be fair to the musicians, this is Joe Rogan’s podcast in a nutshell:

Let there be Pockets

Oldy but a goody

Dad Joke Level: 11

Ring Your Parents

They miss you

That’s it, that’s all.

I promise to do better next week. I have a podcast that I still haven’t edited with one of our shareholders: Euro startup OG and Atomico angel Sarah Drinkwater. Exciting!

My shape-rotator cofounder Mary has also been threatening to contribute some writing for about eight months. I’m not holding my breath. Her Twitter feed does have potential though. If you agree, please call her out and ask her to write something for the Odin Times ;-)

I keep telling her she should.

Cheers,

Paddy

💸 Discover and apply to join syndicates powered by Odin

🏦 Launch an SPV

👨👩👧👦 Apply to join our community (private events, dinners, 121 matching with great people in European tech, Slack channel)

🤝 Access Odin’s Resources

✉️ View previous email newsletters

Risk Warning

Investing in start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. Odin is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via Odin once you are registered as sufficiently sophisticated. This content is for informational purposes only and should not be considered investment advice.

Join Odin Limited is an appointed representative of Aldgate Advisors Limited, which is authorised and regulated by the Financial Conduct Authority (No. 763187).