👷 Operator-Investor

How to angel invest as little as $1k in startups, and why founders are taking more of these cheques.

Hi folks, Patrick Ryan here from Odin. We are building the ultimate tool for angel syndicates to invest together in private companies and funds, via SPVs.

Good morning all,

It is, once more, that time of the week.

Today, our main feature is a guest post from my friend Cyrus Yari, cofounder of the Rational VC podcast. Cyrus covers his journey into startup investing, and offers advice on how anyone can get started.

The key insights:

1. Aim to be an operator-investor, not a VC. This is the role that will put you, in Cyrus’ view, in the position to get the highest returns, and the most career progression, over the long-term.

2. Get started via investment platforms like AngelList and Odin.

3. Build a diverse portfolio, and only allocate a small percentage of your investments to this asset class.

Some elements of this post are going to be a little divisive:

The most illogical finding in modern-day VC is Bankers and Consultants becoming Venture Capitalists. How do those roles qualify you to become a VC? The least value-add and lowest ROI activity known to any founders (or mankind for that matter) is having these blood-sucking vampires on your Board who have absolutely zero awareness of what skin-in-the-game even entails. Charlatans who don't want to do the work

Don’t get me wrong, I know some great ex-banker VC’s. However, I understand the spirit of what Cyrus is saying. At least some of the next generation of hyper-successful startup investors are likely to have specific knowledge and networks built through operational experience in the space they are investing in. Perhaps most.

I believe this is especially true since frontier technology is becoming more complex, and greater specialisation is required as an investor.

Now, before I hand over to Cyrus, let’s briefly see some stuff from tech Twitter…

📰 Best of the Internet

Funny tweets and interesting bits of content I’ve come across in the last week or two.

The Everything Deck

A great little overview from Fred Destin of what to put in your deck. I agree that a well-structured Notion memo is, nowadays, probably a better alternative.

Rules for good writing

Everyone should write more. If it’s good, we will share it with this community.

Solo Capitalists

The Rise of the Lone Wolf GP in Europe

The OG post on this subject by Nikhil Basu-Trivedi is a great read.

Thinking of leaving the pack? Email me.

Escaping Groupthink

An excellent thread from Claire Lehmann, the founder of Quillette, on her mission and journey

Didn’t they just skip like ten letters anyway?

Now, over to Cyrus. Please note, this is a long post, so it may get cut short by your email provider. If so, you can read the full thing on Substack instead.

Becoming A Micro Angel Investor

How to invest as little as $1k in startups and why founders are taking more of these cheques

Inspired by the maestro Nassim Taleb: Skin in the Game - Hidden Asymmetries in daily life.

"It's one IPO to the next one" — Nasir Jones, QueensBridge Venture Partners.

Part 1: My journey to angel investing

Part 2: Why founders prefer taking angel cheques over VCs, and why you should get involved

Part 3: How you can angel invest starting with $1k cheques

Disclaimer: Angel investing is inherently risky and illiquid. It involves a high degree of risk. This article is solely for entertainment purposes and does not constitute investment, legal, or tax advice, or any advice for that matter.

Part 1: My journey to angel investing

I was working in the heart of The City ("UK Wall Street"), opposite the Bank of England, in the esteemed 41 Lothbury building, on the top floor. 23 years young, slicked-back hair, drenched in cologne, 100% wool Savile Row suit and calf-leather good-year welted shoes.

I resembled your favourite pre-revolution Iranian uncle in a mobster movie. I'd just secured a full-time position in banking following a successful internship, yet my mind was already looking ahead at exit opportunities in venture capital and trying my best to "oPtImIsE" by starting the groundwork necessary (those who know me well know my tendencies to over-analyse, over-DD, and over-prepare years in advance).

Of course, a natural and easier exit path for me would have been to work towards joining the venture capital arm of Silicon Valley Bank, where I was at. Much DD later, I still wasn't convinced. I decided to email the messiah of career advice: Brian Dechasare.

Brian founded the OG of OG blogs, breakingintowallstreet.com and mergersandinquisitions.com.

In fact, Brian has written one of my all-time favourite and most shared articles, which I now send to all mentees and kids who ask me about careers in traditional finance. Of course, the first thing I tell them is to get their sanity checked, then tell them to learn to code, followed by sharing Brian's article: "No, You Can’t Have It All: Why Finance Does Not Guarantee You $10 Million and Your Own Beach in Thailand". I can proudly say that I've changed the career path of several kids, reducing the number of charlatans in the world and increasing positive-sum players improving the world.

When I first came across his article, I noticed Brian hadn't touched on the VC path. And so email the GOAT I did. He responded:

Welp, I was truly fucked now. I knew he was right.

My mind shifted to tracking the world of startups. Specifically in sectors I was focussing on in my tech banking role (FinTech, SaaS, Consumer) and developing an expertise in.

Over the years, recruiters reached out to me for all sorts of roles. From VC, to blockchain startups, fintechs, SaaS and so on.

Looking back now, one of the best decisions I made was not joining a VC firm, and to gain some damn operating experience first. You know, easy decisions = hard life, hard decisions = easy life. Something like that. If two options are roughly equal, I usually take the one that seems more difficult and uncomfortable in the short-term.

The most illogical finding in modern-day VC is Bankers and Consultants becoming Venture Capitalists. How do those roles qualify you to become a VC? The least value-add and lowest ROI activity known to any founders (or mankind for that matter) is having these blood-sucking vampires on your Board who have absolutely zero awareness of what skin-in-the-game even entails. Charlatans who don't want to do the work. This is especially prevalent in UK/Europe. Equipped with an MBA from Insead or London Business School, funded by daddy, these are what Chamath calls "box-checkers", or as the GOAT Antonio Garcia-Martinez puts:

Yes, recently Tiger has aggressively been hiring Bain consultants over operators because they can work longer hours, meet tight deadlines, and have great attention to detail, etc. Firstly, only very few shops move like this. Secondly, time will tell if this strategy pays off, and thirdly, they are still slaves with no skin in the game (heaps of LP funding, none of it theirs) and it merely becomes an extension of their job in Wall Street/MBB. Plus if you want to put in tiny amounts of your own funds, then you're mostly looking at pre-seed and there's not much analysis or due diligence to do there, other than the team you're betting on. Being an operator is way more fun. Not only are no two days the same, but your efforts lead to a directly visible impact (skin in the game). It's like drinking out of a firehose. You'll learn more in one year as an operator than you would five years as a traditional VC.

My point is that we now live in a world where cheque-takers (founders) have become increasingly selective with who they take money from. This is further exacerbated by the abundance of capital flowing into the space, allowing them by definition to be selective. Early-stage VCs are becoming obsolete (bar the very few tier-1s of course), and there's never been a better time to angel invest. The best founders want other founders and operators (been-there-done-that) on their cap table (especially early rounds). They seek value, experience, and skin in the game in return for giving you allocation. Who would have thought?

Step 1: Be an operator (create a startup or work at startups) and learn the craft (sales, operations, fundraising, marketing, PR/comms, management, hiring, finance, technical expertise, etc.)

Step 2: Publish your knowledge or proof of work online (content creation) and take advantage of the leverage that is the internet and asymmetric bets. "We are moving from centralisation to a more permissionless world" as summed up by my friend Imran Mahmud in his video.

Step 3: Make great online friends and "add value" (help them in any way, especially if it's an area in which you've learned the craft in your day job at a startup)

Step 4: Unless you have been a real idiot then by now you should have been presented with the opportunity to throw in small angel cheques in various startups. Your network naturally grows and eventually deal flow comes to you. You will find it much easier to get allocation in the hotter startups compared to most VCs, and have way more fun doing so, without being some old white guy's bitch in an old boys "VC" shop.

“Don't view angel investing as a way of making money, see it as a way of increasing your optionality and opportunity for things later on in life. Once you build your brand as a decent angel investor, you will make money over the next 7-10 years by default because of the compounding effect of the investments you make, but more importantly, there is a large amount of non-economic value in being an investor. You don't actually need to put that much money into it. The difference between being on a cap table and not being on a cap table is absolutely huge, whereas the difference between $5k or a $10k cheque is minimal."—Sriram Krishnan, General Partner at a16z.

Operate first, and angel invest on the side.

"Operator-investor" they call it in the Valley.

Kill two birds with one stone rather than just being a sub-par investor your whole life (unless you're a high-performer at one of the very few tier-1 firms, a la a16z, Sequoia, Founders Fund, Khosla, which is extremely rare). The future of venture belongs to those with not only operating experience, but also some "social capital" online. Besides, even if you were trying to break into Venture, you're most likely doing the wrong things. This is not a traditional market. The best guide out there is breakinto.vc by Pietro Invernizzi, and funnily enough if you do most of the things Pietro outlines, it will lead to you having your own deal flow you can invest in, at which point you won't want to join a sucky mediocre VC firm.

It's only right to end this section is by watching this TikTok video from Turner Novak on what it's like to pitch a typical VC.

Part 2: Why founders prefer taking angel cheques over VCs, and why you should get involved

Founders love to get as many helpful angel investors involved from early on. Not only are these angels going to be the biggest cheerleaders, but if they are also operators, then the founders have an entire network of people to lean on when shit goes wrong (or right).

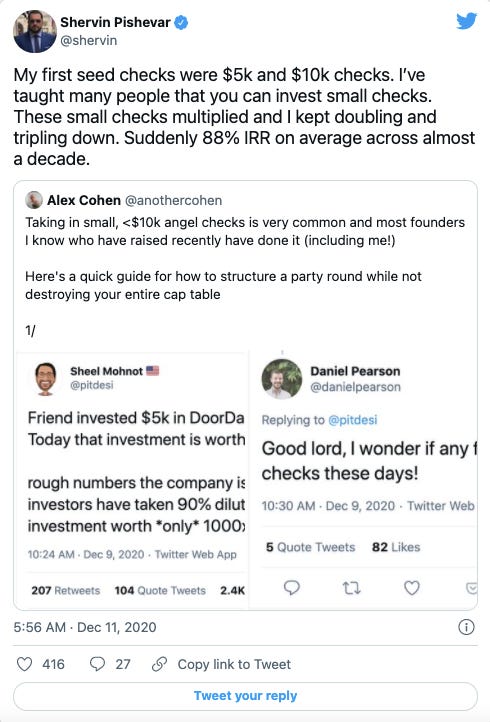

As Alex Cohen goes on to explain, when he raised his last round, he got ~45 angels involved, with cheques ranging from $1k up to $50k. Seeing as he didn't want to deal with 45 signatures and managing 45 wire transfers, he formed an AngelList syndicate. It was structured so that he was the manager of the syndicate, there was no carry, and he ate the $8k standard fees payable to AngelList for setting this up. Investing via the syndicate was nearly identical to investing direct, except there would only be one entity on the cap table, and not 45. Alex outlined the other advantages being:

He had a link he could share with any interested investors with an AngelList page for them to view details and invest

He could take cheques as small as $1k, meaning anyone helpful could get involved (more on this later in the 'how' section)

AngelList handled all the movement of funds, and Alex wasn't stuck managing wires

AngelList is great, but I have a better alternative (given local tax/legal implications) which happens to be a much cheaper option - Odin.

Odin charges up to $7k for each syndicate. For SPV’s led by founders, it is capped at $2.5k. I agree with Alex in acknowledging how fair the fees are given legal and operational overhead. Next time one of your friends is raising money for their startup, remind them of this option. Once on board with the idea, there are two ways to cover this cost:

Pass it to investors; they split the cost proportionally to their investment.

The founder eats the cost, as Alex did; He wanted the syndicate process to feel exactly like investing directly and leave no room for pushback.

Here's how the Maths works:

Let's say the founder receives a $100k investment via the syndicate. Odin gives the founder $97.5k when they wire funds at closing. The funds come from investors, but in their view, it still looks as if they invested their full $100k.

Odin sends a separate document to each investor to sign and they all become one entity on the cap table, representing N number of investors in the syndicate. The investment is wired and the founder goes back to building.

The rationalists like Alex have never done a true party round outside of a syndicate, and like others, he too has heard of horror stories of trying to track down signatures 6, 12, or 24 months into running the business when it becomes time to raise again. He wanted things to be easy.

If you're a founder and can raise enough from angels (which is becoming more common) to justify the $2.5k, then it is a no-brainer.

Founders can still give allocation to certain angels outside of the Odin syndicate. This is advised if they're super experienced which means they likely have an entity they invest out of.

Okay, enough about founders. How can I wire funds into startups?

That's for you to decide, or to discuss with your tax/legal advisor. I personally have invested via one of two methods where the founder hadn't set up their own syndicate:

Putting a few grand directly into a startup under my personal name, or

Setting up a syndicate (SPV) with friends where you each put in as little as $1k and pool your funds together to invest in a startup via the entity created.

Part 3: How you can angel invest starting with $1k cheques

Let me just preface this, by saying that Angel investing is extremely risky. I look at it as the equivalent of speculation (especially at the pre-seed stage) and at this point even your grandmother knows that >90% of startups fail. So why are so many people putting "aNgEl InVeStOr" in their bios?

Are you just trying to angel invest because it's cool and others are doing it and you can't think for yourself and you need validation?

If no to all of the above after your self-reflection, then let's continue.

First, before you allocate any capital, I highly suggest you read 'The Psychology of Money' by Morgan Housel to really put all of this rationality into perspective.

Now, let me give a quick breakdown of what this 'how' section will include:

a. Strategy

b. Return economics

c. Investment assessment and feedback

d. Portfolio construction and Philosophy

Let's get on with it...

a. Strategy

As Elizabeth puts, while you do need to have *some money* to be able to angel invest, it's not as much as most people think. No, you don't need to be super rich. Conceptually, angel investing can be pretty accessible. Getting deal flow and education have been the bigger roadblocks people have faced historically.

Most of your investments will return zero. Therefore, it's crucial to have great portfolio construction (no, not the theoretical jargon we studied in the university's finance class from charlatan academics with no skin in the game).

Elizabeth has made an incredible video outlining why VCs are so obsessed with unicorns ($1billion valuation companies) and this will help walk you through the thinking of the true risk involved and why it's imperative you focus on portfolio construction.

You will lose money not just on companies that shut down but also on the ones that continue to do well but never have liquidity (as well as the ones that do have liquidity but you are at the bottom of the preference stack and later-stage investors hose you).

As such, your winners need to make enough money to cover all of your losses plus make more money. As an angel, you don't need to go for the biggest outcomes ever (unlike VCs) but it's important to have a similar returns mindset -- 2x wins are not good enough.

The way to tackle lots of losses is to invest in a high volume of companies to diversify your portfolio (this is not public markets, this is angel investing, so as much as I love Charlie Munger, we're going to have to throw out the anti-diversification thesis here). One of the biggest mistakes new investors make is thinking they can really pick well and putting a big chunk of cash on one company. Don't try to pick a company. Select a portfolio.

b. Return economics

I totally agree with Elizabeth, that for beginners, a bigger startup portfolio is better. Reason is twofold:

1) It helps with diversification - mitigate downside risk.

2) It helps you learn and get reps in.

Investing requires practice like everything else. Therefore, you'll have to see a lot and invest a lot (by volume, not necessarily value) to get better. As this OG Venture Hacks blog post, titled: "11 angel investing lessons" by Naval and Nivi states: "You need a lot of data to build up your instincts."

There are lots of opinions on "concentrated" vs "large" portfolio theory. The pros and cons are that a large portfolio mitigates risk, but also returns too. A concentrated portfolio increases both the risk and the upside. As Elizabeth puts: "I think for beginners, it's better to walk first. Then think about running."

This is why it's helpful to be investing smaller amounts such as $1k. If you're going to diversify in say 100 companies -> $100k over say 5-10 years. This means that you need to have $10-20k per year. That's the kind of budget you need for this to mitigate risk.

Further, when you have no deal flow, you need to team up with people who do in order to maximise your chances (more on this later, and funnily enough when you start doing these things, VC firms will show an interest in you but by then you won't want to join them). Try to find other people who have been angel investing or even small fund managers you can look at companies with.

Although you may have different opinions from these investors, in order to practice, it's helpful to understand how other people think about things (and understand what they think about) when they are making a decision.

Once you are able to tag along with other people for deal flow, this is really a game of decision making and how you improve your decisions over time. The more disciplined you are in your thought process, the more you can improve. Like sports or musical instruments, in order to get better, you need to take in feedback, and work on those *specific weaknesses*.

However, many investors don't get better, because the cycle from beginning to exit is years. So how do you get feedback to get better?

c. Investment assessment and feedback

In startup investing, there's short-term and long-term feedback.

In the short term, it's making a decision to invest in a startup, then working with the startup to re-assess whether your hypotheses were true.

It's often hard to figure this out, because you are not going to be day-to-day with the team. And as Elizabeth or any seasoned investor will tell you from their learnings across hundreds of companies, most company updates don't really say much.

But you can mentor at an accelerator and work with companies week over week. That's one way (and you can learn a lot BEFORE you put down your own money too). You can also work with your companies on a project. Help them with their deck or their website. Provide feedback on their product. Any form of adding value is good.

All of these things help you validate or disprove specific hypotheses. Over time, you will build a mental model of how to assess on various criteria better as well as what is important to you. This is how you get better at angel investing.

Finally, it's a long term game. So most of your companies - even the ones that do REALLY well, will not look great in the beginning. They will face MANY downs and will have to pivot. So it's important to look at the long term and be willing to wait (and potentially lose) all your money.

People ask “how can you invest only $1k?” Make a fast decision. Then say, "Hey - really love what you are doing. But unfortunately I'm not rich enough to invest more than $1k. I won't be a pain and can help you with [X]." X = intros, deck, product feedback, etc.

Elizabeth taught me some fundamental lessons, and opened my eyes to opportunities that were not so obvious or common across the pond here in the UK startup space, which is always a decade behind. Plus, this is how many of the GOATs in the Valley got started.

If it's important enough for you, and it feels like play and not work, then you'll make time for it and will put in the effort just like Michele, who found a way to help founders and get deal flow:

And the final piece of the "how"...

d. Portfolio Construction and Philosophy:

As Jim O'Shaughnessey said in a podcast episode, we are moving to a world where everything is about asymmetry and leverage and if you don't participate you get left behind.

Iman and I understand this when investing under the rational.fund brand as micro angel investors, and we're EXTREMELY optimistic about the future, BUT we personally like to combine this with rationality to mitigate delusion.

Do what works for you, but how we currently like to structure investments is as follows (strong opinions loosely held, so this may change in the future):

10% of the portfolio is extremely risky investments, such as angel investing, which is essentially speculation and money you're willing to lose once it leaves the account, and

90% of the portfolio are low risk investments compounding over the long-term (see below)

This is somewhat taken from Nassim Taleb's "barbell strategy" - an investment concept that suggests that the best way to strike a balance between reward and risk is to invest in the two extremes of high-risk and no-risk assets while avoiding middle-of-the-road choices. The strategy advocates pairing two distinctly different types of assets. One basket holds only extremely safe investments, while the other holds only highly-leveraged and/or speculative investments.

Taleb described the barbell strategy’s underlying principle this way: "If you know that you are vulnerable to prediction errors, and accept that most risk measures are flawed, then your strategy is to be as hyper-conservative and hyper-aggressive as you can be, instead of being mildly aggressive or conservative."

Given our age and various other factors, Iman and I will never consider a "no-risk asset". We are Millennials in our late 20s and submerged in tech. Further, given current levels of inflation, for our personal risk toleration, the S&P 500 index is what constitutes "no-risk" for us — clearly there is risk involved but if you're looking at this with a multi-decade lens then it's only going in one direction so I consider it zero risk. We'd never invest in bonds or CDs. Plus, we never disrupt compounding and we acknowledge its true power over the very long term. Your barbell may look different if you're older and have a family. Please read all of Taleb's work. Recommended reading for life.

Now let's be honest, as Buffett says, >99% of you are not really passionate about investing. So who are we kidding here? You're not going to spend 6 hours a day reading annual reports and studying companies day and night. Besides, life's too short and now asymmetry is more prevalent in the investing world with 18-year olds making millions from pure speculation.

In the most recent Berkshire Hathaway annual meeting, Buffett stated that when he passes away, besides the large chunk of his wealth that will be going to charity, the portion that goes to his wife will be going straight into the S&P 500 index. He is not even leaving it in Berkshire for his own people to manage, but rather putting it into the S&P 500 index! He sounds like a broken record as he repeats this every year, but states that the best thing for anyone to invest in (who is not a full-time die-hard investor like him) is to put your money into the S&P 500 index. Yes, there will be down periods, but if you're holding for life and you have an automatic payment going into the S&P every month, and truly understand the power of compounding then you will beat most active hedge funds who spend near enough 100 hours a week with large teams trying to beat the index.

So what am I saying here? Put the other 90% into S&P 500 index? No, that's not what I'm saying. Do as you wish. There is no hard and fast rule and I am not here to advise.

Iman and I do actually enjoy being nerds and consuming a lot of information, so while we invest some of the other 90% in the S&P 500, we still put a decent amount into well diligenced (or we'd like to think) lower beta tech growth stocks and into actively managed funds such as FundSmith (managed by Terry Smith, the "English Warren Buffett") who've achieved an 18.3% annualised rate of return. Terry Smith has a better long-term record than us in the public markets as it's his full-time job. His philosophy (as is ours for the 90% side of the barbell) is:

Buy good companies;

Try not to overpay;

Do nothing.

How novel, yet obvious, and beautiful does that sound?

At some level, our thesis may appear contradictory. The key is to take minimal risk balanced with some risk, but do so with both feet in the water.

Never do anything half-heartedly with one foot in and one foot out, or without proper diligence and thought. Don't be lazy. Put the effort in and make a commanding, sometimes defiant decision.

And this goes for everything in life, not just investing. How you do one thing is how you do everything.

If you're in this for the long game, you are genuinely interested in supporting the next great wave of innovation and you want to maybe make some money along the way. In this case, angel investing may be for you.

Just remember to balance the load and put the reps in, consistently. When it's all said and done, do you want to look back and realise you've spent your finite time working with soulless traditional VCs who stand for nothing, lack values, and authenticity, or would you rather foster real friendships with likeminded people, and have at least some visible impact on the world in your day to day?

If you're not going to become a founder, start today and work towards becoming an operator-investor. You'll also have more freedom and control of your time, which in turn allows you to spend that time on the more important things in life.

“Intimate, loving, and enduring relationships with our family and close friends will be among the sources of the deepest joy in our lives.”

― Clayton M. Christensen, How Will You Measure Your Life?

A big thanks to Elizabeth Yin and Alex Cohen for their timeless and incredible insights. Give them a follow!

Also check out this video / podcast Iman and I recorded on Angel Investing and Portfolio Construction:

If you'd like to angel invest / set up a small syndicate with your friends, check out Odin. This is not a sponsored post. I rarely vouch for other brands but they are awesome. Reach out to them with any questions - super helpful.

Iman and I do not currently accept outside investors in our private angel investing syndicate. We may open up a few spots a year from now - we'll let you know if we do.

Thanks to Iman Olya and Aria Fard as always for reading drafts of this.

Recommended / supplementary content:

Elizabeth Yin - Twitter

Alex Cohen - Twitter

The Psychology of Money - book by Morgan Housel

breakinto.vc - Free guide by Pietro Invernizzi

Naval & Nivi, Spearhead podcast, How to Angel Invest, Part 1 & Part 2

Naval & Nivi, Venture Hacks blog (some parts outdated but principles are timeless)

Jason Calacanis book on Angel Investing (some parts outdated but principles are timeless)

John Henry (Harlem Capital) on getting started in angel investing

Romeen Sheth's thread on lessons from angel investing $2MM (less relevant for micro angel investors but some very useful principles)

Thank you Cyrus for allowing us to share this post with the Odin community!

Cyrus and I were introduced digitally about a year ago by my cofounder Mary, and finally met face to face for the first time Friday, which was lovely! We will be collaborating more closely in future, so look at for more content from the Rational VC and Odin.

That’s all for this week. As always, please reply to this email with any questions or ideas!

Playing this weird musical chairs of class vs ideology, reminds me of this image from Ribbonfarm (and the Gervais Principle book). Turchin and Rao having similar ideas across disciplines are curious. https://twitter.com/vgr/status/1183881949305114624