Pre-seed is coming

The pandemic's aftermath will be a boon for founders at the stage when they need venture capital most

Hi folks, Patrick Ryan here from Odin. We are building the ultimate tool for angel syndicates to invest together in private companies and funds, via SPVs.

Hey folks,

Sorry I’ve been a little quiet of late. We’ve been working hard on a few things internally and are finally close to onboarding new users to the Odin Community platform at scale. Exciting times ahead!

This week: investing in space and why I think European pre-seed is the next big thing

First of all, a quick side note.

I’m excited to invite you to our event this Wednesday. We’re catching up with Jeff Crusey from Seraphim Capital to talk about investing in space tech. This follows on from a recent event we held with two Odin members who are building space tech, Marc and Mark.

The event will be recorded and available via our podcast, but if you want to come along to the live recording, ask questions and meet Odin community members, you know what to do.

Don’t miss out on this doozy with Mr Crusey. He also does wonderful digital artwork, including self-portraits!

Now, onto the main topic for today.

Since we decided it made sense to become an investor ourselves (and not an introductory / matching platform, as originally planned), we needed a clear investment thesis - a view on how exactly we should invest, and what we should invest in.

Our thesis - tl,dr:

Invest at pre-seed and seed.

Don’t try to pick winners. Aim to index top quartile.

Engineer network effects into everything you do.

Collaborate with operator-investors with deep expertise and founders with a touch of madness.

Be bottoms up, with a preference for impact and (some) deeptech.

Today I’m going to focus on points 1 and 2 and explain why I think this is a smart, proven and timely approach. I’ll touch briefly on point 3, but I’ve covered a lot of it here already. 4 and 5 will come in a second post.

Debt is coming

I recently reread Alex Danco’s impressive essay “Debt is Coming”. If you haven’t, you should.

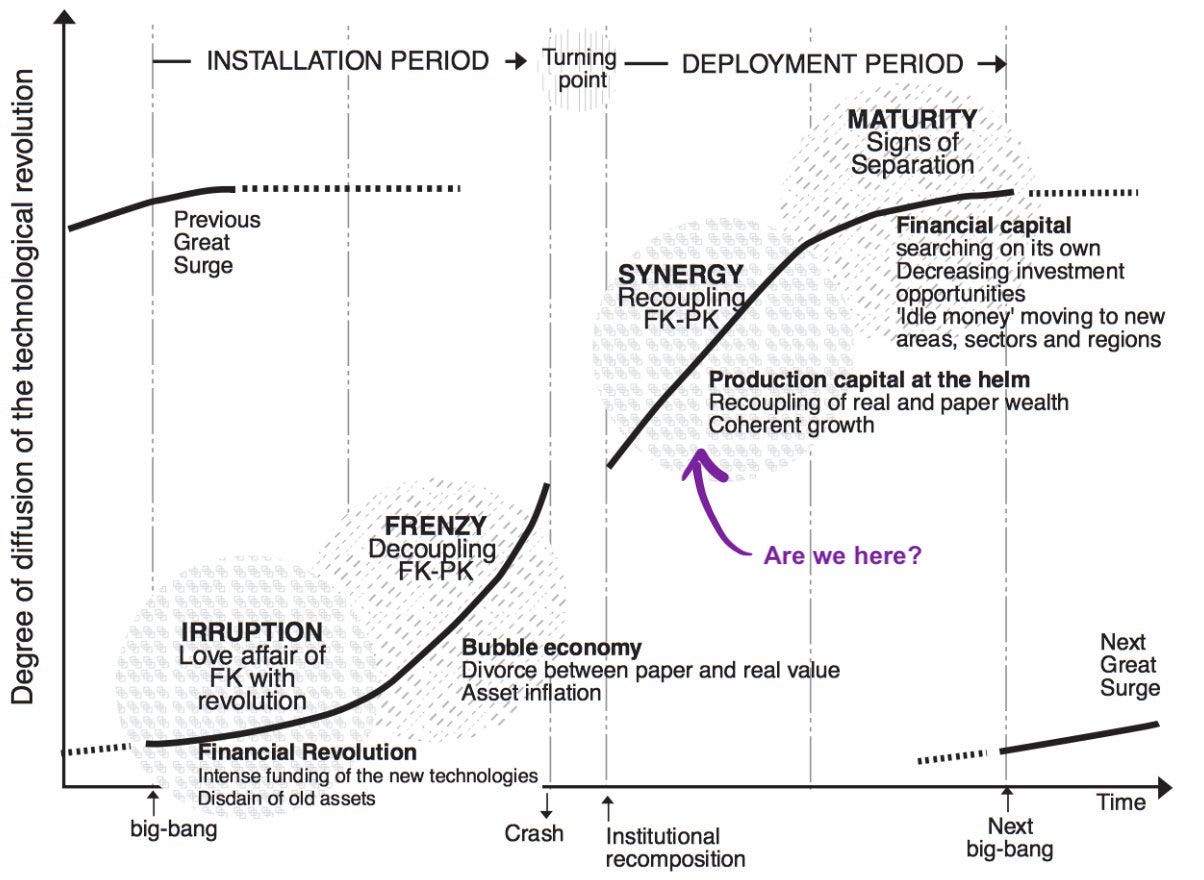

For those unfamiliar, Danco refers to the economic theory developed by Carlota Perez in “Technological Revolutions and Financial Capital” to argue that we are moving into a period in the development of this wave of technology where there will be less speculative equity financing, and more rational debt financing:

“In the first phase of a technological revolution… new technology is exciting, and the market opportunities are large but unknown. Speculative investment, with ambitious but inexact expectations of financial return, is important fuel for founders who build the unknown future. However, investors and operators are often deeply misaligned: investors think in bets, while operators think in consequences. The relationship is tense, but can be explosively productive. The VC model is an institutional expression of this tension.

In the Deployment Period which follows…We reach a turning point away from speculative financing and towards more aligned investment, where capital gets put to work less exuberantly and more deliberately. The investor, at this point, has a good understanding of the assets that they’re buying and the cash flows that they will generate. The operator has reasonable expectations around cost of capital, and a tried-and-true game plan for how to put that capital to work ... This does not look like VC. It looks like regular finance.”

What does this mean, in concrete terms?

It means that safe bets like subscription software, ecommerce and marketplaces - which all tend to have predictable revenues once they scale up and have been trading for a couple of years - will become more and more difficult places for VC’s to make money.

Clever innovations in debt will outcompete VC’s.

The most obvious of these innovations is known as revenue based financing and unless you’ve been living under a rock for the last 2 years, you’ve probably heard of it.

In short, it means lending money in exchange for a share of future revenues. When the revenues of tech businesses are so predictable, it makes total sense to bundle them up (reducing risk) and sell them to investors. In many ways, this aligns the needs of founders and investors much better than VC does. Investors reduce their risk, and founders give away less of their business.

The signs that debt is coming (and needed) are all around us:

Thanks to absurd amounts of quantitative easing, there is now more money sitting on the balance sheets of large financial services firms than they know what to do with. Interest rates are at rock bottom, so yields for fixed income investments (eg. treasury bonds) are woeful. The firms that invest in fixed income don’t really invest in VC, but they love lending money. Once they can lend money to scale-up SaaS firms, venture will be competing with some seriously deep pockets.

There is a rapidly growing army of smaller technology-driven companies (mainly ecommerce but also other niches like paid communities) built on low-code and no-code stacks made possible by innovators in Silicon Valley. These smaller firms are highly unlikely to ever be billion dollar potential “venture backable” businesses, but may very well be $10 million businesses.

Napoleon once referred to England as a “nation of shopkeepers”.

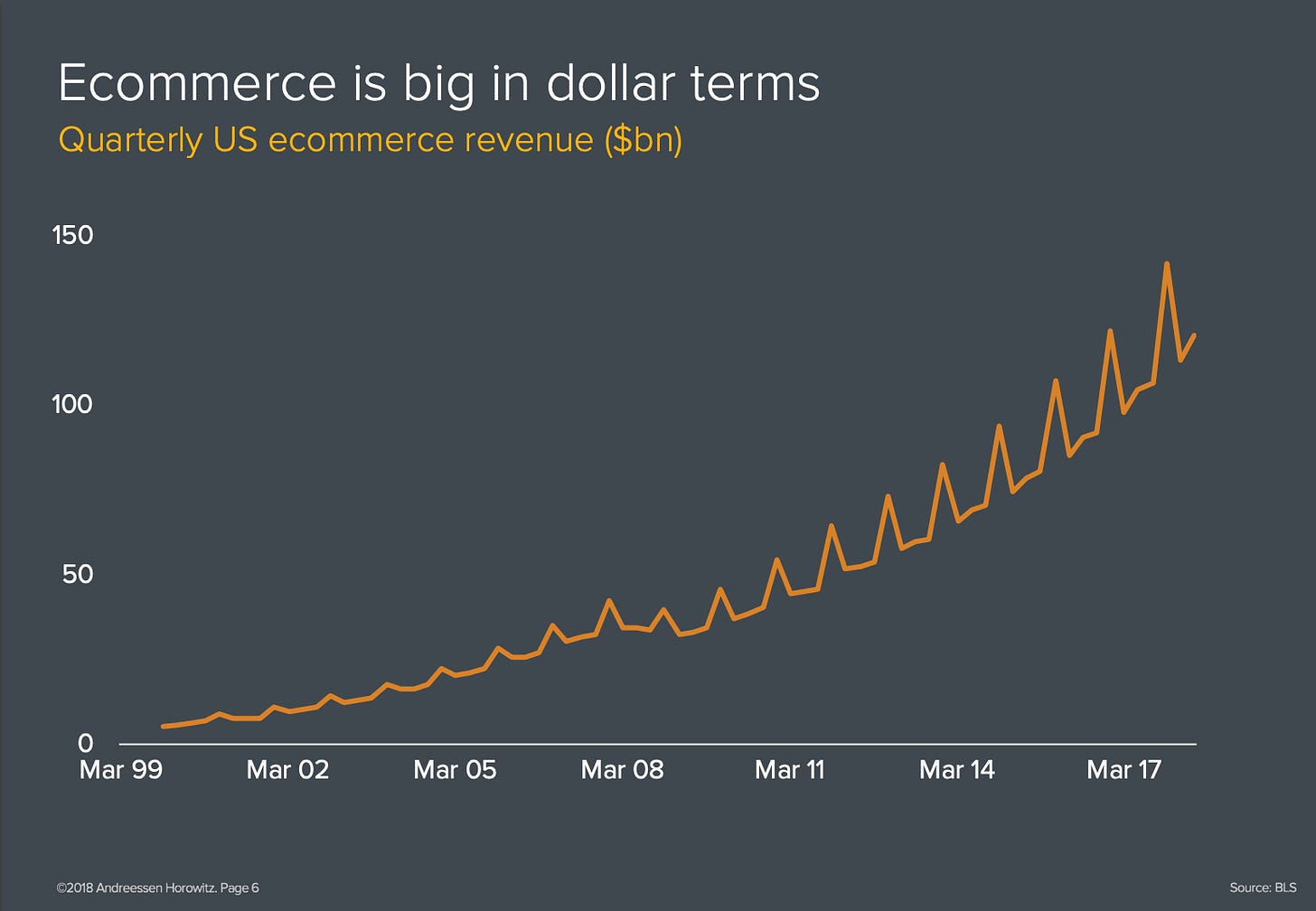

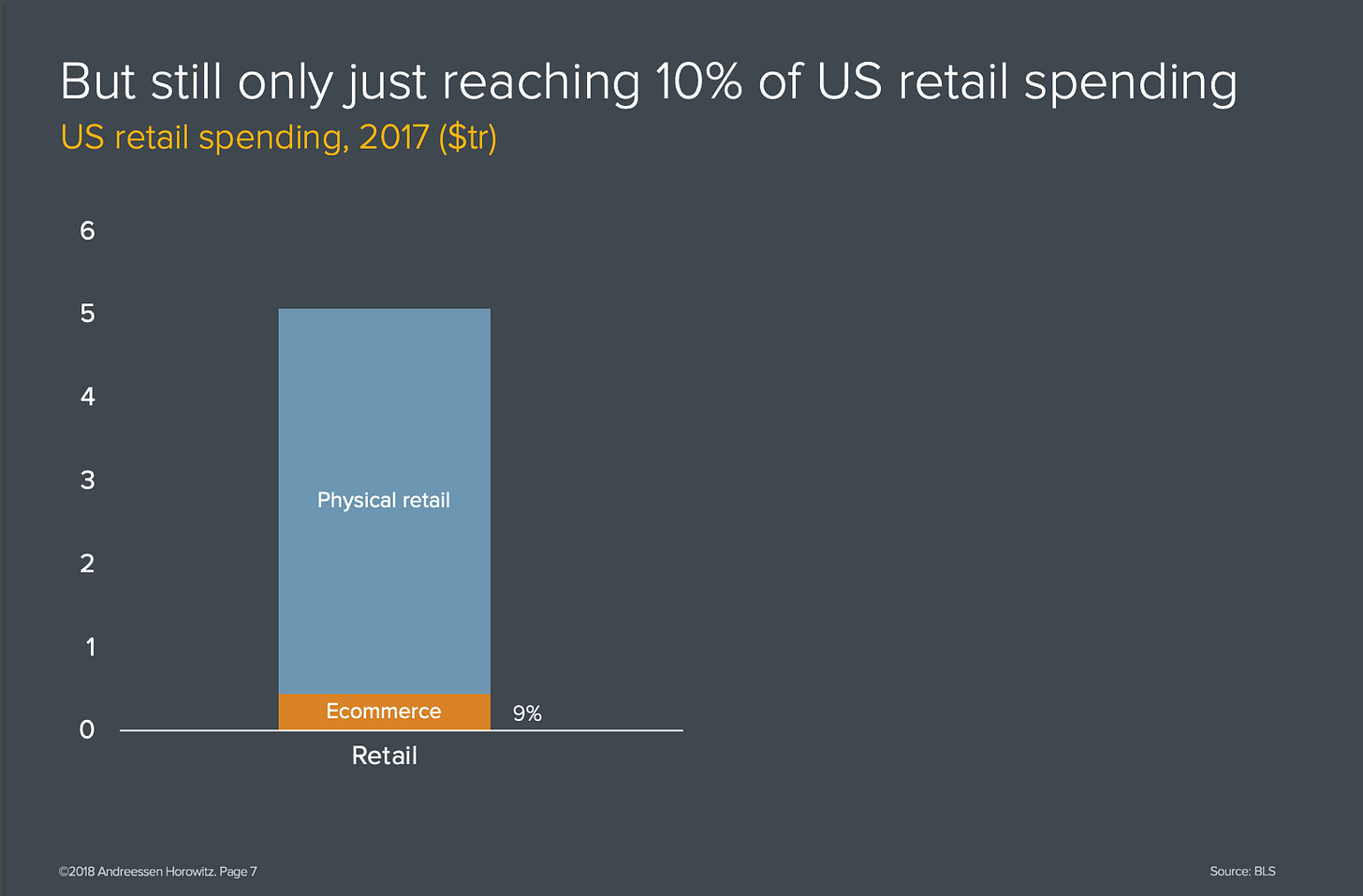

Now the entire internet is. And we have still barely touched the sides of what is possible in ecommerce, as Benedict Evans pointed out in his presentation “the End of the Beginning” in 2018:The pandemic has, of course, accelerated this process, but we still have a way to go.

Source: Nasdaq Alternatives to VC, promoted by the likes of Zebras Unite have been gaining popularity for a while. Founders aren’t a fan of VC’s “one size fits all” approach to financing, and they sense that there might be better ways.

Finally, the facilitators of this new wave of debt financing are becoming much more visible and reaching scale. Many, somewhat ironically, have been well funded by VC’s.

Take a look at just a few of the multitude of emerging players positioned to ride the debt wave over the coming 10 - 20 years. You might have heard of some of them…

Stripe Capital - the kings of fintech. Eating payments, banking and VC for breakfast. Watch out. They were still the internet’s most undervalued company just 9 months ago, according to Packy McCormick

Shopify Capital - these guys can model the predicted revenue of an ecommerce business better than anyone. They are the backbone of half of them. No coincidence that Mr Danco is involved in the money side of their business. He has made his bet. Shopify is an incredibly strong position to disrupt not just ecommerce, but also financial services.

Our friends at Clearbanc - offer revenue based financing for ecommerce and SaaS. They have raised $120m from Founders Fund, 8VC, Frontline Ventures and Highland Capital Partners. They’ve also got a war chest of £500m in debt to deploy in UK ecommerce companies.

Pipe - doing very interesting stuff by securitising SaaS revenues and trading them on an exchange. To quote Mr Danco “If you think there’s too much money flowing into startups now, just wait until someone makes a high-yield fixed income product for institutional investors to buy recurring revenue…Recurring revenue securitization will be like gas on the fire. Forget Softbank; imagine what it’s going to be like competing against someone who’s hooked up to the debt market.”

That’s what Pipe is.Indie VC and Earnest Capital - interesting new models for VC which offer alternatives to straight equity, but with the support a VC firm traditionally offers.

Uncapped - UK based Clearbanc competitor backed by GFC, Seedcamp and White Star Capital.

Kontinuous - very early-stage new take on this trend that securitises revenue for ecommerce businesses on the blockchain, meaning the security is tradable on a market that is already relatively liquid (in theory).

So that's debt, and explains why now is a good time to start investing at pre-seed and seed - it might soon be the only stage at which a lot of founders need your help. But there are more good reasons…

The everything bubble

For this section, I’m just going to directly quote from this excellent piece by angel investor (and master early stage indexer) Fabrice Grinda…

“The warning signs of market mania are everywhere. P/E ratios are high and climbing. Bitcoin rose 300% in a year. There is a deluge of SPAC IPOs. Real estate prices are rapidly rising outside of dense major cities.

These, along with retail-driven short squeezes, mini-bubbles and increased volatility are symptoms of a bubble….

Note that in my case I do not even own stocks. I have a barbell strategy with only cash and early illiquid privately held tech startups. If you have enough diversification (meaning over 100 investments) to account for the startups that fail, private early-stage tech startups are the best asset class. They create value for the economy and can grow rapidly. As such they are amazing to own in both inflationary and deflationary environments.”

I could probably have left it at that for the whole article, but I’ll continue. Maybe you’re still not convinced that yolo’ing Gamestop is a bad idea, and that you should invest your money in a portfolio of pre-seed and seed stage startups instead.

There has always been a sound logic to this approach. There is a reason successful angel investors (eg. Alexis Ohanian, Naval Ravikant, Charlie Songhurst, Fabrice Grinda, Jason Calacanis, Xavier Niel) and accelerators (Y-Combinator, 500 Startups, Techstars, The Family, Entrepreneur First) take the approach they do. Let’s break it into its two constituent pieces: getting lucky, and entry price.

Up all night to get lucky

Indexing works because we are not anywhere near as good at picking winners as we think, and in VC winners deliver insane power law returns

Venture as a business is subject to absurd amounts of uncertainty. Whilst you can theorise to your heart’s content and backwards rationalise every bet you make, there is a lot of luck involved. This is educated guesswork, my friends.

Steve Crossan is a computer scientist and I believe we can trust him as something of an expert on statistics. Steve previously led product at Deep Mind and is now running GSK’s AI lab searching for novel drug molecules. When he isn’t busy revolutionising medicine he is also a venture partner at Firstminute Capital (for the lols I guess).

He wrote an interesting piece in 2018 where he outlined some Monte Carlo simulations he ran on fictitious portfolios of early stage investments. The implications of his research are, in short, that an optimal venture portfolio should probably contain a minimum of 150 investments, and maybe as many as 300. This greatly increases the probability of delivering a 3x cash on cash return. It also marginally increases the probability of delivering a 5x fund return.

It is glorious to sit in the camp of those who believe you can pick 20 winners from a bucket of thousands. But it is not rational.

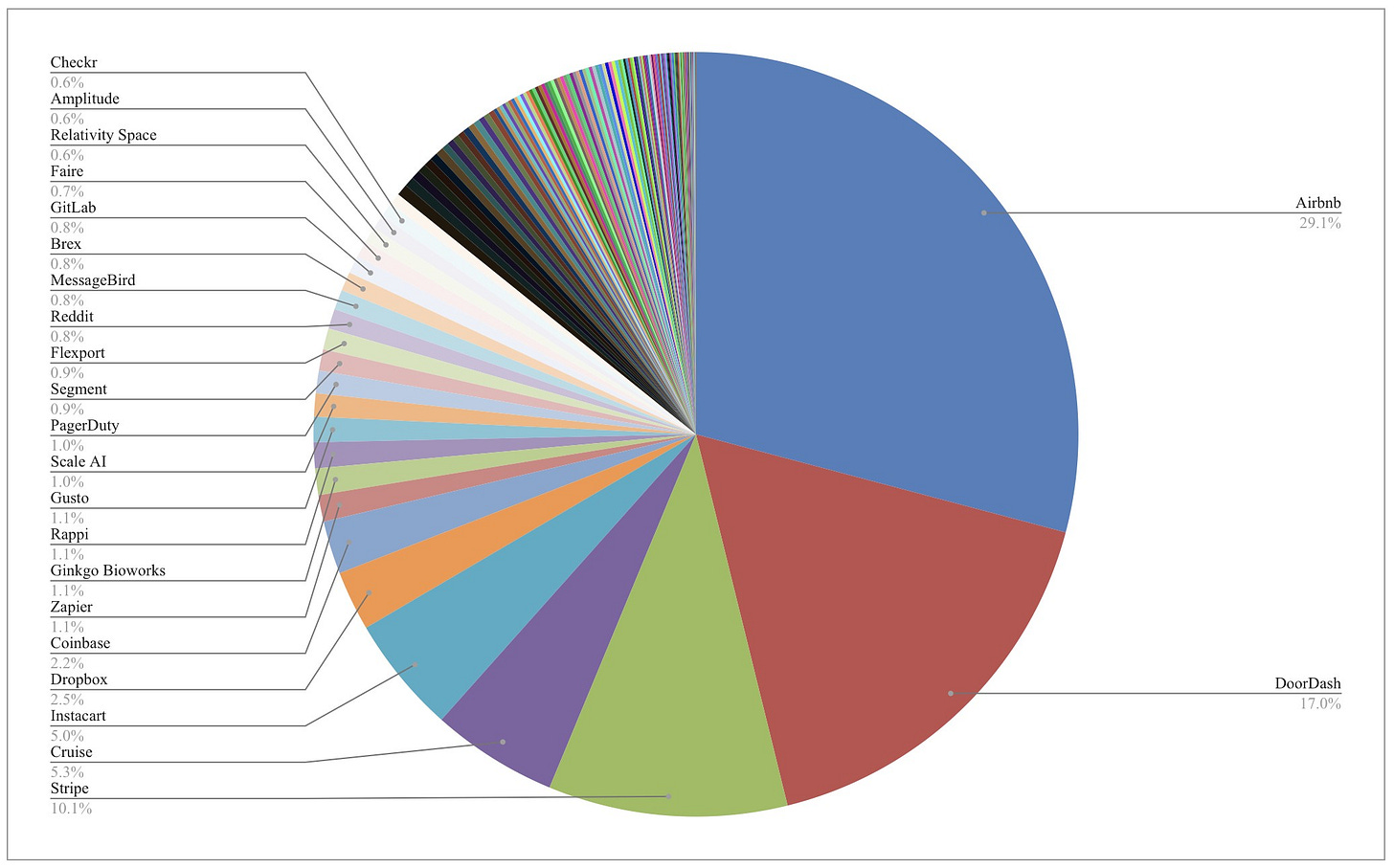

Look at Y Combinator. It is the world’s most successful startup incubator. They’ve backed thousands of businesses and three of them (Airbnb, Doordash, Stripe) represent over 50% of returns:

The thing is, that doesn’t matter when those three return 10,000x invested capital.

Make more bets.

It’s cheap

Pre-seed is good because entry price is low. This is because the market is opaque, there is more uncertainty and there is less competition. This = more opportunities to access power law deals, and more access for small ticket investors.

As soon as a they are on Crunchbase / Pitchbook, there will be a plethora of seed and series A funds looking at any decent company. Good luck getting in at a good price with a small cheque.

At pre-seed, you can find gems before they sparkle. To paraphrase Paul Graham, you can farm black swans. Plus, at later stages good founders will take money from the big boys and girls. They don’t want your money if they can get Sequoia’s.

The other advantage in the UK is that, as a private individual, we have a tax regime (SEIS) that is literally begging people to invest at the earliest stages by refunding you half of your investment instantly in tax relief. Effectively, you apply a 2x leverage to every investment you make, for free. Juicy.

Network effects, baby

The final thing to consider is the value that this investment strategy yields simply because it gives you more access to more investments. By investing in more founders, you see more of their friends’ companies (provided you’re not an arseh*le). You also get more shots at getting lucky, meaning more chances of getting your name out there as successful. This again means more access to good deals.

Over time, every deal you do increases your chances of seeing even more good deals. This compounds the value of your investment endeavours in a non-linear manner.

I’ve already written about community and its potential in the venture space. It’s core to our approach. For us, this is also about network effects. Every new member brings additional value to the table for existing Odin members.

There is a final question I have not yet addressed…

Why invest in Europe?

I believe Europe is primed for a revolution in early stage investing.

We have talent, strong institutions and good infrastructure. We also have decades of economic stagnation, young people with a chip on their shoulder and a legacy angel investor ecosystem that is, in a lot of ways, overly conservative and stuck in the past.

This last point has its downsides, but also means that competition is limited for new investors at the earliest stages.

Beyond this, I believe that European VCs will continue to raise more seed and series A funds and Silicon Valley VCs will also begin hunting in these waters in larger numbers. All this means more chances for follow on funding and growth for portfolio co's.

With any luck later stage funding and the IPO market will also mature over the next 10 years, meaning more exits.

I believe Maren Bannon is dead right... Pre-seed is coming.

P.R.

📚 Further Reading

VCs: Would You Rather Be Yahoo or Google? - Nicolas Colin

Modelling suggests rational venture investors should have bigger portfolios - Steve Crossan

Black Swan Farming - Paul Graham

The End of The Beginning - Benedict Evans

Technological Revolutions and Financial Capital - Carlota Perez

On $300B of Y Combinator Startup Success - Jared Heyman

Welcome to the everything bubble - Fabrice Grinda