Secondaries

An overview of what's been happening in VC secondaries, plus some exciting new product announcements from Odin

Hi folks, Patrick Ryan here from Odin. We build powerful tools for VC’s, angels and founders to raise and deploy capital seamlessly.

Today I am excited to announce that anyone can now process a secondary purchase of shares quickly and easily on Odin using our SPV administration software. We’ve had this functionality for a while but have significantly improved the UX recently. If you’re interested in learning more, drop me an email.

Today we’ll be diving into the state of the venture capital secondary market and assessing what the current opportunities and risks look like.

San Francisco based Industry Ventures are something of a pioneer in the venture capital secondaries market.

They raised their first secondaries fund in 2000, just as the dotcom crash was kicking in. They saw the opportunity to buy into great companies and funds at better prices while the market at large was panic-selling. Over the years they’ve used secondaries and other innovative strategies to back some huge winners, from Airbnb and Alibaba to Uber and UIpath.

Industry recently raised a $1.45bn fund to take advantage of both indirect (fund-level) and direct (company-level) secondary opportunities in late stage venture. This is an enormous fund in VC terms. It represents 20% of the total capital Industry have raised in their 23 year history.

In Europe, numerous managers, including Gresham House and Flashpoint have raised smaller funds with similar plans. EQT, one of Europe’s biggest VC & PE houses, is testing its own private market, allowing its 1,000+ LPs to trade secondaries between themselves. Retail investment platforms like my former employer Crowdcube, with their recent acquisition of employee secondaries provider Semper, also see opportunity

According to a recent survey by Goldman Sachs Asset Management, 48% of private markets LPs (limited partners - the investors in PE and VC funds) plan to increase their allocation to secondaries in the next year. This makes it the second most popular new strategy for LPs, behind co-investments. Both secondaries and co-investments are signs of a buyer’s market for LPs. They see the opportunity to access great deals at better prices (secondaries) and to muscle in directly on hot opportunities because fund managers are finding it harder to raise money (co-investments).

As is often the case, secondaries activity in VC echoes what is happening at a larger scale in the private equity landscape. Goldman Sachs ($15bn), Blackstone ($25bn) and French private equity group Ardian ($20bn) have all raised record-breaking secondary funds this year. The PE and VC worlds increasingly overlap, of course: a former Ardian exec recently teamed up with VC firm General Atlantic to launch Clipway, a $4bn growth / buyout crossover secondaries fund.

All of this activity is doubly impressive given that it is happening against a backdrop of higher interest rates and news that, in general, LPs are reducing their allocations to private markets assets.

It is, of course, a classic case of Warren Buffet’s advice to be greedy when others are fearful.

Many VC firms are at the end of fund cycles for very large funds that they raised in 2010 - 2018. For growth funds in particular (those investing at series B and above, aiming to drive liquidity in ~5 years or less), if they did not return much cash to investors before the IPO and acquisition markets began to close up in late 2021 / early 2022, they’re now sitting on paper returns at significant markups to publicly listed comparables in a buyer’s market. They’re also under intense and increasing LP pressure to deliver cash. As a result, investors who can offer liquidity can do so at knock down prices.

There is also LP pressure to deliver cash for other reasons:

If you are an institutional LP like a pension fund or a university endowment (the type of money behind big VC firms), you typically have strict rules about the level of exposure you are allowed to have to private companies vs. public companies (eg. 80% publics : 20% privates). You need to keep your exposure roughly in this ratio. When public stocks gradually began nosediving in December 2021, LPs became overexposed to their private portfolio, and “rebalancing” was necessary - selling off some privates to get the ratio back to 80:20 or whatever was mandated.

If you’re a fund of funds, you might also be under pressure to return cash to your investors. If everyone is taking out their pension and all the pension fund’s cash is locked up in venture capital or private equity, you’re also in trouble.

As such, much of the current activity appears to be happening at a fund level, with LP stakes providing exposure to 20+ late-stage tech companies changing hands at a significant discount (often 40% or more anecdotally) to NAV (net asset value). Growth funds seem particularly popular.

An interesting public comparable here is Molten Ventures, a VC fund listed on the London Stock Exchange. Molten is currently trading at a ~60% discount to NAV, and is significantly undervalued according to analyst Berenberg. Its shares are down almost 6x from their 2021 highs.

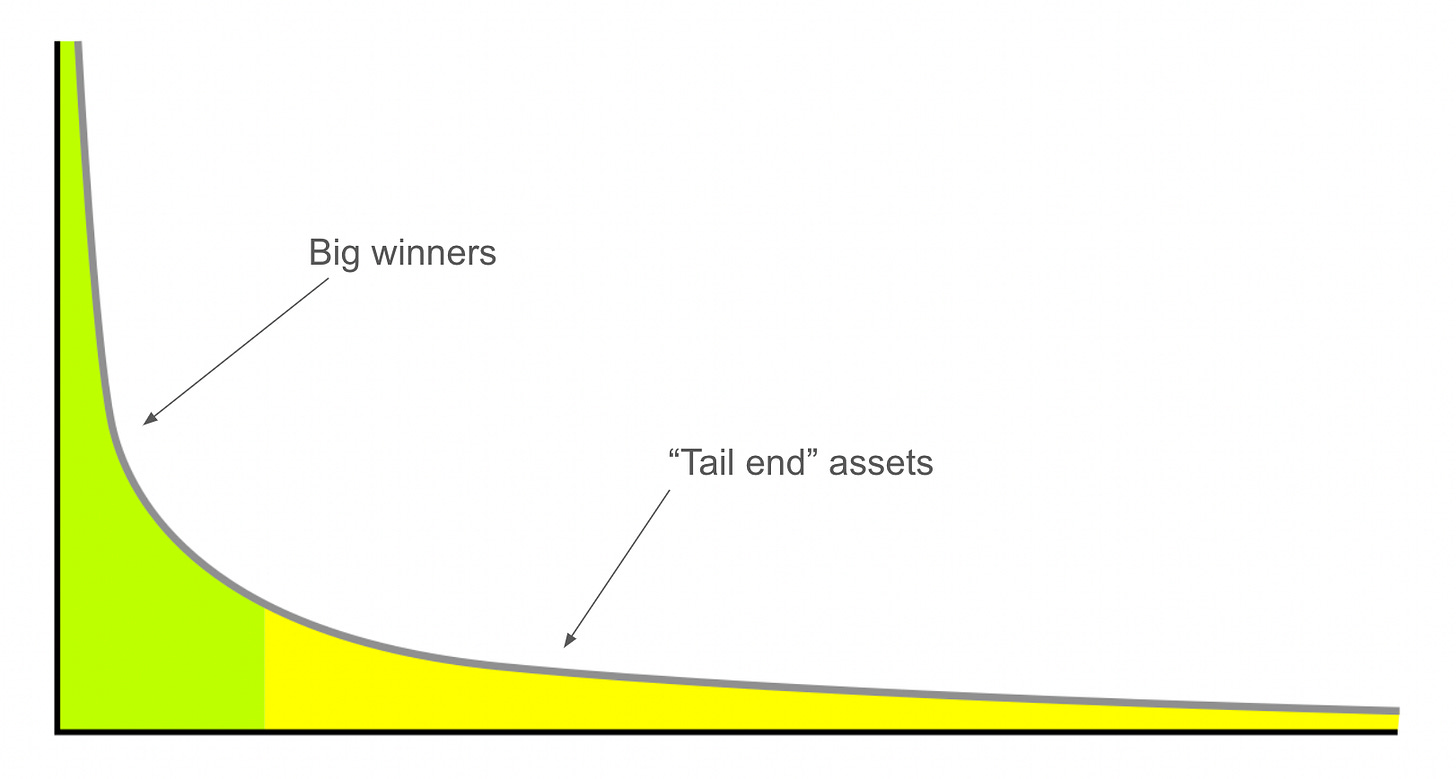

Fund-level transactions are complex - you need to due diligence 20+ companies and figure out where the winners might be. Information on the underlying assets may be hard to get hold of. Particularly in the case of transactions led by the GP (the general partner - the VC fund manager), you may only be getting exposure to the “tail end” assets that the GP wants to offload (rather than the entire fund), since they want to hang onto their winners and may have LPs who are willing to do so too.

Whatever the case, to succeed in the arbitrage game of secondaries, you need to be able to see value where the current owners do not. You also need to ask yourself the obvious questions: why do I have access to this transaction? Who else has already said no? Why did they say no?

You see, just because you’re buying something for a steep discount doesn’t mean it’s a good deal. Forward revenue multiples – the primary valuation methodology for public SaaS companies - had fallen on average by 67% from their 12-month highs by mid 2022, and for some companies by almost 90% (source). The fastest-growing companies, which traded at the highest multiples before this sell-off, were hit the hardest. And remember, we are talking here about the companies that actually made it to IPO in the last cycle (i.e., as a rule, the top performers). As the recent plight of companies like Wework shows, often the direction of travel for a company with a falling share price is further down, all the way to zero.

So far, direct secondary deals in specific companies (outside of big employee offerings in hot deals like OpenAI and SpaceX) have been thinner on the ground. There is currently a very large bid/ask spread - the difference between the price that buyers are are offering and sellers are asking for. In general, this is an indicator of low liquidity - i.e. there are not that many buyers & sellers, and relatively few transactions are taking place.

There are numerous possible reasons for this. Alongside the general shift in investor sentiment, portfolio rebalancing and liquidity constraints that are natural to a relatively small market like VC, the following are likely at play:

Founders don’t want transactions at a significant markdown happening

Unlike public companies, in many cases private company founders & boards have control over whether secondary transactions can occur. If you’re trying to raise a new round of funding (i.e. a primary transaction) and people are selling secondaries at a 60%+ discount, it sends the wrong signal to the market, so you’ll block the transaction.The cleanse is just getting started

A number of companies that raised in 2021 at punchy valuations raised a lot of money - 3+ years of runway - so the washout of these companies has not yet reached its crescendo. I.e. we might expect more bankruptcies in 2024, and more panicked investors selling direct secondaries as a result.People are trying to sell things nobody wants

As a rational seller, the smart thing to do is sell things you think are overvalued (or worthless) and hang onto things you think still have long term potential. But as a rational buyer, you want the opposite. If people are still hanging onto their quality deals, why buy anything?Lack of Transparency:

Private companies typically do not have transparent financials and operations when compared to public companies. Even if a transaction is possible, you might struggle as buyer to get proper information from the company. This makes valuing the company very difficult.

That being said, deals - often in big names - are happening. And they are happening at steeper and steeper discounts, according to data from Carta:

(and a guy on Twitter):

All in all, I’m excited to see what the next couple of years holds for the secondary market in venture. It is important to remember that this is still a nascent sector of asset management. Venture capital AUM has increased sixfold in the last 20 or so years. That’s a lot of tied up cash. Opportunity in secondaries is only going to grow as a result.

And more exits of any nature means more liquidity. For early investors, founders and employees, selling at a discount to the last round (over)valuation can still mean a great result. In Europe in particular, liquidity for founders, employees & early investors is sorely needed to strengthen faith in our ecosystem and drive fresh capital into new companies.

This is what will help accelerate innovation, which is ultimately why many of us, myself included, choose to build & invest in startups in the first place.

If you’re interested in structuring a secondary transaction, drop me an email.

Some Other Interesting Stuff

Murder Facts

There were 100x more murders in England per capita in the 1300s than there are today. Click the tweet for more interesting murder facts from Ben Southwood.

California Dreaming

A fascinating gonzo deep dive into the drug-fuelled carnage that is the Tenderloin neighbourhood of San Francisco. The excellent and always entertaining Andrew Callaghan interviews homeless drug addicts, teenage thieves and Honduran dealers. He also explores the underlying problems creating the chaos. “American funded Chinese fentanyl manufacturers working with Mexican drug cartels” is a real quote from this documentary. Enough said.

Fair play now, in fairness

This is how not to buy secondaries, in case you were wondering. Definitely a good way to sell them if you can though.

That’s all for today. Thanks for reading!

PR

Risk Warning

The above information is not investment advice and is for informational purposes only. Investing in start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio.

Join Odin Limited (trading as “Odin”) is registered in England (No.12849405), with registered office at Unit 105, 65 - 69 Shelton Street, London, WC2H 9HE.

Access to the Odin platform is restricted only to those individuals who are able to first truthfully evidence that they are persons eligible to receive exempted financial promotions in respect of private investment opportunities in compliance with the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (SI 2005/1529).

Odin is not regulated by the UK Financial Conduct Authority.

So why are there not more ‘market makers’ on these online platforms for selling and buying secondaries? Feels like a perfect opportunity for a VC firm to set up a couple desks that actually do deeper diligence and trade these. Are there any banks / firms that have started to build these out?