The Startup Investor's Almanac 📖

An experiment in collective intelligence

Hi folks, Paddy here from Odin. We are making it 10x cheaper and easier to launch & invest in syndicates and venture funds. We are now live in private beta.

Want to set up an SPV? Learn more here, or click below to get started. ⬇️

“In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time – none, zero.”

Charlie Munger is one of the greatest investors alive today. He is known for both the depth and breadth of his knowledge. He is, famously, a voracious reader.

He is not alone in this pursuit. Patrick Collison loves reading so much that his payments company, Stripe, opened its own publishing house.

About 18 months ago, I decided to start curating the books, articles, presentations, podcasts and other sources of wisdom that had an impact on my thinking into a tagged archive.

Unfortunately, like most new hobbies, my enthusiasm for this activity waned quickly. As we got busy fundraising and launching our SPV product, it slid down my priority list. The archive has since been sitting unloved in the recesses of my digital garage.

I’ve decided to dust it off and start growing it once more.

The idea was always to make this project multiplayer. Why?

“Trying to be smarter than other people is very hard and it doesn't work very often. Trying to have an insight that you get because you sit in a different information flow just seems exponentially easier.”

That quote is from another famous investor called Charlie - Charlie Songhurst.

I’m calling this new information flow the Startup Investor’s Almanac (until someone comes up with a better name). Over time, I hope to turn it into an interactive wiki that helps me (and you) to do two things:

Assess early stage investments more effectively.

Learn to “think better” in a more general sense.

By pooling the best of our learnings in one place, we will all get a bit of exposure to the best of everyone’s brains.

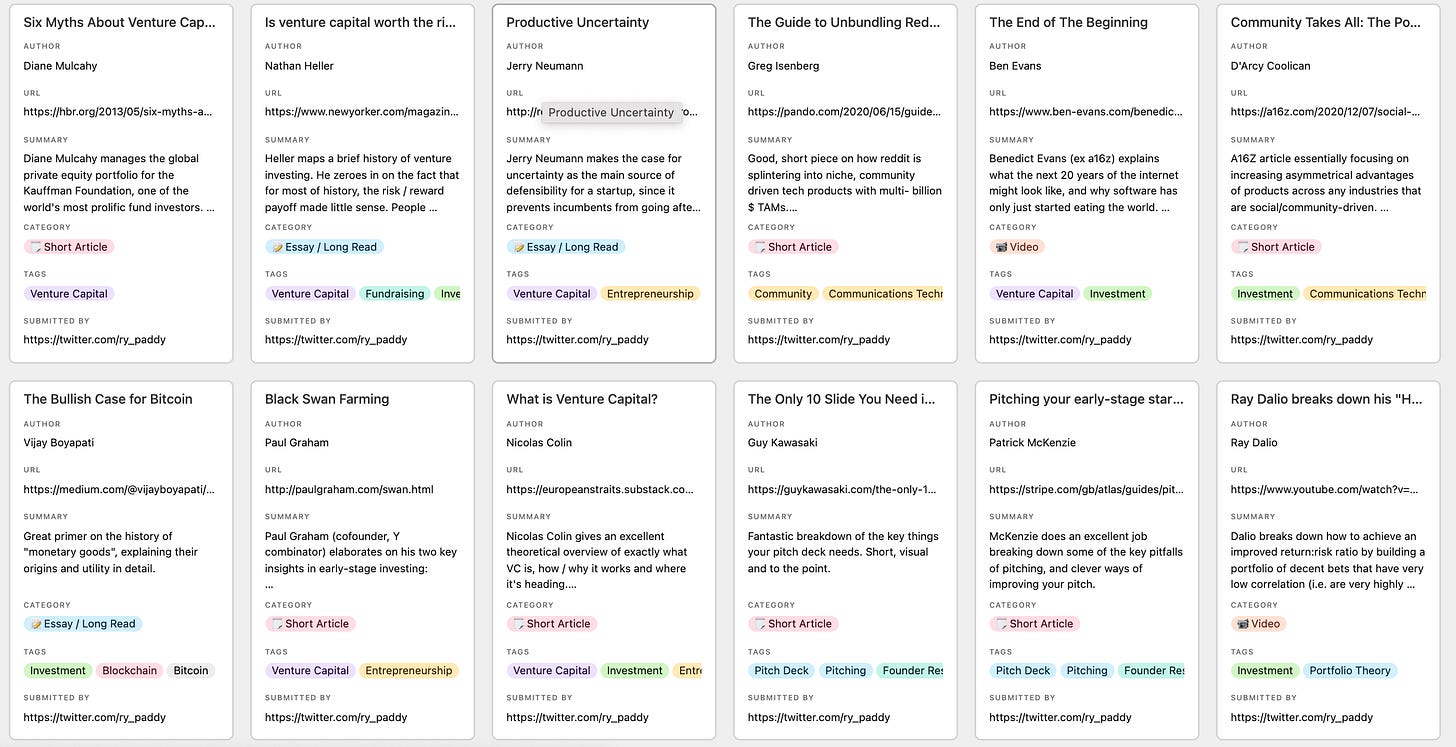

You can take a look at what we’ve pulled together so far:

It’s literally about 40 articles and books, but it’s a start.

I am going to let anyone contribute, and see how we get on. Quality will, of course, vary. However, my hope is that this activity will, by its nature, largely self-select for the right type of person.

For now I am happy to volunteer as sole curator / librarian, which will involve improving the tagging and summaries, as well as some moderation. Let me know if you’d be interested in participating in this capacity. I am also very open to suggestions on how we improve the resource. For example, should I be looking at something like Roam to help link ideas to each other more effectively? Let me know.

Best of the Internet

Bag Holders

Interesting to look at valuation growth in the last couple of years at different stages (data from Rahul Parekh via Michael Jackson). Seed has had by far the least valuation inflation (1.6x over 2 years) Compare this to Series D valuations, up almost 10x over the same time period.

The asymmetry perhaps reflects the opportunity for a quicker buck at Series C & D. Other possible factors include the movement of capital down the stack seeking yield, and people’s natural tendency to herd towards something that is “already a success”. Plus a lot of other stuff I haven’t considered.

This was all fine whilst these assets were dumpable on the public markets. Now that the wind has changed, things aren’t looking so pretty.

It’s funny how our collective consciousness can change so quickly and so radically.

Booking some time in with the mob on calendly

Two things happened on Twitter this week that led to the poking of a significant amount of fun.

First, the founder of payments company Bolt, Ryan Breslow, wrote this thread.

Breslow complained that the two firms had used unfair tactics to push his company (now valued at $12 billion) out of the market. Perhaps there is some truth in these claims - who knows? His evidence was rather scant, and people seemed to think it was all a bit ridiculous.

Separately, a VC called Sam Lessin shared a short piece complaining about how founders sending him Calendly links was a subtle way to signal that they were higher status. Apparently, they were all deliberately flexing on him.

Again, folks didn’t tend to agree.

I have to say, I do enjoy reading these exchanges.

At the same time, things can get a bit mean. You wonder how all the trash talk makes the other person feel. Reminds me a bit of this Thinkwert tweet.

Thinkwert doesn’t dunk on people. He runs one of the most wholesome accounts on Twitter. Highly recommend.

Doppelgängers

I thought this was quite a cool project. I would love to meet my doppelgänger.

From the Almamac

I am going to start sharing my favourites from our archive every week.

Today, I recommend you read Paul Graham’s “Black Swan Farming”.

In this piece, PG (cofounder of Y combinator) elaborates on his two key insights in early-stage investing:

(1) Effectively all the returns are concentrated in a few big winners, to an insane degree - eg. of 1000 businesses, 10 will deliver 1,000x and the rest will deliver nothing in comparison. When this article was written (2012), YC had backed hundreds of companies. Two (AirBnB and Dropbox) were already responsible for 75% of returns.

(2) The best ideas look initially like bad ideas. Most things that look like bad ideas are bad ideas, so it's about finding the tiny number of businesses that are actually good ideas. This is very hard, and you will only know if you've been successful much later. Even things like follow-on funding are pretty poor indicators of success.

The first one is well known to most - that’s the Power Law. The second one was new to me when I first read this piece. You can see why Peter Thiel’s favourite question is “What important truth do very few people agree with you on?”.

That’s all for today.

I’ll leave you with a thought: if everyone reading this post contributes their #1 book or article - the piece that has most impacted their thinking as a founder or investor - we will have an indexed resource of over 4,000 great books and articles. Obviously there will be duplicates, but you get the picture.

Imagine how handy this would be.

Let’s make it happen!