Venture funding isn't jet fuel - it's more like steroids

A commentary from Anthony Collias on the risk and reward of VC money

VC isn’t for every business. Josh Kopelman of Uber investor First Round Capital made this point in a famous tweet:

This has subsequently been oft-paraphrased:

“I sell jet fuel, and some people don’t want to build a jet.”

It’s an innocuous enough quote that makes a fair point; different kinds of businesses require different kinds of financing (it’s part of the reason so many different forms of financing exist!). You shouldn’t finance your business with a type of financing that doesn’t match your needs and outlook.

This is particularly true of venture funding, where they follow a ‘moonshot’ model. It’s a model that may need updating - most funds don’t beat public markets index funds and have way worse liquidity - but for the time being, it is dominant.

The model is pretty straightforward…without getting too specific, VC’s make big bets with high risks specifically on businesses that can quickly produce outsized valuations. This means that, in a sentence (that every VC who’s ever taken an MBA class has said, repeatedly), every single investment must have the potential to return the entire fund. Depending on the fund size and stage/size of investment this normally means a valuation comfortably in the high 100’s of millions up to the 10’s of billions.

So what’s wrong with the jet fuel analogy?

I’ve read or heard this quote paraphrased countless times over the last few years. VCs love it. And of course they do - it sounds glamorous. But is it appropriate?

Another phrase you’ll hear as a founder is “venture money is the worst money”: It’s money you take because you have no better option. It means giving up meaningful control and can be incompatible with many entrepreneurs’ dreams of being their own boss. Even with the cash in the bank, success is rarely without significant struggle, and failure certainly doesn’t occur in a blaze of glory — more often it’s a protracted process, ending in quiet ignominy and a blog post claiming the learnings were definitely worth it. Let’s take a look at the potential downsides of venture funding.

1. Growth at all costs

The biggest danger for founders is that VC funding can lead totally healthy businesses to put growth ahead of everything. This sort of aggressive expansion can become incompatible with a pleasant working culture, respecting the existing regulatory framework, maintaining a clear code of ethics, staying true to your original mission, enjoying yourself, etc. Perhaps this is why so many unicorns quickly make the transition from plucky underdog to evil incumbent, no matter how hard their PR team works. Think Facebook, Airbnb, Uber (do I need to explain these 3?), Revolut (huge compliance issues, PR issues around toxic working environment), Deliveroo (frequent rider strikes, arguably exploits self-employed model).

2. Focusing on the wrong things

People celebrate big financing rounds. The media culture around VC funding encourages this. Tech news raves about them. Companies like Pitchbook and Beauhurst are built almost purely on tracking them. But it’s totally missing the point to treat raising money as an achievement. It’s simply the start of a new cycle of hard work and trying to fulfil ambitious promises. As one of our main investors always says, the only thing worth celebrating in business is your actual performance. Fundraising isn’t scoring the winning goal, it’s moving the goalposts. Sobering research from CB Insights underscores this fact, showing that, at the top end of the scale, raising more money leads to poorer outcomes post-IPO.

3. Misaligned incentives

Across the middling range of outcomes (when it turns out you’re not a jet, but maybe a super car), there is also a huge disconnect between what is a good outcome for a founder and what’s good for a venture investor. As a founder, any return netting you $1m+ is a life-changing sum of money. For a VC (depending on fund size), generally anything sub $100m wasn’t a good use of their time. Of course a founder is also happy with that big exit, but sometimes it’s better to bank a small win and move on. Not so for the investor; for them, it’s “go big or go home”.

This disconnect can cause a lot of friction.

This all sounds very negative — and that’s exactly my point. VC funding is a great opportunity, but there is a dark side that you need to be aware of.

In fact, jet fuel isn’t a great analogy - it’s too sexy. I have a better suggestion:

VC’s sell steroids

Do you want to be the biggest and the best, and achieve it faster than you normally could? Are you afraid of your competitors and in need of an edge? Seek VC funding. But beware…there might be some really negative side effects, side effects that make you regret your decision.

That’s the price you pay for a shot at being the biggest, the best. The more VC funding you take, the more likely the side effects and the higher their severity. The fact is, VCs don’t care about your health, they care about their returns on capital and time. If you aren’t going to generate big capital returns, many would rather your business died and didn’t take up their time.

Let’s roll with the steroids analogy. I hope that many founders will agree it is much more apt…

1. Jet fuel is for jets only, but anyone can take steroids and see gains.

VC money has leaked into tons of industries it arguably makes little sense in: direct to consumer brands, food products and even real estate. Some of these have failed spectacularly (WeWork, Brandless) or are close to it (Casper, Away, etc). Others have been really successful (Warby Parker).

Can these jet specialists not tell an F16 from a tractor, or are things maybe a bit more fuzzy than they like to pretend? Put bags of cash into any business and it’ll be able to achieve more growth than before. Value anything at a stupid multiple and hand it off to other investors, and you’ve made bank. Then just tell yourself you were unlucky on the ones that failed and displaying prophet like prescience on the ones that didn’t.

2. You can’t fly a jet without fuel, but you can still be a great athlete without steroids.

The jet fuel analogy implies that jets NEED jet fuel. But for startups, this isn’t really the case. While VCs hate to admit it, a good company can very often still be a good company without their money or help. Plenty of hugely successful companies chose to bootstrap or received very little funding (Microsoft, Github, MailChimp, Zapier and JetBrains are great examples) and people built companies long before venture capital existed. The most successful startups ever (Microsoft, Facebook, Google, Amazon, Apple) all raised less in total than most series B+ rounds nowadays.

3. If you decide to take steroids, you should take the smallest amount possible. This minimises negative side effects.

Again, the jet fuel analogy doesn’t seem to communicate this nuance well; if anything, more fuel is a good thing. This decision is very different when you’re seeing it as a trade-off between your health and your growth. When you’re giving something up and taking on uncomfortable side effects, you don’t want to take more than you need.

It feels like people are taking WAY too much nowadays. The outcomes perhaps used to resemble something healthy or even desirable (if a bit extreme). Now it’s starting to look obviously unhealthy and weird.

Both VC and performance enhancing drugs came onto the scene in the mid/late 20th century. At first, people were using them a little bit but they were still new and largely unknown, so this use was limited. Over the decades, people got more used to them. They began increasing intake to get an edge on each other. This built up usage as a gradual process. At some point, to be the biggest or best you simply had to take tons of the stuff. In fact, managing your intake has become an important part of operating in the elite, nearly as important as your actual execution.

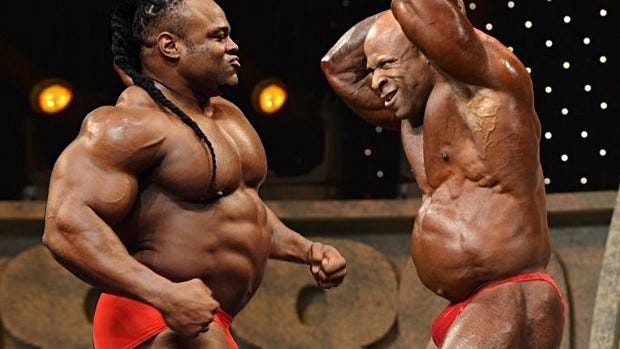

The result? We went from this:

To this:

Do you need to take the performance enhancer?

Taking venture capital is a choice, not a necessity. It exists on a spectrum (you can take tiny amounts, some, or tons)! Sadly, there are many failed or abandoned businesses that could have become very successful for founders (worth 10’s to 100’s of millions) if they hadn’t flown so close to the sun. It may mean accepting that it will take a few years longer than a VC’s timeline, raising less and maybe even reaching profitability rather than relying on funding (surely not?!).

Many unicorns could have compromised some of their growth and still had great outcomes. They could have included ethics within their decision making and, overall, the founders and team may have enjoyed the experience more. Maximising your happiness should, after all, be a key consideration in your business choices. Most founders didn’t become entrepreneurs to work investment banking hours, flaunt all their morals and effectively have investors for bosses!

The above scenarios happen because VC’s are heavily incentivised to push companies to take more money. They want outsized returns, and also need to get their funds deployed to earn management fees. Once they’re in, they simply hope the business can survive and make them some cash — or that they can pass the parcel before it explodes.

I’ve heard phrases several times before along the lines of ‘wouldn’t you rather swing big and fail fast if it doesn’t work out?’. Pretty rich from someone who’s probably already personally very wealthy, whose business model guarantees 2%-3% in annual fees for the lifetime of each fund (i.e. $40m over 10 years on a $200m fund) and is statistically unlikely to generate a better return for their LPs than an ETF (since such a small % of VCs do).

As with so much advice founders receive, we must learn to silence the voices that are not helpful or, even worse, do not have your best interests at heart.

So what’s my advice?

Go forth and make decisions based on what you believe works for you, on balance. Ignore platitudes that are designed to make you feel inferior and imply everything is binary (“you’re either a jet, or a motorcycle”).

If anyone tries to sell you ‘jet fuel’, remember that it’s steroids. If you’re going to take it, then you better know the risks.

About the author, Anthony Collias

“I co-founded a startup. We’ve raised a couple rounds of venture funding from a few VCs and have spoken to dozens in the process. In our case, we were very fortunate to partner with investors who had previous experience as startup founders/operators themselves. The capital we raised was enough to take us to the next level, but not so much as to be corrosive to our business or personal health. The growth trajectory we were targeting made financial sense for us, without compromising our ethics or our team’s wellbeing.

It was a good and considered match and we’re extremely happy working with them, so the negative ‘side effects’ have been very limited.

Great one. Super insightful and well-thought