What Goes Up...

Some thoughts on the big picture as we hit the dip

Hi folks, Paddy here from Odin. We are making it 10x cheaper and easier to launch & invest in syndicates and venture funds. We are now live in private beta.

Want to set up an SPV? Learn more here, or click below to get started. ⬇️

Good Morning,

Today, I’m going to spend a bit more time on the news.

What Goes Up

It’s been an interesting week in the public markets. As the FT reports, value investing is back in vogue, and growth investors have seen severe corrections to their portfolios, driven mainly, of course, by the decline in tech stocks, which had climbed to insane multiples in the last 18 months.

Cathie Wood’s ARKK and Buffet’s Berkshire Hathaway are great corollaries for the market more broadly.

The Nasdaq Composite is down 17% from November.

The biotech index has fared even worse, down over 20% over the same time period, and more if we look back further.

Folks who have been bemoaning the behaviour of the Wall Street Bets posse for months on end are finally feeling vindicated.

Chamath the SPAC daddy has been getting a severe roasting:

It would be wrong, however, to call this outright chaos. It is driven by a combination of the likelihood of higher interest rates, tapering (reduction of QE), plus the dumping of overpriced meme stocks by speculators, which drives further selling by the fearful.

Outside of “stonks”, the market as a whole is not too panicked,

The key lesson is the same as ever - diversify, then you won’t get hammered. Let time and compound interest do their work. And also, try to think about the big picture.

I am, as always, optimistic about the future. Zooming out is important. This image captures things nicely:

I try to spend time thinking about the big picture. I also seek to understand the present clearly, rather than predict the future. Finally, I doubt my ability to pick individual stocks successfully. I believe if you do these three things, you’ll probably do pretty well with minimal effort over the long term.

Things, however, are not all sunshine and roses. Carlota Perez is one of the major writers I recommend on this big picture thinking. She is insistent that the natural alignment between “production capital” (workers) and innovation, which tends to emerge at the tail end of an innovation cycle, is being held back by quantitative easing. QE is keeping “financial capital” at the helm and driving speculation rather than real value creation:

You can see this tension in all the creator economy / Web3 / DAO hype. The vision is an ownership economy, but the reality is a lot of people pumping shitcoins and speculating on NFTs.

The same thing has been happening in the public markets. The longer this happens, the harder the fall will be when it comes.

Incidentally, I’d love to get Carlota on our podcast. If anyone knows her personally, I’d appreciate an introduction!

Must come down go back up?

Does Bitcoin fix this? Probably not, but I think there are some moves worth making.

Crypto as a whole has suffered a more severe bashing than tech stocks. This makes sense - it’s the ultimate casino.

At its worst, Ethereum was down 50% and Solana 60% from November 2021 highs, with Bitcoin faring little better.

I luckily moved most of my crypto holdings to USDC before November’s peak last year. I am now planning to reinvest some of those gains in the relatively lower risk, more passive stuff - Bitcoin and popular L1 tokens from Ethereum, Solana, Cardano, Polkadot, Terra and Avalanche.

What interests me most about blockchain technology is its potential uses for three things: proof of ownership, governance and (most importantly) as money. If it can achieve these things more effectively than our current institutions can, it has a huge role to play in our future. I dug into this with Dermot from Eden Block in a newsletter / podcast in August 2021, called The Bank of Me. Here’s a couple of highlights:

Web3 creates hard to tamper with infrastructure for putting people in a position of ownership as stakeholders and voters, which is what the Internet has been trying to do for years.

Cryptocurrencies like Bitcoin are a potential hedge against the problems that QE creates with fiat currency. Alongside Carlota Perez, other OG’s like Ray Dalio have also talked about this problem. Dalio calls it the “Big Debt” cycle.

Basically, by allowing QE to happen, we don’t rip the plaster off during natural market downturns. As a result, the wound festers, and at some point you end up having to amputate the whole leg.

For these two reasons alone, I think crypto is worth betting a certain % of my portfolio on.

What about the private markets?

Later stage investors like Tiger and Coatue have been having a field day for the last two years. As Finn Murphy points out, this is now a more dangerous place to fish.

I said it last week and I’ll say it again.

My strategy is the same one organisations like Y Combinator and individuals like Naval Ravikant, Xavier Niel, Charlie Songhurst, Jason Calacanis and Fabrice Grinda have been deploying for years.

As Fabrice put it in “Welcome to the Everything Bubble” (Feb 2021):

“I have a barbell strategy with only cash and early illiquid privately held tech startups. If you have enough diversification (meaning over 100 investments) to account for the startups that fail, private early-stage tech startups are the best asset class. They create value for the economy and can grow rapidly. As such they are amazing to own in both inflationary and deflationary environments.”

If you haven’t yet, you can apply to join our private community and access pre-seed, seed and Series-A deals from syndicate leads in our network with small cheques. Apply here:

Best of the Internet

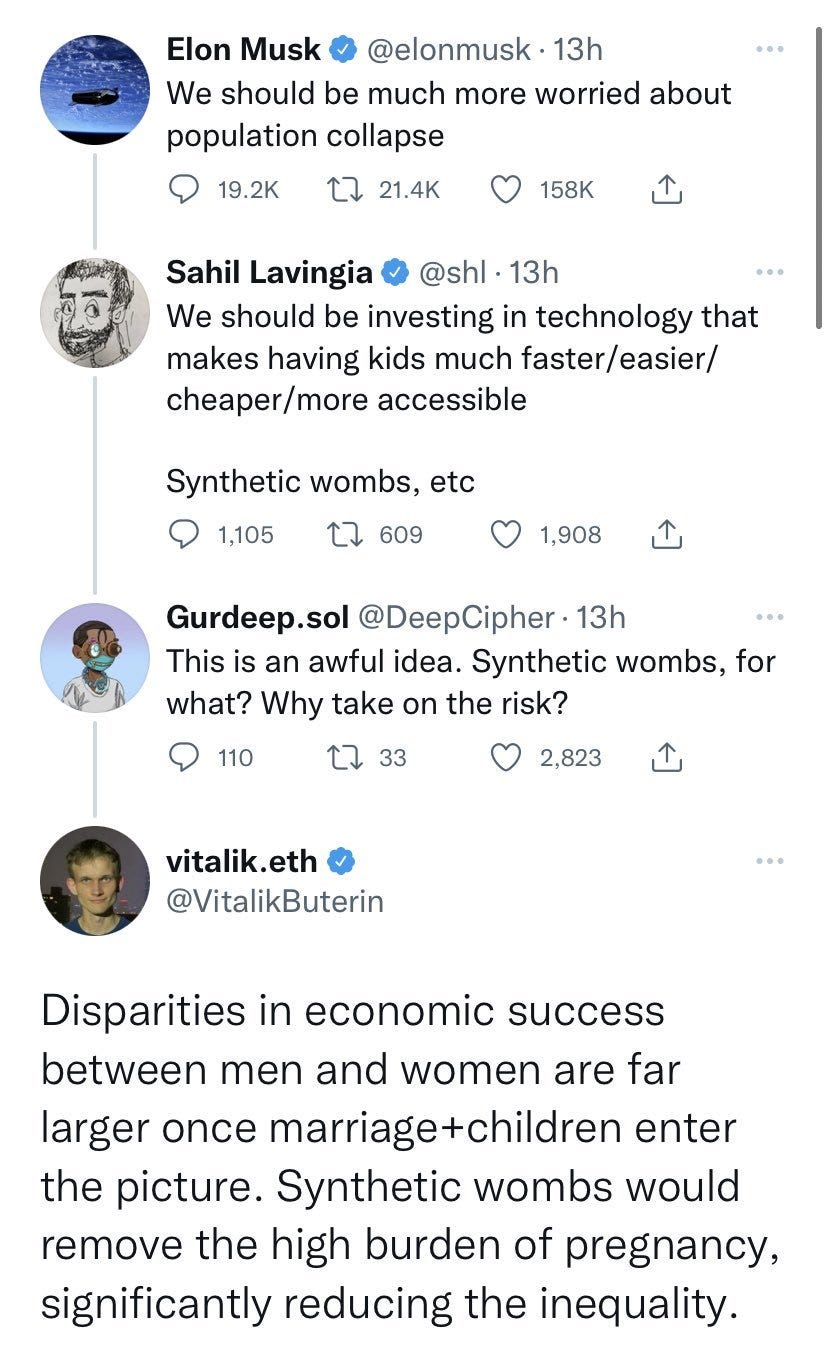

Synthetic wombs, etc.

This conversation caused a lot of kerfuffle. Who knows what is right or wrong here. One thing is for certain - the future is going to be weird.

For anyone interested, I’ll soon be doing an airdrop for my new cryptocurrency $BABY which we will use to increase the human yield for Mars expeditions. The coins will represent ownership of the babies’ future income or something equally dark. To join my ponzi scheme see the white paper, just email me.

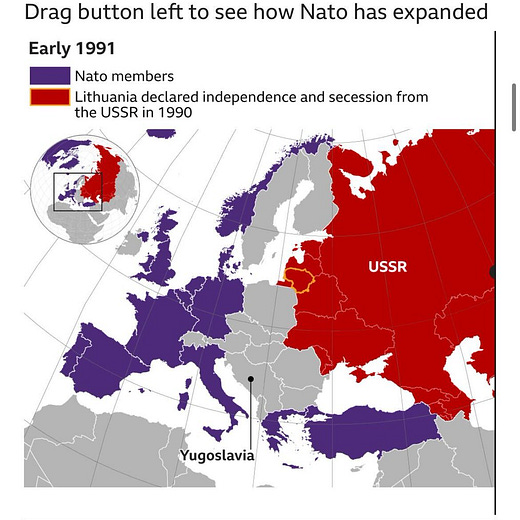

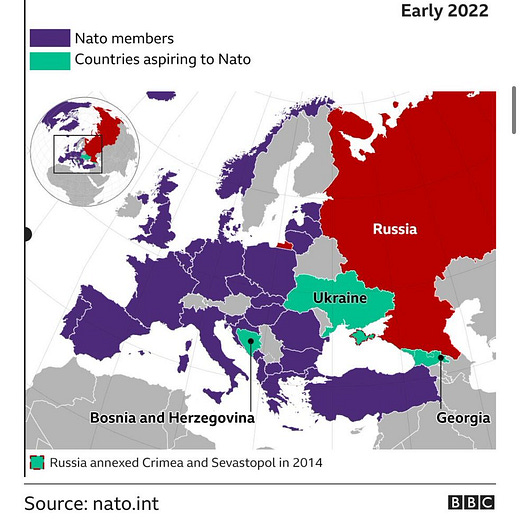

Meanwhile, in Russia

I wrote a thread attempting to explain Russia’s side of the story r.e. Ukraine. For context, I studied Russian at university, am married to a Russian and currently live in Moscow. However, I am not a political scientist or historian, so I might be talking rubbish. Make up your own mind. All I would say is this: the world is not black or white, but every shade of grey.

RIP Meatloaf

Not to make light of the big fella’s death, but I like to think he’d have enjoyed this one.

All kinds of strange

I guess a chunk of the US tech scene moving to Miami is going to be a good thing for the gals.

Yeah it’s sort of like baloney

This is from ages ago but it made me lol.