Wikiseedia

Our investment thesis

Hi folks, Patrick Ryan here from Odin. We are building the ultimate tool for angel syndicates to invest together in private companies and funds, via SPVs.

Good afternoon,

If you missed me, sorry I’ve been so quiet.

I have neglected this blog for over a month. We have been very busy launching new syndicates and SPV’s with our customers. My weekends have been spent moving house and furniture shopping (💀).

I’m excited to be back in London, and glad to finally be sitting down to do some writing. More fun than traipsing around Ikea.

Today I’m going to break down Odin’s investment thesis. It’s a long read - I hope you find it interesting.

Is it possible to build a community driven investment system that consistently generates top-quartile venture returns?

💸 Typical net IRR for a top decile VC fund in Europe: approx. 27.5% (i.e. ≈ 9x one's investment over 10 years).

Top quartile: approx 16% (i.e. ≈ 3.8x one's investment over 10 years).

Mary and I have spent about a year and a half working full time on this problem, figuring out the regulatory hurdles and testing ideas.

In the past 9 months we have picked up the pace, raising a $1m pre-seed round, hiring some amazing first employees and launching a regulated investment platform.

We have quietly gone off and already helped our community structure SPV’s to invest in ~100 exciting companies, alongside world-class investors like Accel, Coatue, Y Combinator, LightSpeed, Kleiner Perkins, Index, Coinbase Ventures, Sam Altman, Lee Fixel, GFC, Speedinvest, 20VC (Harry Stebbings) and many more.

Nice.

However, this all means very little if we don’t get some exits.

Our core revenue stream at the moment involves structuring deals in exchange for a cash payment. The syndicate leads have their own networks of LP’s - they use us to handle the legals, payments, and other admin.

But we also select certain syndicates and promote their deals to our broader community. Most of our potential future income is from the capital we introduce this way, which comes in the form of carried interest - a share of future profits.

So we are part fund admin provider, part fund of funds.

In Pre-seed is coming, I outlined why I believe aiming to index top-quality pre-seed and seed startups is a smart investment strategy (tl;dr: better access and entry price, more chance for outliers that deliver crazy 10^3 or 10^4 returns, pro-rata rights on lots of opportunities that you can then double down on later via SPVs).

It seems to have worked pretty well for the likes of Jason Calacanis, Y Combinator, Seedcamp, Charlie Songhurst, 500 Startups, Kima Ventures, and a number of other investors I respect.

The difference between Odin and these guys is that we don’t have any partners, principals, associates or investment analysts. There isn’t a Patagonia vest or a pair of AllBirds in sight.

In fact, only one person at Odin - my colleague Tim Durbin - has ever actually worked at a venture capital firm. I did a bit of consulting work in corporate venture, but it’s not the same.

There is method to our madness. We are a building a software company, not a venture capital firm. We treat capital allocation as a pure engineering problem. The long-term plan is to automate this process as much as possible.

💡 Ahem - we are hiring, especially in engineering - check out roles here

I used to think this was about data, but it isn’t really. It’s a human coordination challenge. At scale, Odin will look much more like a mixture of Twitter and Wikipedia than a quant fund. It’s about getting specialist operators with niche expertise and off market deal access in one place, and building technology that optimises the ways in which they can collaborate and access capital. There will, of course, be some data later on, but it’s secondary to the networking and collaboration tools.

How do we choose the community members and deals to prioritise? For that, we need an investment thesis.

Our thesis is pretty simple. It boils down to three key ideas:

Who? Build a community of smart, ambitious specialists who are first or second time managers.

What? Target as many high-impact problems with outlier return potential as possible.

How? Index the best opportunities surfaced.

1. Smart, ambitious specialists

Since we started Odin, we've focused a lot of time and energy on building a small, tight-knit community, which we are only now gradually expanding. We've sought to identify and build relationships with three key categories of early member:

Successful Founders

They have practical experience from the coal face. They have spent time raising money, building and selling companies. They bring empathy, invaluable advice, and much more to the table for portfolio founders. They usually like to invest in areas they’ve built stuff in. They get access to great opportunities because other founders want to take their money. They tend to have a good eye for people who “have what it takes” and are usually already angel investing regularly themselves.Niche Operators

Again these people have practical experience, but it’s different. They’re narrow sector experts, super focused and knowledgeable about a specific area - anything from machine learning to precision agriculture. Within their domain they are masters. They often write or produce other content about their area of expertise. They may not already be knowledgeable about how VC or angel investing works.VC’s going solo

A lot of people working for more established funds are interested in going it alone, and we want to help them do so. These folks already have a good knowledge of deal structures, markets, and the technical nuances of venture. They tend to have a pre-existing network that gives them deal access. They understand what we are doing, align with our values and are keen to participate.

Note that only one of the three groups has previous VC experience. This is intentional. We don’t think the best crop of outperforming new managers will be created by tapping established channels only. Most VC’s in Europe have never even worked at a startup. This experience is invaluable if you’re investing early, which we are.

Of course, these people need to be working within a common sense framework and must be implementing best practices:

Investing in growth markets;

Backing smart, tenacious founders who will walk through walls;

Looking for businesses with network effects, strong unit economics and increasing returns to scale;

Actively hunting and fighting for the best deals;

Implementing good governance;

Working with portfolio founders to support them in securing follow-on funding.

I don’t think these concepts are rocket science. They’re simple and effective.

As venture capital bifurcates further into agglomerators and specialists, our bet is on these early stage sector specialists (bottom left in the below infographic) who are usually first-time fund managers. The Kauffman Foundation has found that new and developing funds have consistently constituted the majority of top 10-ranked VC performers over the past 15 years. Research from CB Insights also supports this.

By putting community and collaboration at our core and targeting people who share these same values, we aim to drive cross-pollination of opportunities, ideas and knowledge between the three groups. The hope is that a bit of a Medici Effect will further improve return profiles.

This is already producing some interesting results. Next week I’m meeting someone from DeepMind who is planning to launch an investment syndicate with an experienced corporate venture investor. They met via our community.

2. High-Impact Problems with Outlier Return Potential

I am wary of the word “impact” in the context of investing.

It is vague, and means different things to different people. When I use the term “impact” here, I just mean problems whose resolution will materially impact humanity’s progress towards its loftiest ambitions. It’s not specifically about social impact, climate, or something like that.

That being said, we are not really interested in things like 15 minute grocery delivery or SaaS workflow tools to optimise retail inventory. This isn’t because we are making a value judgement about what other people choose invest their time and money in. Everyone contributes to society in different ways.

We just think the real money is going to be made this century by solving a different category of very non-incremental problems.

Below I briefly outline the six areas - computing, life sciences, energy, financial empowerment, education and space - that we are particularly excited about at the moment, and touch on some of the companies we’ve already supported in these areas.

The list is not exhaustive - we are very open-minded - but it gives you an idea of our focus.

I’ll dive deeper on each sector in other blog posts.

Computing

In many ways every other sector of interest for Odin is a subsector of computing. It’s all made possible by this technology.

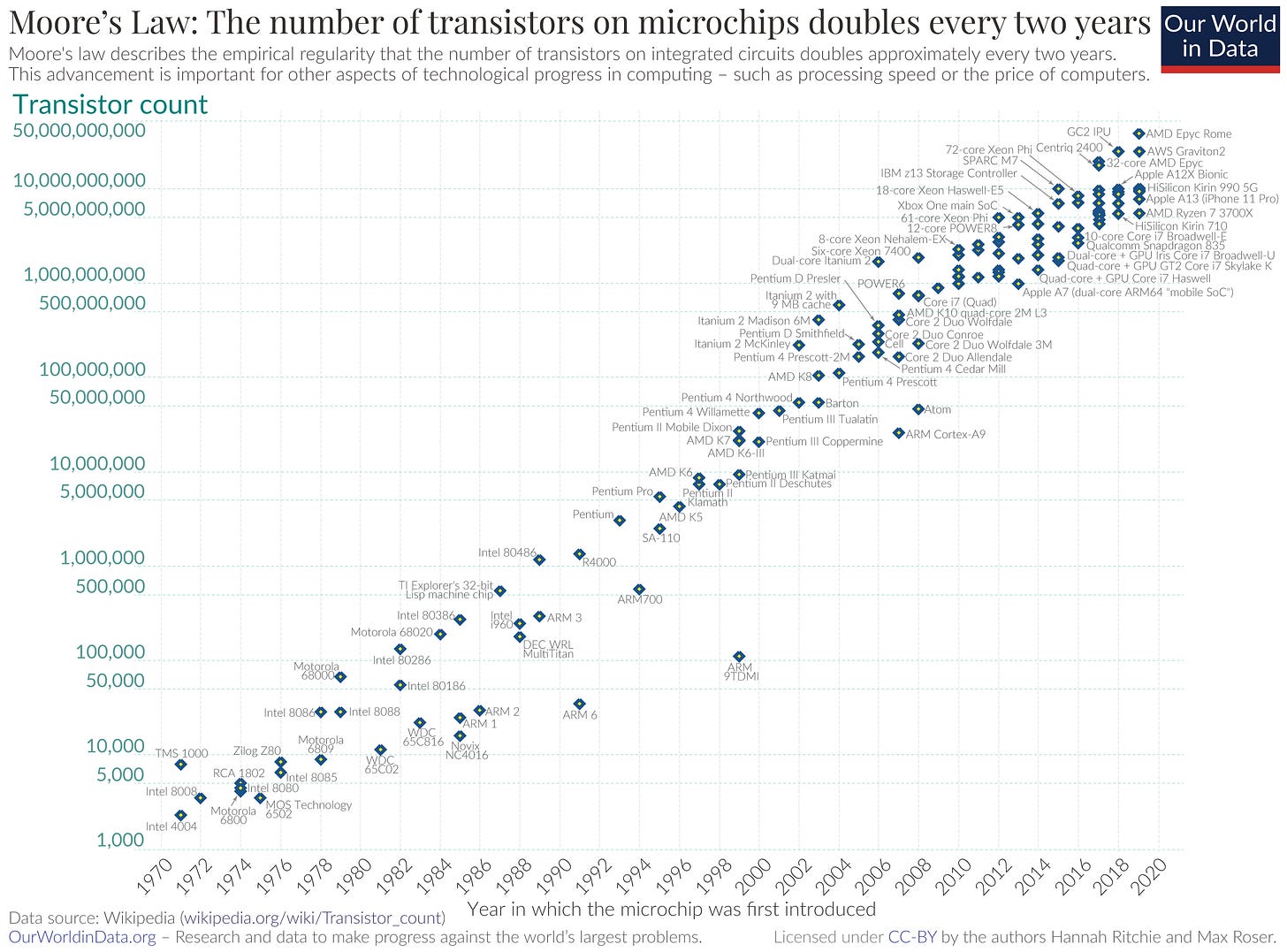

The silicon transistor has been the gift that keeps on giving ever since it was first developed at Bell Labs in 1954. Since then, Moore’s law has brought us reliably cheaper compute every year, and with it incredible advances in hardware and software that have formed the basis for the technological revolution we are now living through.

As Moore’s law nears its physical limits (basically chips are so small that quantum interference is affecting their ability to function), it’s going to take something different to meet the need for computing that is ever faster, cheaper and more efficient. There is a range of interesting technologies out there that aim to solve this: quantum, neuromorphic and edge computing are all areas with high potential.

We are also interested in the opportunities that current fast, cheap computation technology unlocks. We like software that acts as infrastructure other people can build on - everything from no-code platforms to DevOps tooling.

The next frontier for software and hardware is AI. Artificial intelligence is already radically altering the boundaries of what is possible in multiple industries. We’re excited.

Some of our Computing portfolio:

Ori - enabling computing anywhere, any time, via a distributed cloud platform. Customers get up to 50x faster data transfer and 70% reduction in networking backhaul costs (cost of data transfer).

Rain Neuromorphics - a hardware startup building analog computer chips that mimic the way the brain works to supercharge AI. Their first generation neural processing unit (NPU) has the potential to offer 1000x better energy efficiencies than existing digital AI chips, and be capable of scaling to 100x larger model sizes.

Smarter.ai - a marketplace for machine learning models, allowing any business to use AI to increase turnover, reduce errors, and make daily operations run more seamlessly.

Life Sciences

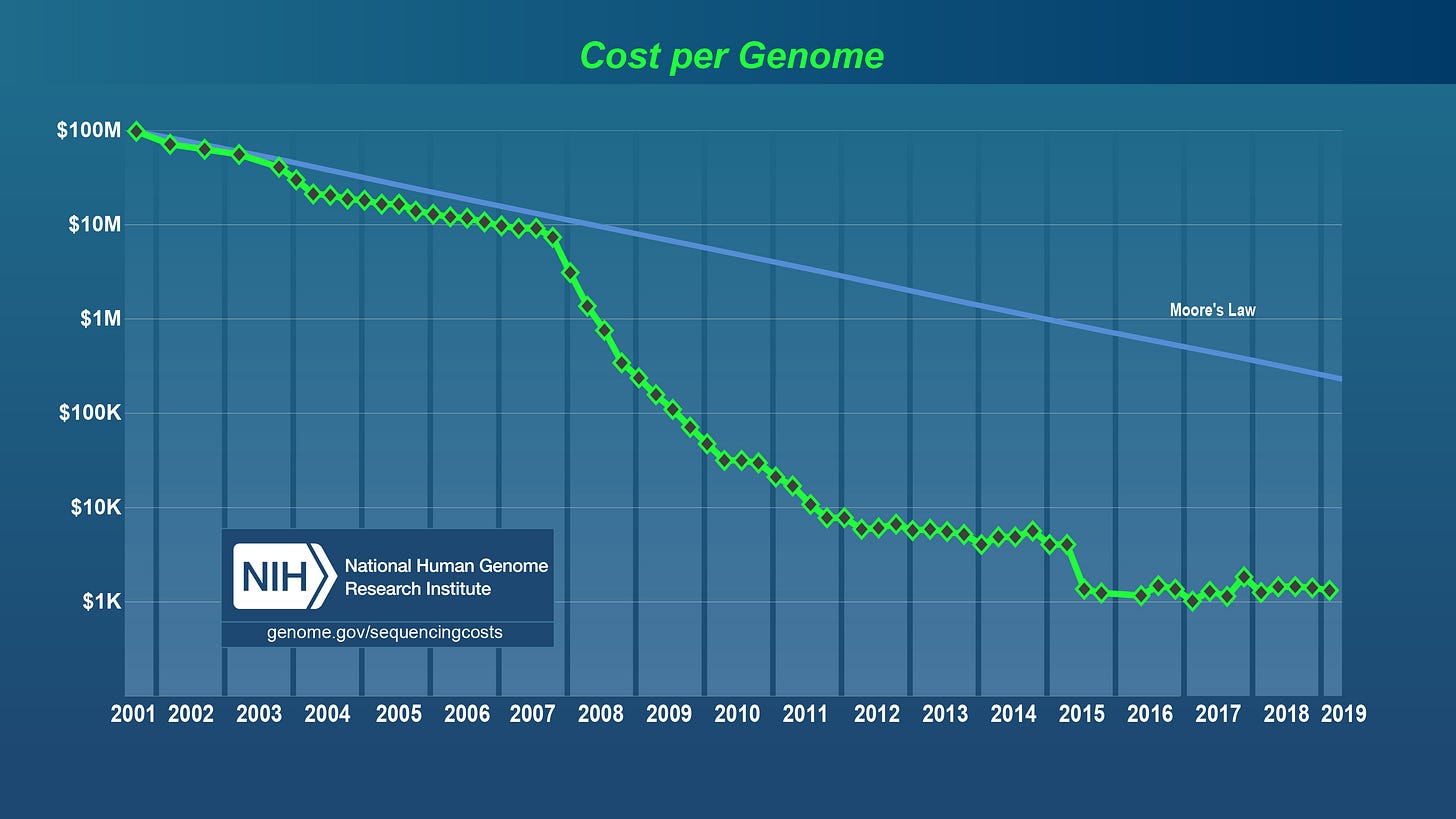

As I’ve mentioned previously, our ability to sequence genomes at radically low cost has accelerated astonishingly fast in the last 20 or so years. Much faster than Moore’s law.

When you combine this with cheap gene-editing technologies like CRISPR / CAS-9, there are massive implications for healthcare, agriculture, manufacturing and pretty much every other area you can think of. We can redesign life from the ground up.

Advances in AI act as further fuel. For example, Alphabet recently span out Isomorphic Labs, which uses AI models to predict the way proteins will fold, accelerating new drug discovery.

As this science fiction enters the realm of reality in the coming 20 - 40 years, it will change what it means to be human. It will force us to ask deep moral and ethical questions about what we want our species to become. I think it is important that many voices are heard and that we consider all angles, which is why I believe allowing more people to participate as shareholders is important.

Some of the life sciences companies we have supported:

Stealth - a British hardware moonshot at the intersection of life sciences and computing (also in the neuromorphic computing space). They’re building “wet computers” using biological proteins based on actual neurons.

Kiwi Biosciences - developing novel, patent-pending enzymes that improve human digestion and embedding them in everyday products like dietary supplements and foods.

AOA Dx - building a revolutionary way to save half the women diagnosed with Ovarian Cancer. AOA’s liquid biopsy test accurately enables early diagnosis of ovarian cancer through the analysis of tumour markers.

Energy

Energy is the base currency of the universe. Pretty much every problem you can think of that is worth solving is downstream of energy. If you can remove energy as a “rate limiting factor”, you can solve all those other problems much faster.

Since 1900, human energy production and consumption has exploded.

Notwithstanding short term fluctuations due to geopolitical conflicts, energy is now cheaper and more accessible than ever before in history.

But as the technological revolution accelerates, so too will our energy demands. We need to find ways to make energy

Cheaper

Less harmful to our environment

Easier to store (especially challenging with renewables)

Solving these problems is going to require significant intervention from governments. But the private sector also has a big role to play in building the infrastructure and tools to make this work.

Things like nuclear microreactors, fusion, electric vehicles, carbon capture, solar photovoltaics, new battery technology and pumped hydro have all seen significant capital outlay from the private sector in recent years. Interesting new opportunities will continue to emerge.

A selection of energy-related portfolio companies:

Heimdal CCU revolutionises Carbon Capture and Utilisation by extracting dissolved CO2 from ocean water. This allows for an energy effective restructuring of CO2 into more desirable compounds - such as limestone - that can be sold profitably to manufacturers as carbon negative building materials.

Bonnet aggregates the fragmented EV charging market, where there is a complete lack of price consistency, availability and quality of service, by providing an app which offers uniform, subscription-based pricing and access to all EV charging networks.

Financial Empowerment

“Money cannot buy you happiness, but it does bring you a more pleasant form of misery”. - Spike Milligan

This one is close to our hearts, and the sector in which we have seen the most activity on our platform. Money (or lack thereof) is the primary source of anxiety and suffering for a large number of humans globally.

We love companies that make earning, saving and investing money easier. This is always best when accompanied by appropriate education and resources that put the needs and concerns of the user first.

This is less about the “income inequality” narrative, which is disputable outside the USA, and more about the massive unlocking of global human potential and economic growth that financial empowerment can create. Emerging markets are a particular area where we see opportunity. If fewer people are spending their time worrying about money, they can focus their attention better on contributing to society in valuable ways.

Some of the many financial empowerment companies we’ve helped:

Rain Financial - the biggest crypto exchange in the middle east.

Duplo - a B2B payments platform for Africa.

My Home Pathway - empowering Americans to manage their financial health and navigate the mortgage loan process in order to buy their first home.

Dotte - a marketplace allowing parents to buy and sell second hand children’s clothing.

Bloom Money - a P2P approach to financial services for migrant communities, building upon tried and tested ways of borrowing and saving money that are already used around the world.

Goodloans - Africa-focused B2B lending platform.

Education

Again, this is an area where we have already made massive progress in the last ~200 years.

But there is more to be done:

“Education is the single biggest transformative factor for the individual, the nation and society. Societies cannot thrive unless all children and young people have quality education that provides them with academic knowledge and an understanding of values.” - UN Women Executive Director Phumzile Mlambo-Ngcuka

In spite of recent advances in technology, our approach to education (the subjects we teach, the methods we use) has changed little since the Victorian era:

We are excited about innovation that unlocks people’s potential and helps them learn in a more personalised manner.

A selection of education investments we have facilitated:

Vygo puts personalised support at the finger tips of every student, relieving the administrative burden for program administrators, and providing real-time insights into the impact of student support initiatives. Universities across Australia & the UK use Vygo to power diverse student experience initiatives, from mental health support to mentoring programs for nursing students.

Space

For a clearer picture of why there is real substance to the current hype around Space, I highly recommend giving this piece of writing from the Founders Fund investment thesis a read. This graph says a lot:

By driving down launch costs, SpaceX is vastly increasing the size and potential of the space industry. This creates a whole new frontier for humanity to build and explore. There are massive implications for communications, advanced materials manufacturing and other industries. There will be potential to create whole new classes of product and economies in space.

I’ve already dug a little deeper on space in a podcast with Jeff Crusey, investment director at Seraphim Space. Check it out :-)

Space investments we’ve facilitated:

Transastra - developing technologies for transporting, prospecting, & harvesting resources like water, iron and precious metals in space.

3. Indexing

I’ve covered this in previous posts, so I don’t want to harp on about it. You can also check out this excellent deep dive on the subject by Nicolas Colin (the Family).

In brief:

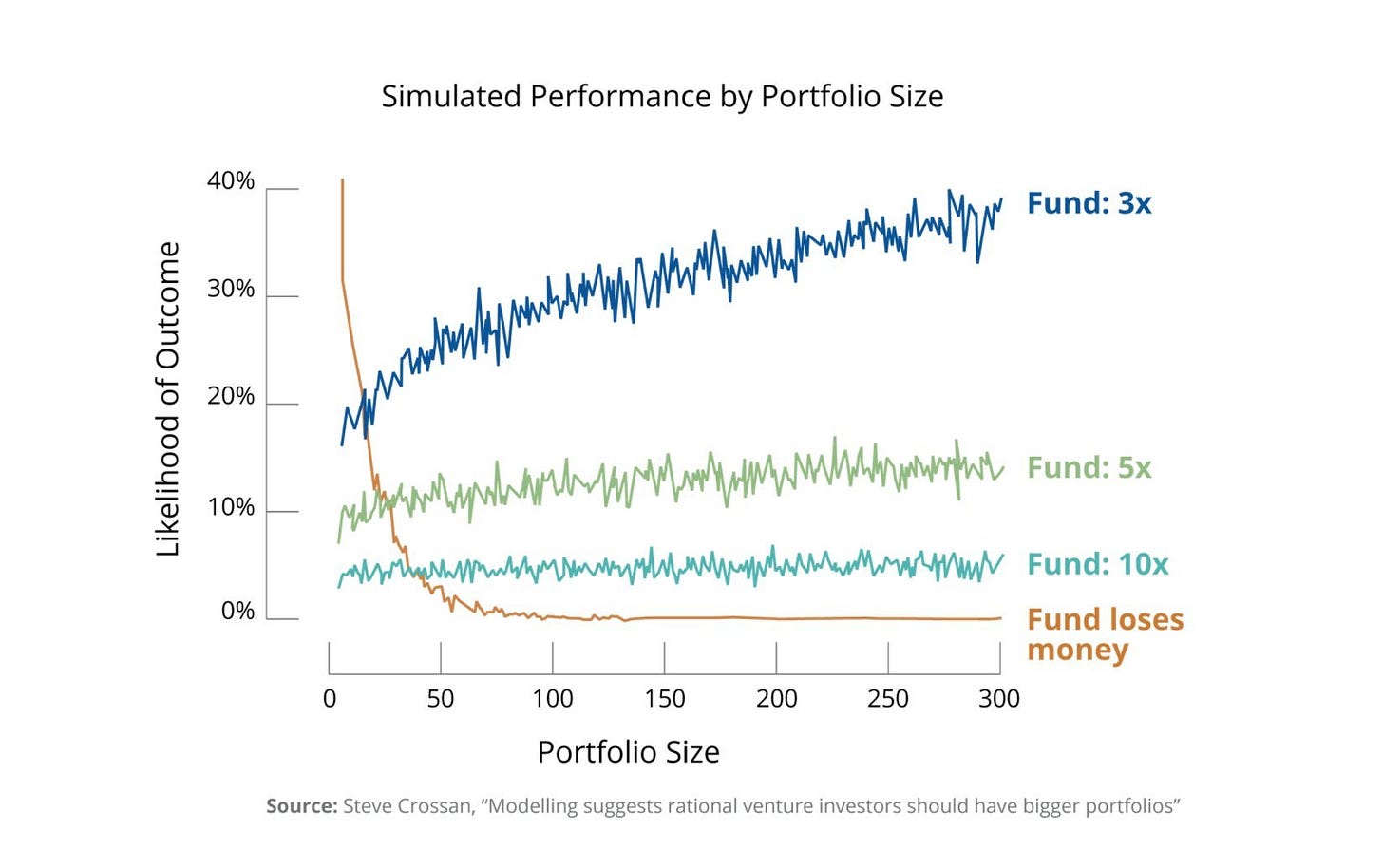

Most VCs are much worse at picking winners than they think they are.

Outliers drive insane returns, so you should take lots of shots.

The solution is just to put a bit of money behind as many interesting deals as possible, then double down on winners later via pro-rata rights and good relationships with founders.

It is not just logic that drives this philosophy. It also solves a selfish challenge for me. I’m interested in so many things, but I don’t have the knowledge or time to invest in them all with confidence. Investing very broadly in deals brought to us by the specialists in Odin’s community - who have skin in the game (they invest themselves) and an incentive for the companies to succeed (they take carried interest) - solves this problem.

We have plans to make passive exposure to these opportunities much simpler.

Here are some interesting data points supporting the index / double down approach:

That’s it for this week.

We are still hiring for more roles, particularly in engineering.

Join the movement.

Cheers

P.R.

Risk Warning

Investing in start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. Odin is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via Odin once you are registered as sufficiently sophisticated. This content is for informational purposes only and should not be considered investment advice.

Join Odin Limited is an appointed representative of Aldgate Advisors Limited, which is authorised and regulated by the Financial Conduct Authority (No. 763187).