Finding Your Why

A conversation with games entrepreneur and investor Joakim Achren

Hi folks, Patrick Ryan here from Odin. We are building a better way to invest together. We’ve started with a tool that lets anyone, anywhere raise money from their network in a few clicks. It’s used by founders, angel syndicates and emerging fund managers globally.

We take care of legal stuff (SPV’s, carried interest), KYC & AML, regulatory, payment flows and everything in between.

In late October, Mary and I caught up with Joakim Achren for a chat - you can listen to the conversation below.

Joakim is an experienced games developer and gaming entrepreneur.

His second games startup, Next Games, IPO’d on on the Scandinavian Nasdaq exchange in 2017. It was eventually acquired by Netflix (last year) for around $70 million.

Joakim has spent the last four years or so focused on investing in games companies. He has a large following via his blog, Elite Game Developers, where he shares insights and tips to help people build healthy and profitable games companies.

He also runs a syndicate with Odin, which you can apply to join!

Subjects we cover in this conversation:

The current fundraising environment and what it means for founders & investors: fewer high-quality pre-seed companies, but lots of quality deals happening at seed stage;

Token investing and incentive alignment - why illiquidity in traditional startup equity investing is a feature, not a bug;

The challenges of building unicorns & decacorns in gaming;

Joakim’s life philosophy

Stoicism - the value of leading a virtuous life, and the freedom of discipline;

Growth Mindset - viewing yourself as constantly evolving and always improving. Goals are good, but perfection is never achieved (or desirable);

Finding your “why” - your purpose in life - and accepting how this changes over time. Joakim felt burnt out after Next Games, and realised that actually he didn’t want to keep building venture-backed startups. He has found more pleasure in helping others through EGD;

How Joakim approaches investing at pre-seed and seed, and insights from his conversations with founders:

Getting a read on people’s motivations: is there something that puts them into “the 1% group” of founders who have a 20 year vision and ambition for what they are building, as well as the skill to get there? Why are they doing what they are doing? Is it because they are obsessed with the problem, or are they just doing it for status or something less sustainable?;

Founder dynamics and people problems - for Joakim, this is the main failure point for a business, so you need to understand it very well;

The pitfalls of being “market obsessed” instead of “founder obsessed” as an investor;

The Next Games exit to Netflix, and what Netflix is planning in gaming.

Thanks Joakim for coming on - we really enjoyed the conversation!

You can listen on Spotify.

There are other listening options here: Apple Podcasts, Anchor, Listen Notes

Best of the Internet

Rats in a maze

Probability

Great Poems

Some great lines and beautiful short poems in the responses to this tweet.

A Soft Landing?

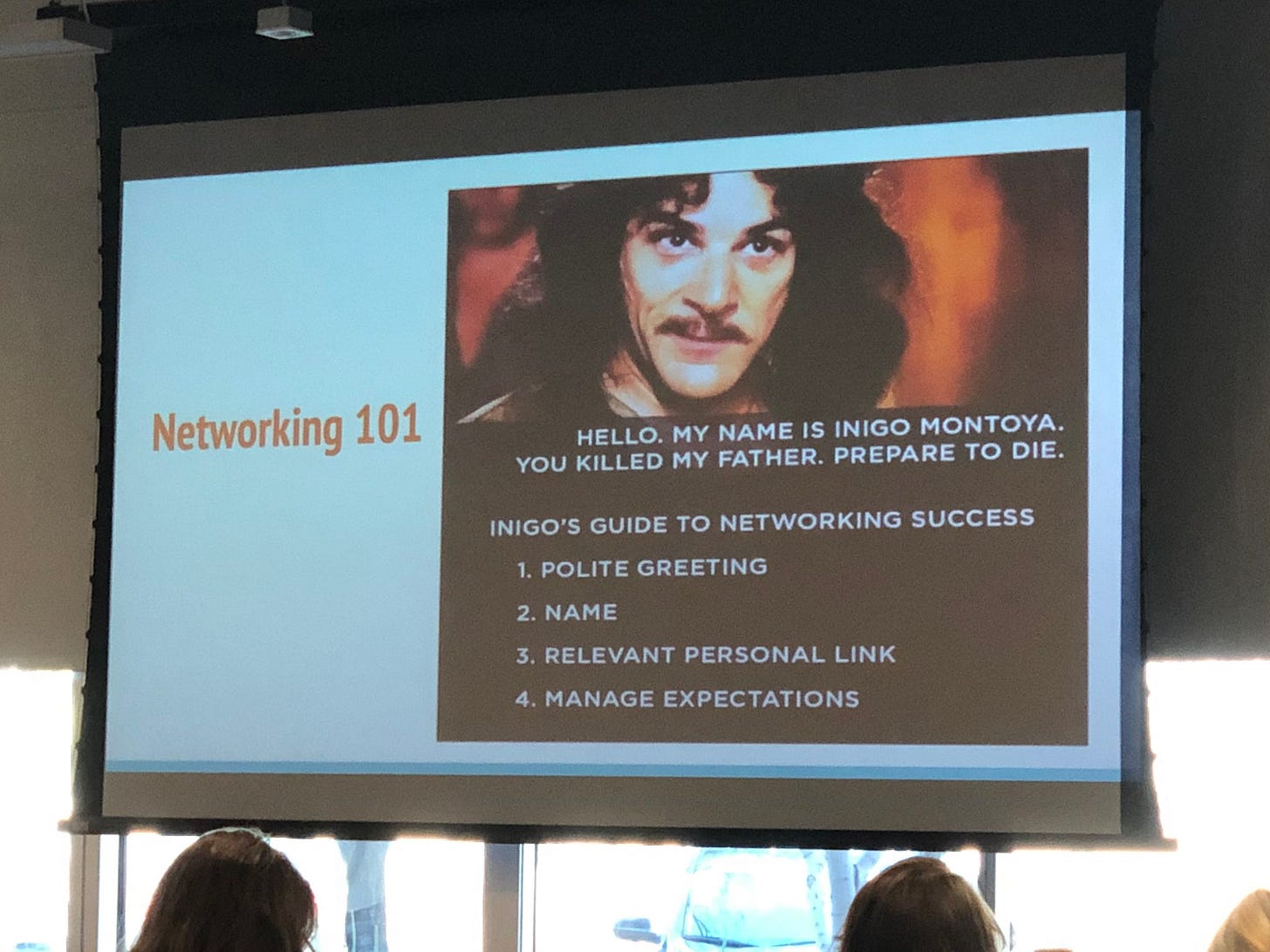

How to Network

Most Startup “Advisors”

The Child is father of the Man

“All grown-ups were once children. But very few of them remember it.”

That’s it for today. As always your thoughts, comments and feedback are welcome

PR

Risk Warning

Investing in start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. Odin is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via Odin once you are registered as sufficiently sophisticated. This content is for informational purposes only and should not be considered investment advice.

Join Odin Limited is an appointed representative of Aldgate Advisors Limited, which is authorised and regulated by the Financial Conduct Authority (No. 763187).