How to Run an Angel Syndicate - Part 2: What Does ‘Good’ Syndicate Performance Look Like?

Building and optimising your investor funnel to maximise conversion

Hi folks, Patrick Ryan here from Odin.

We build powerful tools for people to connect, collaborate and invest together.

There is a lot of information out there about how to build a startup. There isn’t so much on how to build a VC firm.

We see running an angel syndicate as the logical first step.

This is part two of our latest series written by Jed Ng, founder of AngelSchool.vc. We discuss both the practicalities and some of the trade secrets you need to run a syndicate successfully.

It builds on the previous 4 part series we released - How to Start an Angel Syndicate - which is a great place to begin if you’re thinking about going down this path.

Now, over to Jed.

AngelSchool.vc and Odin are teaming up again for the next cohort of the Syndicate Program!

In 8 weeks, you learn all the strategies and get all the tools you need to build and scale your angel syndicate to a point where you are regularly writing $500k+ cheques per deal.

Cohort 7 begins June 10th

Part 2: What Does ‘Good’ Syndicate Performance Look Like?

Leading a syndicate drastically improves the risk/reward for you as an angel investor. You get to spread personal capital across more deals and enjoy higher upside through carried interest. Syndicates actually have a structural profit advantage over VC funds, as I’ve outlined previously!

Starting a syndicate has its challenges (going from 0 to 1 is always difficult) but the right execution plan will allow you to launch in as little as 3 or 4 months.

LP (investor) networks can also be a source of reliable, scalable capital. I’ve grown my average syndicate cheque from $100k to nearly $1m simply by growing my LP base.

The ‘Allocation Dilemma’ of Syndicates

There is a classic problem that the syndicate model faces. I call it the ‘Allocation Dilemma’.

Let’s say you’ve managed to put together a group of LPs who are excited to see your deal flow. You’ve also found a great company to invest in. Great! Let’s get the deal done.

The founder asks “how much allocation do you want?”.

What is the right answer?

You don’t actually know. That’s because fundraising for syndicate deals happens after diligence. It’s the opposite of a fund. Funds spend a long time up front fundraising so that when it comes to investing, you can write a cheque straight away.

With syndicates, LPs decide whether to invest and how much on a deal by deal basis, once you’ve picked a deal that you’re investing in personally.

Here are your options for solving the Allocation Dilemma:

Option 1: Be conservative and make a low estimate so you have confidence in filling the allocation.

Option 2: Be optimistic and hold a big allocation to maximise your upside.

Most investors err on the side of caution and go with option 1. On balance, it is likely the better response, since the consequences of a failed fundraise can be disastrous for you and the startup. That said, it’s a suboptimal decision, because you’re leaving capital (and upside) on the table.

The optimal allocation is exactly as much as your LPs decide to invest in the company.

So, how can we figure out what that is?

Funnel Management to the Rescue

Syndicate fundraising takes place over a series of steps, from reaching out to potential LPs, through sharing deal flow with them, and eventually to closing capital. There is a conversion event that needs to happen before moving to the next step.

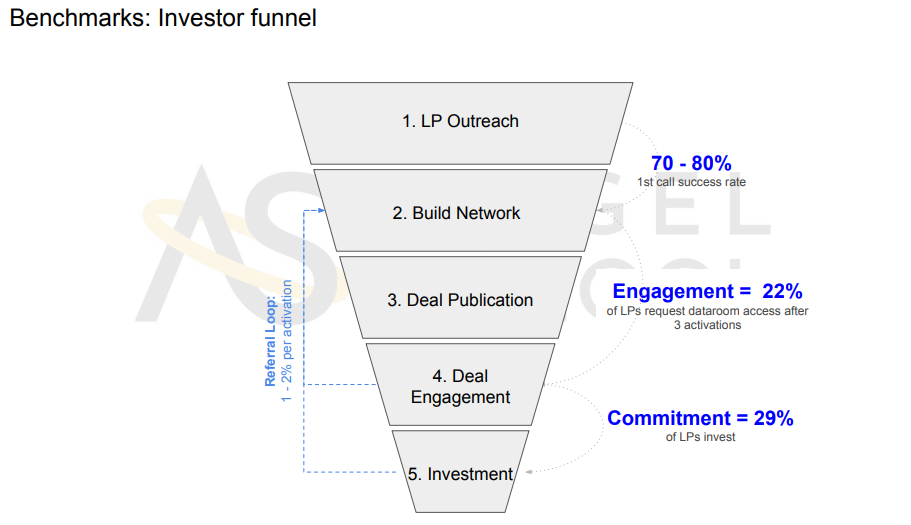

Here are the key parts of the funnel:

LP Outreach:

This is how you find and get in contact with potential LPs. When starting out, you’ll be proactively reaching out to LPs. As you grow, you should get inbound.

Getting to know potential LPs and getting them excited about your deal flow is how you convert them to your network.LP Network:

Investors in this part of the funnel have agreed to receive your deal flow. They are prospective future investors. They’re your pool of potential capital.Deal Publication:

In this step, you’re sharing deal flow with LPs.Deal Engagement:

Engaged LPs are investors who have indicated interest in a particular deal.

This can be an outright expression of interest, or a tacit one, like when someone requests access to a data room.

You need to be able to identify who’s engaged and nurture their interest.Investment:

Some percentage of engaged LPs will end up investing in the deal.

If you manage your funnel appropriately, scale your LP base and understand your conversion metrics, you can commit larger amounts to deals with much more confidence on raising the amount you commit.

Benchmarking Performance

Now that we have a framework, we need a way to benchmark each conversion point.

We’ve developed these benchmarks from executing dozens of deals and deploying millions of dollars through a network of 1000+ LPs. This level of scale and the consistency of results we see gives us a high degree of confidence in these metrics.

We’ve found that roughly 6% of people in our LP network (step 2) invest in each deal. This shows you how important having a large top of funnel, with plenty of engaged investors, is to your success!

LP Outreach & Network Building

When building your LP network, 70 - 80% of prospective LPs that you reach out to should be saying ‘yes’ to seeing your deal flow. You achieve this by targeting the right LPs, establishing your credibility as an investor, aligning your thesis with them, and address their concerns and objections. I’ve covered how you do this in detail before, in my article on how to build your investor network.

Deal Publication

When sharing deal flow with LPs, we’ve managed to achieve a 22% deal engagement rate. In other words, 22% of LPs express interest in investing in a particular deal. Your deal flow volume, deal quality and copywriting are your major drivers here. Distribution also matters ; Consider the UX when you’re sharing deals on chat groups, slack channels, Notion pages or some other platform. As I mentioned in my last post, I find that an email with the right level of detail (not too much) is the best way to start.

Investment

We’ve managed to achieve 29% commitment rates. I.e. of the 22% of people who express interest in a deal, roughly a third go on to invest. You can drive this with thorough diligence, a well argued thesis, and how attractive the company is. There are elements out of your control, such as each LP’s cheque size.

This equates to about 6.4% of our total investor base.

Parting Words

Syndicates have tremendous influence over fundraising success for founders. As such I encourage angels to think consciously about how every aspect of the LP experience can be optimised.

The depth of your relationships with LPs, your deal flow quality, how compelling your diligence is and your process management all matter. What you say about a deal, how you nurture interest and how you close commitments directly affect outcomes.

Your funnel performance is the sum total of how you design and optimise every LP touchpoint.

Jed

AngelSchool.vc and Odin are teaming up again for the next cohort of the Syndicate Program!

In 8 weeks, you learn all the strategies and get all the tools you need to build and scale your angel syndicate to a point where you are regularly writing $500k+ cheques per deal.

Cohort 7 begins June 10th

Thanks once more to Jed for a valuable and insightful piece!

If you missed it, we also ran a webinar (recorded) yesterday with Jed and Alex Farcet, where we discussed the strategies for success when scaling your syndicate. There were some really great insights! Here’s a short extract from the conversation:

That’s all for today. Thanks for reading!

PR

Risk Warning

Investing in start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. Odin is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via Odin once you are registered as sufficiently sophisticated. This content is for informational purposes only and should not be considered investment advice.

Join Odin Limited is an appointed representative of Aldgate Advisors Limited, which is authorised and regulated by the Financial Conduct Authority (No. 763187). Join Odin Limited is registered in England (No.12849405). Registered office: Hermes House, Fire Fly Avenue, Swindon, Wiltshire, England, SN2 2GA