New Adventures, New Heroes

As the bubble deflates, what's next for VC?

Hi folks, Patrick Ryan here from Odin. We are building the ultimate tool for angel syndicates to invest together in private companies and funds, via SPVs.

RIP Good Times

In the last ~25 years, venture capital has transformed from relatively obscure cottage industry into perhaps the most talked about business in the world. The internet is packed to the gills with content and memes about VC. In a weirdly fitting meta-cycle, the serpent has eaten its own tail; the people creating content and memes about VC are now becoming VCs.

However, once you’re on the inside, things remain tricky.

It is incredibly difficult to access the best deals and succeed as an investor. Most people never manage it. This is the venture capital industry’s big dirty secret: 95% of VC’s aren’t actually earning enough ROI to justify their existence, on a risk adjusted basis.1

It’s not going to get easier. Public markets have tanked, inflation is at record highs, the West is stuck in a proxy war with Russia, and interest rates are creeping up. The cheap capital bonanza is over.

Investors have been able to hide behind paper markups made by later stage funds for some time. But all that really matters at the end of the day is distributions to paid in capital (DPI) - how much cash you put in vs how much cash you get out.

Eventually, to paraphrase Warren Buffet, the tide goes out. And then you find out who has been swimming naked.

The coming low tide will likely reveal its fair share of bare bottoms.

As many people have noted in recent years, the safe bet of Series A to Series C software companies (think B2B SaaS, e-commerce and some marketplaces) was always going to become a more and more difficult place for VC’s to make money. The writing has been on the wall for a while. It’s a result of three key factors.

Competition: more funds than ever before fighting for access to the same deals, which drives up valuations, with more startups than ever targeting the same markets, which drives down profits;

Debt: new non-dilutive sources of capital (like revenue based financing) for later stage software businesses are attractive to founders. Many software companies have very predictable revenues once they scale up and have been trading for a couple of years. Since we now understand their business models much better than ~20 years ago, investors with lower risk appetite are getting more comfortable lending, rather than buying shares;

The Everything Bubble2: a lot of the growth in the last 10-15 years was fuelled by low interest rates and quantitative easing. This led to mega funds being raised and deployed in a frantic search for yield. This meant lots of paper gains, liquidity through secondaries and some bumper IPOs too. For context, the founder of Hopin, Johnny Boufhart, made more money in secondaries last year than the company has made in revenue in its entire history at that point. As this bubble now seems to be deflating, if not bursting completely, it will be harder for later-stage software companies to continue raising money, and also more difficult for these businesses to go public. Those that manage it will do so at lower valuations, often taking a haircut vs. their previous private valuation. Funds who invested heavily in the B - E rounds over the last couple of years will be left holding the bags.

These three factors are probably also going to push more VC’s into earlier software deals (at seed stage). The alpha could well get eroded there too.

I wrote about this in March last year in a piece called “Pre-Seed is Coming”. This was inspired by the fantastic “Debt is Coming”3 by Alex Danco.

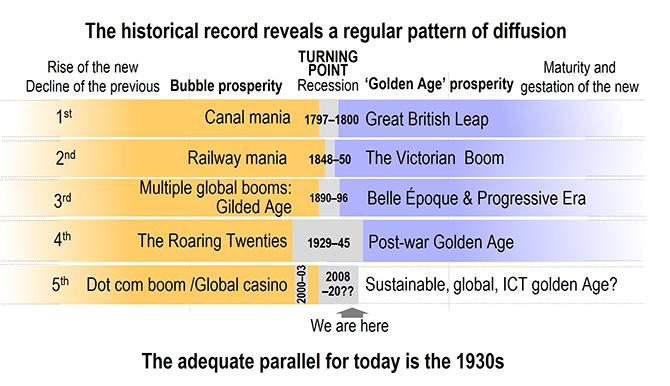

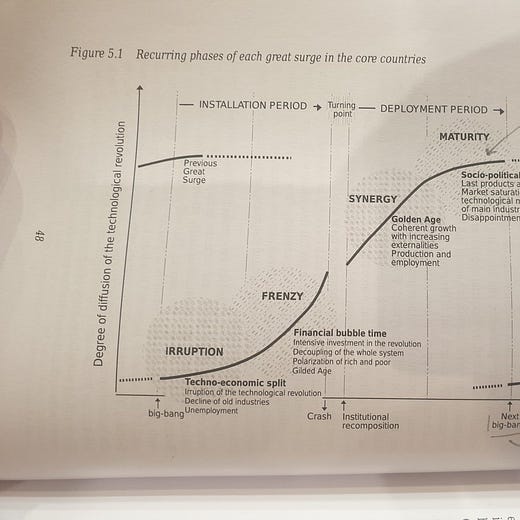

To be clear, I don’t think it’s the “end” for software. Far from it - we have the potential to soon enter a “golden age”, in the words of Carlota Perez:

[The] recession phase is what I call the ‘turning point’, because it is the time when the control of investment shifts from finance to production, normally with the aid of the State. When that has happened in the past, we have experienced strong growth in what can be called a Golden Age, with broad-based prosperity.4

If governments make good policy decisions, everyone has access to the internet and no-code tools abound, software can be deployed everywhere, at scale. Human productivity and wellbeing will have great potential to improve as a result.

There is still an enormous amount of upside for investors in traditional software. But the frenzied, explosive growth of the early days may well be over. Much of the low hanging fruit has been picked. The next 1,000x investments will probably not be in B2B SaaS.

It’s time for a new (ad)Venture

VC needs to go back to its roots. Peter Thiel’s Founders Fund has been banging this drum for over a decade already:

“In the late 1990s, venture portfolios began to reflect a different sort of future. Some firms still supported transformational technologies (e.g., search, mobility), but venture investing shifted away from funding transformational companies and toward companies that solved incremental problems or even fake problems (e.g., having Kozmo.com messenger Kit-Kats to the office). This model worked for a brief period, thanks to an enormous stock market bubble. Indeed, it was even economically rational for VCs to fund these ultimately worthless companies because they produced extraordinary returns – in fact, the best returns in the industry’s history. And there have been subsequent bubbles – acquisition bubbles, the secondary market, etc. – which have continued to generate excellent returns for VCs lucky enough to tap into them…

VC has ceased to be the funder of the future, and instead has become a funder of features, widgets, irrelevances.”5

Thiel has already gone against the grain very successfully on numerous occasions, backing companies like Tesla, SpaceX and Palantir in the very early days.

Packy McCormick wrote a good piece6 recently outlining his view on the future of VC. Like Founders Fund, he believes “hard startups” in new verticals will be the big winners in the next ~20 years.

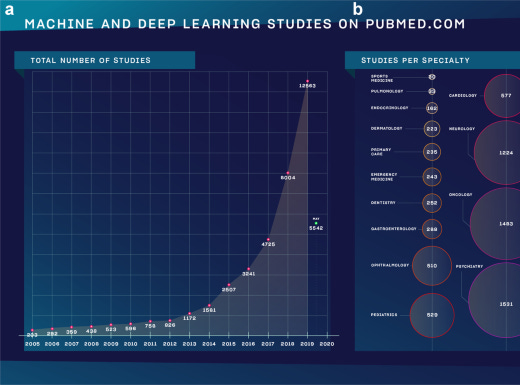

He breaks this up into tricky new software problems (“bits”) like web3, AI/ML, VR/AR, etc., and “atoms” - problems that VC’s haven’t historically focused on, which will involve leveraging advances in software, but also often involve hardware to a large extent - biotech, climate, space, defense, healthcare, transportation, manufacturing, real estate, logistics & supply chain, and similar industries.

Evan Armstrong recently wrote a fantastic review of “The Power Law”, Sebastian Mallaby’s history of VC, echoing this sentiment:

Many of us know viscerally that this is true. It’s not about ROI - it is simply clear the other stuff is both more exciting, and more necessary.

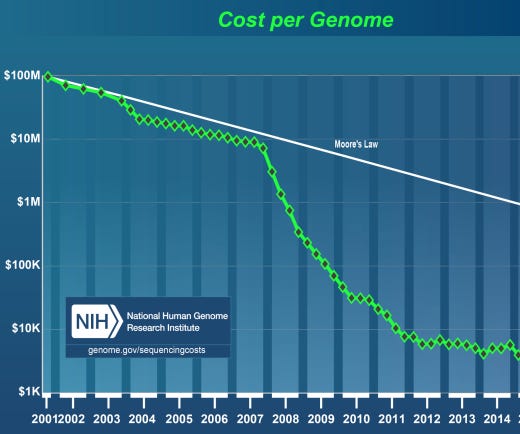

What is necessary will usually win in the end. However, market timing is also important. It feels like we are perhaps on the cusp in some industries right now. The point where biotech, medicine and AI/ML intersect is particularly exciting, and has very clear momentum:

New adventures require new heroes

Ultimately, it is very hard to know what’s next.

What I think we can be more certain of is that the next Lowercase Capital7 probably won’t focus on B2B SaaS or e-commerce.

This creates massive opportunities for new entrants. Our vision at Odin is, put simply, to build better infrastructure for this new crop of investors, and simultaneously make a massive bet on their success.

I am sure a lot of the stalwarts will make the transition to the next “irruption” of new technology. Just as they successfully shifted from funding microchip and computer manufacturers in the 70s and 80s to funding software in the 90s, the Sequoias, Bessemers and Greylocks of the world will carry on.

But many smaller firms will die out. And there will be new entrants who look very different.

These will likely be people who have already spent years, focusing on something previously overlooked, like climate science, computational biology, aerospace engineering, nuclear fusion or advanced materials.

Deep knowledge in specific sectors is likely to be a competitive edge. Things are rapidly and exponentially becoming more complex and more technical in almost every industry. It is very hard to invest successfully in complicated things that you don’t understand.

But if you do understand, there is readily available infrastructure to help you accelerate your activities.

The fastest route to success for this new crop of investors will be that of the solo capitalist.

The solo capitalist8 route will tend to follow this pattern:

Learn: absorb as much information as possible about your sector of focus, and about early stage investing;

Test: create and iterate on your investment thesis at small scale. Work for companies in your target sector, make some angel investments, maybe work at a fund focused on that sector;

Build: begin to build your own track record and your brand. Improve your dealmaking ability by launching a syndicate and investing deal by deal via SPV’s;

Scale: grow your syndicate, and then launch your first fund.

Wherever you are from stage 1 - 4, welcome to the new (ad)Venture.

We’d love to talk to you.

P.R.

🤔 and 😂 stuff

Have cars ruined cities?

An interesting thread. The car-free streets in London are some of my favourite places. It’s one of the reasons we chose Exmouth Market for our offices.

I got arrested in Kazakhstan and represented myself in court

This is from 2016, but it’s timeless.

As mad as it sounds.

Probably the iPhone’s worst-designed feature

Soon also a hit single.

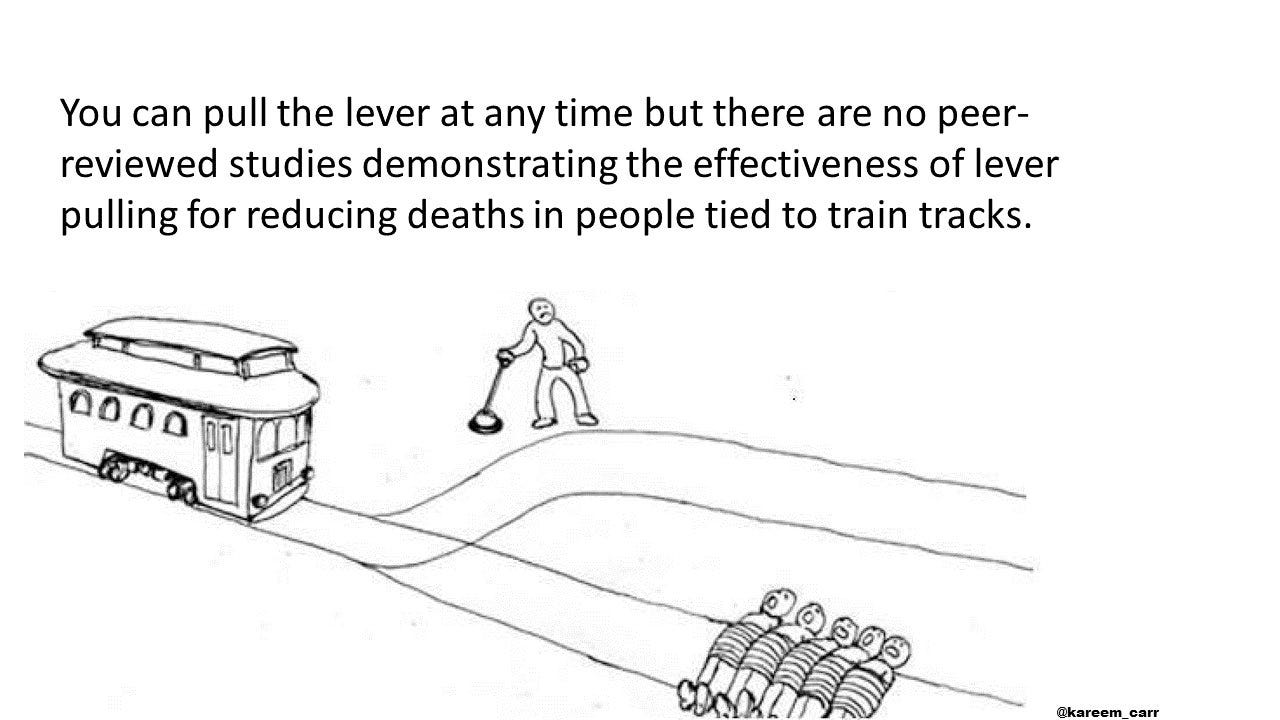

US gun policy in a meme

Welcome to the Everything Bubble - Fabrice Grinda

Debt is Coming - Alex Danco

From A Casino Economy To A New Golden Age - Carlota Perez

What happened to the future? - Founders Fund

The Good Thing About Hard Things - Packy McCormick

LowerCase Capital’s first fund is reportedly the best performing VC fund in history, with a DPI of > 500x

The Rise of the Solo Capitalists - Nikhil Basu-Trivedi