The Origins of Alpha

The Emerging Manager’s Guide to Origination

“In today’s market, you’re either a lifecycle capital partner to founders, or you’re a niche operator originating unique opportunities for those who can be. To originate deal flow, one needs some combo of unique networks, top tier reputation in a niche, or uncommon levels of investment rigor for the company stage.”

Outperformance Begins With Origination

While there is a lot of talk about “winning deals” in hot markets, the real success in venture capital typically comes from investments in unusual or overlooked sectors. You’ve got to find outliers. This is especially true for emerging managers, who lack the network, brand or AUM to compete head-to-head with other firms.

The challenge, of course, is figuring out how to find good opportunities before they become competitive. This is the art of “origination”; identifying new opportunities that are invisible or illegible to other firms, and avoiding getting into a bidding war.

“The consensus in recent literature is clear: proactive deal origination is pivotal for achieving superior outcomes in venture capital investments.”

Optimizing Venture Capital Deal Origination - Marie Claudette Garella

Importantly, “origination” differs from “picking” in that it refers to the pool of opportunities you create, rather than the ones you choose. Research demonstrates that proactive origination (as opposed to the passive harvesting of in-network dealflow) has significant influence on performance:

“Private equity and venture capital funds that employ a proactive origination strategy have consistently higher returns, driven by both greater quantity and higher relevance of incoming investment opportunities.”

Where Are the Deals? Private Equity and Venture Capital Funds’ Best Practices in Sourcing New Investments - David Teten & Chris Farmer

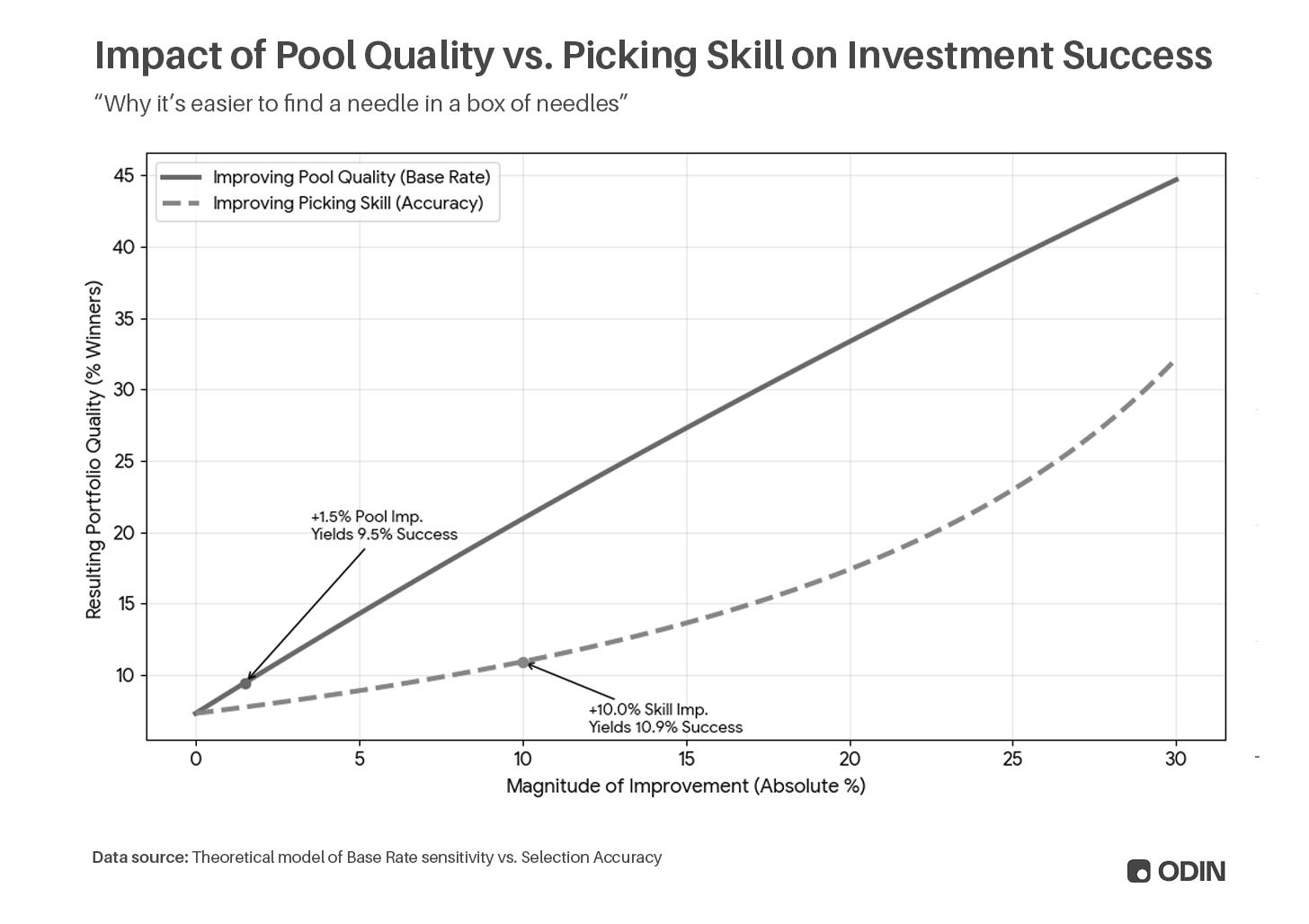

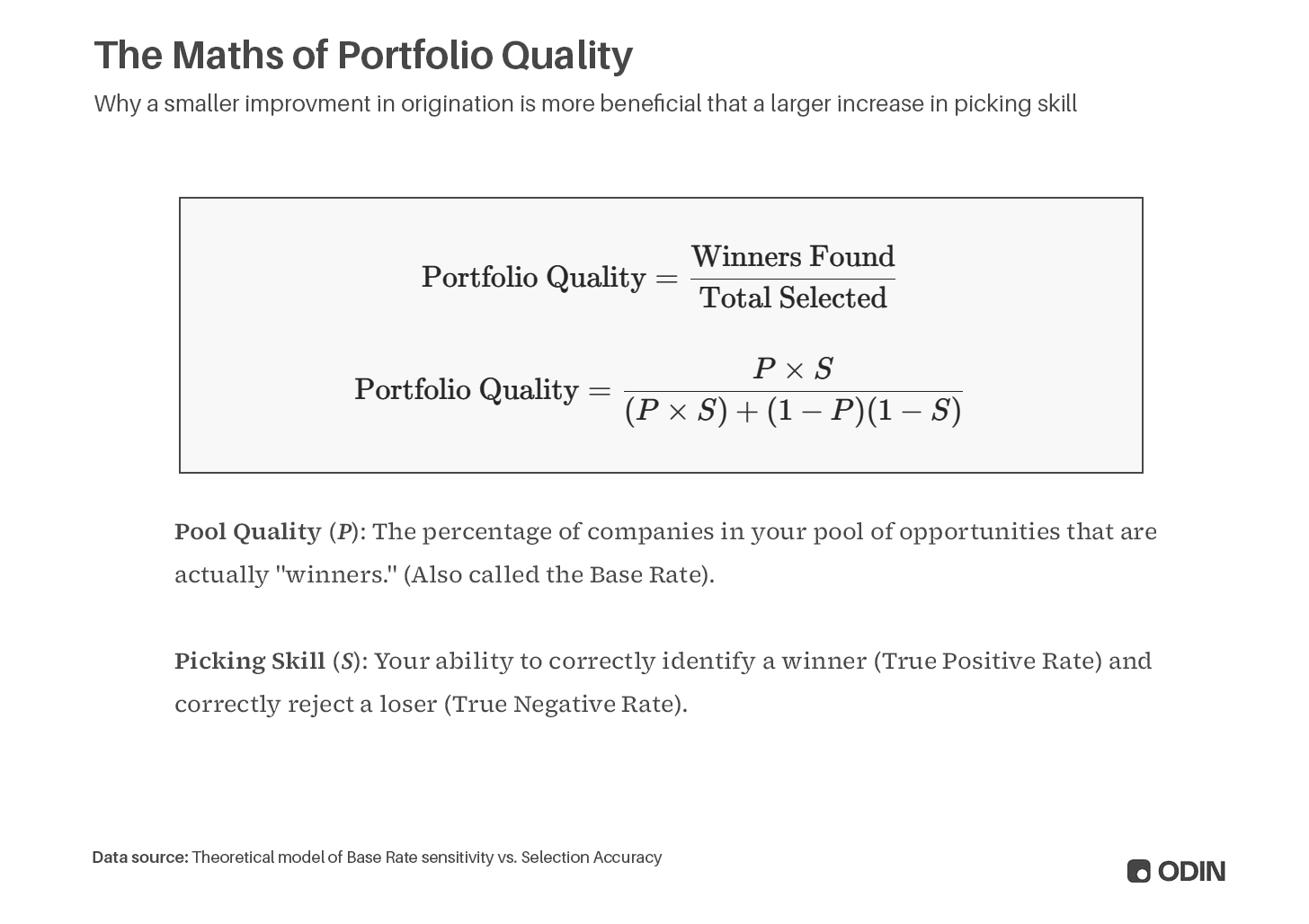

There's a mathematical explanation for this: the success rate of investments is essentially a combination of pool quality and picking skill. Pool quality acts as a ceiling or constraint - you can't pick winners that don't exist in your pool.

Thus, a small improvement in pool quality yields greater returns than a much larger improvement in picking skill, as picking skill compounds on pool quality to produce alpha.

Put another way, your ability to pick well only matters if there are good options to pick from.

The x-axis represents the effort/improvement you make (e.g., +5%, +10%). The y-axis represents the quality of your final portfolio (the percentage of winners you end up holding).

Notice how the solid line (Pool Quality) shoots up rapidly, while the dashed line (Picking Skill) grows much more slowly.

A mere 1.5% improvement in the quality of the pool raises your portfolio’s success rate to roughly 9%.

A massive 10% improvement in your picking skill only raises your portfolio’s success rate to roughly 7%.

You would need to become drastically better at picking stocks to match the benefit of simply finding a slightly better list of stocks to start with.

As Charlie Songhurst put it, in this episode of Invest Like the Best:

Trying to be smarter than other people is very hard and it doesn’t work very often. Trying to have an insight that you get because you sit in a different information flow just seems exponentially easier.

This phenomenon is grounded in Bayes’ Theorem and the concept of the Base Rate.

Despite this, the competitive concepts of “picking” and “winning” absorb a huge amount of attention in VC. Everyone is keen to beat their chests about deals they “picked” or “won”.

Origination, meanwhile, is relatively overlooked. Short-sighted venture capital firms will throw their cold-inbound flow to a junior associate, or focus on attending events which are primarily attended by other investors instead of finding new opportunities in new places.

The Odin Times is brought to you by Odin. We let anyone, anywhere launch and run a private investment firm online, and work with over 10,000 VCs, angels and founders globally.

Go-to-Market for Venture Capital

There’s endless advice aimed at helping founders grapple with go-to-market strategy; novel solutions require creative ways to identify and convert target customers. It goes without saying that this is a critical skill for entrepreneurs.

But what about investors?

The equivalent of go-to-market for venture capital is origination: identifying the type of founder a firm is looking to back (encompassing everything from founder attributes to stage, region and industry), and understanding where can they be found in the greatest concentration.

The exact answer is unique to a firm’s strategy, but it usually falls into one of two broad categories:

Networking via in-person events & targeted outbound

Brand-building and cold-inbound

Essentially, the founders that firm can go out and find, and the founders it can attract into the funnel. In a sales context, these might be described as “hunting” and “trapping”. There’s also “farming”, which (in the venture capital context) would be nurturing existing portfolio companies to tap into their networks, secure the subsequent rounds of repeat founders, and generate referrals.

Typically, small firms tend to specialise in finding founders, as they don’t have the same media footprint or brand strength for a large deal funnel. Larger firms, on the other hand, can leverage their scale to attract more founders into the funnel simply through notoriety and the signal associated with their brand. Both also tend to focus on nurturing their community of portfolio companies, albeit with different approaches: small firms focused on specialised support, while larger firms build comprehensive platform teams.

In this article, we’re mostly focusing on the strategy of smaller firms and the need to build proactive origination strategies rather than the brute-force strategies of larger firms.

Searching for Signal

While venture capitalists spend a lot of time talking about the founders they invest in, and the traits they tend to see in those founders, they spend relatively little time on the specifics of how they find those people in the first place.

For the purpose of illustration, here are two example strategies:

Find People, Not Companies

You don’t need to worry about competing for deals or finding promising startups if you’ve built a community of brilliant young future-founders. This might involve running events with universities and schools, or extra-curricular activities for young people interested in technology or entrepreneurship.

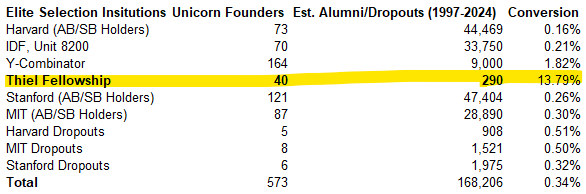

An excellent example of this is the Thiel Fellowship, which offered qualifying candidates (younger than 22, no degree) $100,000 over two years to pursue their ambition. The result was an unprecedented rate of success, with 13.79% of the fellows going on to create unicorn companies — including Figma, Ethereum and Plaid.

This is an insane hit rate when you compare it to other elite institutions. It’s almost an order of magnitude better than the runner up, Y Combinator:

Of course, the Thiel Fellowship is not a venture capital firm, and the structure and incentives aren’t the same. It is also hard to replicate “the Prophet’s” unique wisdom & eye for talent.

However, these principles have continued in 1517 Fund, a firm created by Michael Gibson and Danielle Strachman who previously managed the fellowship. In addition to events for young adults, 1517 Fund also runs a grant program called Medici, offering $1,000 to bright young minds with big ideas.

“It’s really a relationship over time. So a lot of times when we’re writing a check, we’ve already known the founder sometimes for months or sometimes for years. We might meet them through our grant program that we run. And then they might come back later and say ‘Hey, I’m starting to build something in the startup realm’. And we’re like, oh, we’ve seen this person execute before. We’ve seen how they work with other people. They’ve sent us quarterly updates on what they’re up to.”

Identifying genuine human potential might be the most deeply qualitative and tricky part of a venture capitalist’s role, but if you can crack the code it appears to provide a significant edge. In the case of 1517 Fund, and the Thiel Fellowship, that edge may be related to Michael and Danielle’s background in philosophy and education.

Find Ideas, Not Companies

Another way you can avoid having to compete for access is by identifying the future opportunities ahead of everyone else. Indeed, with hindsight many of the technology shifts that ended up producing immense value in venture-backed startups were the subject of discussion in academic circles or hacker communities far in advance.

A good example of this strategy is the research-oriented firm, Compound. By guzzling a firehose of academic work, and learning to distinguish noise from signal, Compound has been ahead of the curve on a number of trends — including voice models (Deeepgram, 2016), autonomous driving (Wayve, 2017) and world models (Runway, 2018).

“[Ulkar Aghayeva] wrote a piece called [Waking up science’s sleeping beauties], and the idea is very similar to something that we talk about, which is that major scientific breakthroughs sit out in the world for a long time. [...] And so a simple thing I tell people who get interested in trying to do more thesis-oriented research is like, if you find a paper that you think is really interesting, you should set citation alerts and get an email anytime anyone cites that paper. You will get to see as more and more people start citing it. [...] That will tell you a bunch of people who are ostensibly smarter than you are starting to care about a thing and are spending material amounts of time writing and talking about that thing. And so I think we have a bunch of signals like that in the same way that a lot of great VCs, you know, believe they have signals on how to tell if a founder is amazing.”

That’s not to say that Compound isn’t focused on founders, just that their path to finding founders is very different. Instead of following great founders towards the interesting places to build, Compound looks to understand those interesting places first and then meet the founders there.

Right Place, Right Time

Both of the strategies outlined above share a recognition of the importance of timing. Research tells us that success in VC is significantly connected to being in the right place, at the right time due to the cyclical nature of technology investment.

For example, had you raised a fund for internet companies in 1995, or SaaS in 2010, you’d have been likely to outperform based on the nascent opportunity. On the other hand, funds raised in 1998 or 2018 generally had a much harder time, and significantly worse returns. They arrived to find a flood of capital, and the current carried them over the cliff.

Implicitly, the best thing you can do is to optimise your origination strategy around being in the right place, at the right time. You can do that by following the journey of talented young technologists, like 1517 Fund, or you can do it by following the science, like Compound. Both offer a compelling approach to identifying genuine opportunity ahead of market momentum.

To repeat an earlier point, these are just two examples of a particular belief executed in a particular manner. The opportunity to formulate a strategy matching your own thesis and market is vast. There’s a huge amount of alpha left on the table by venture capital firms that stick to the typical playbook - there are many, many more unusual ways to run origination than these two examples.

Origination Tools

In addition to bespoke strategies that involve finding founders out in the wild, there’s a growing list of tools that venture capitalists can use to find opportunities. Historical examples include Crunchbase or F6S, where investors can search through a database of opportunities, filtering by features like industry, stage or location. Of course, this biases towards slightly older companies, and it also means your edge becomes how you filter a pool that everyone else can access.

Newer AI powered tools also claim to help venture capitalists find deals. It’s worth noting the three likely outcomes of these tools:

Least likely - they make it easier to find great investments. They tend to magnify investor attention and push prices up in a way that will erode any advantage created by the tool; also known as “alpha decay”.

More likely - they make it easier to filter the total pool of companies (and/or people) on the platform, which allows investors to find opportunities that fit a narrow thesis more easily. In this case, these tools will help generate alpha.

Most likely - they land somewhere in the middle, and end up without much measurable influence on venture capital outcomes. At the early stage, the greatest outliers will still be more easily identified by investors with a unique thesis, reflected in how they approach origination.

Curating Cold Inbound

While the volume of cold inbound (pitches submitted without any existing relationship) is unlikely to be a problem for emerging managers, it may become a burden if the firm has a well-known founder or a particular investment catalyses a lot of interest in the firm. Certainly, with time and with success, the firm’s inbox (and those of the partners) will require an increasing level of attention.

“VCs are obsessed with the idea of gaining ‘proprietary dealflow,’ yet reject some of the most easily implementable methods to expand and diversify dealflow pipelines. They argue that cold inbound is definitionally non-proprietary because everyone sees non-networked companies. That’s clearly not the case since most funds don’t accept cold inbound and therefore don’t “see” anything in that domain. Most importantly, their argument fails to conceptualize inbound dealflow sourcing and filtering processes as themselves powerful fund differentiators and branding opportunities.”

As mentioned earlier, a common mistake is to throw the problem at junior team members who haven’t been properly trained. Instead of looking for potential outliers, they are more likely to seek simple patterns and prioritise hot industries and well-credentialled founders. Often, in trying to select deals that are likely to get partner approval (seen as “success” in screening) they will over-index on recent deals the firm has made.

Recognising value in an inbox of pitches is neither easy nor fun, but there’s a lot to be said for partners pitching in and doing the work. They will most efficiently be able to pick out opportunities, applying what they have (hopefully) learned about managing the various biases involved in investment decisions. Much may be learned from Y Combinator’s screening process, which limits the information that partners consume to a single one-pager, expediting the process and focusing their attention on meaningful factors.

Once you have a well-designed approach to finding alpha in your inbox, by systematically improving the signal-to-noise ratio, you can consider options that scale the exposure of your firm to founders in your thesis. Ideally, the value you get from cold inbound always scales with the volume of interest.

Constraints Breed Creativity

In theory, the highest-performing venture capital investor would see the entire market and be able to select the best opportunities within it. Unfortunately, “picking” is significantly overstated as a persistent skill in venture capital, and it’s only possible to see a small fraction of the available deals at any time.

Thus, origination is the art of setting productive constraints on your firm. How can you focus your attention in a way that improves the aggregate quality of opportunities while also preserving outliers? Essentially, you must optimise for quality without accidentally overweighting moderately-risky companies with middling potential.

As portfolio construction recognises the inability of venture capitalists to pick winners consistently, origination recognises that they would drown in a sea of unfiltered opportunity. Designing processes and systems that enable more consistent outcomes (and learning from mistakes) is the key to surviving in a world where only 10% of firms make it to a fourth fund.

DG

Best of the Internet

Cancer cures Alzheimers

Full article at Nature.com

The political compass according to people in each quadrant

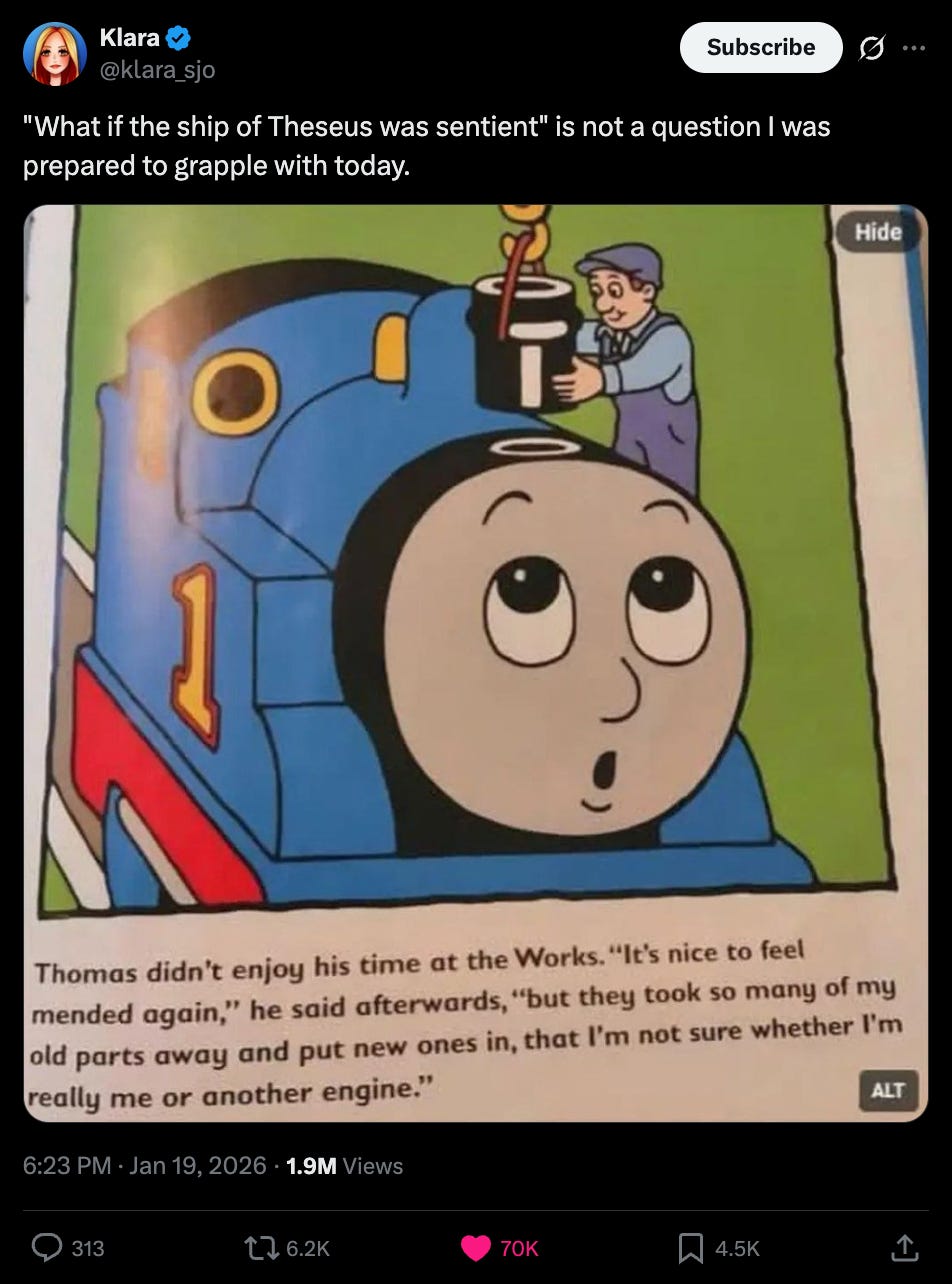

Light Reading for Kids

Get Rid of the Golden Snitch

He’s kind of got a point when you think about it.

Thank you for reading!

If you need global, multi-currency SPVs (US and UK options) or a better, more digital fund admin, get in touch.

Thank you for this thorough deep dive, I will share it with people in my network.

Two things where I'm still not convinced, after reading it -

"Small" improvement in deal flow generates better outcomes than "big" improvement in "picking" skills.

Even from the math equation you have provided, it seems both are equally important.

I do agree it is often less talked about.

And, in general, I do feel "origination" deserves more space and attention.

Second thing, based on what criteria was this concluded: "Most likely - they land somewhere in the middle, and end up without much measurable influence on venture capital outcomes. At the early stage, the greatest outliers will still be more easily identified by investors with a unique thesis, reflected in how they approach origination."?

Once again, thank you for the article, a good read indeed.