Too Big to Succeed

Emerging Managers in Venture Capital are underfunded. They deliver better financial results and are also important drivers of human progress

“The single best opportunity in venture capital today is investing in operators’ funds that are small in size, have differentiated access, and exercise independent judgement. I’d bet this cohort of managers will outperform 90%+ of traditional VC’s with billions in AUM.”

- Ankur Nagpal, Founder of Carry

You might assume that venture capitalists broadly improve their performance over time, alongside growing experience, brand and network. Each of these factors, in theory, allow investors to make better investment decisions based on a higher quality pool of opportunities, and produce stronger returns.

While this is true for some, it doesn’t appear to be a general rule. In fact, venture capital has notoriously weak “persistence”; the performance of one fund isn’t necessarily predictive of success with a subsequent fund.

The silver lining is that emerging managers (funds 1-3) have remained an attractive part of the market, with above-average performance and LP-friendly terms. Thus, LPs benefit from access to great firms before allocation becomes competitive, and the market enjoys the healthy competition created by new entrants.

Despite this, the emerging manager opportunity remains overlooked and underfunded, as LPs have retreated to the safety of “established” brands.

The Urgent Demand for New Ideas

“The biggest risk in early-stage investing is likely the ongoing difficulty for emerging managers to raise new funds. While multistage managers may boost their activity, and AI will keep channeling more money into VC, emerging managers invest in many companies both inside and, importantly, outside major capital hubs.”

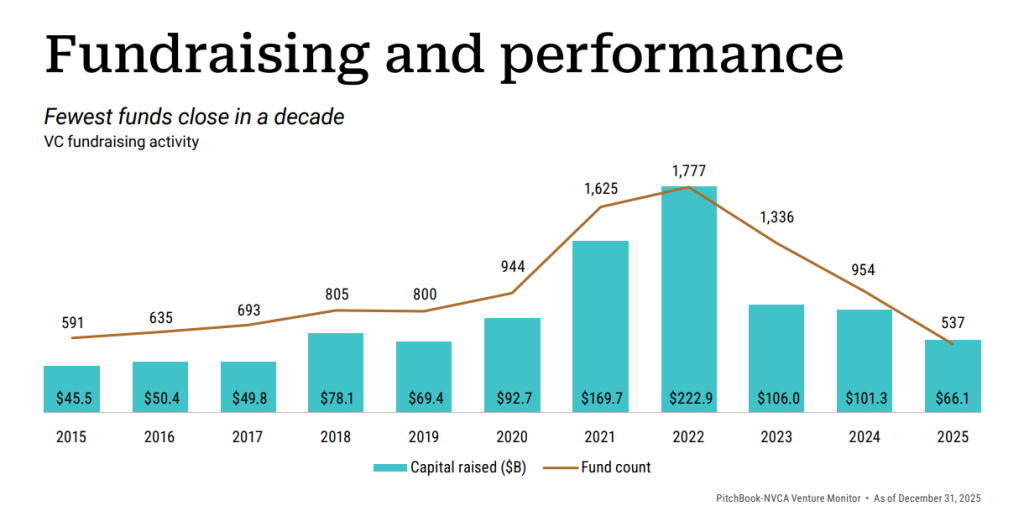

It’s no secret that the last few years has been brutal for smaller firms, and particularly for those without a meaningful track record to show prospective LPs. Data from PitchBook shows first-time funds in the US raising a total of $7B in 2024, and $6.6B in 2025, compared to $15B raised by Andreessen Horowitz alone.

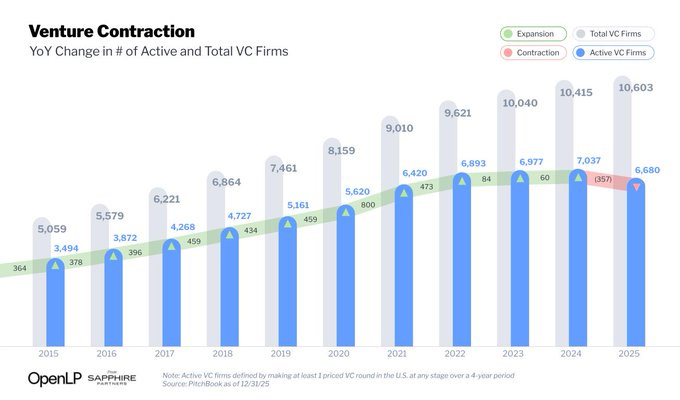

Indeed, according to analysis by Sapphire Partners, 2025 is the first year since the dotcom bubble burst that there has been a net decrease in the number of active VC firms.

Active firms are categorised as those that have made a single equity investment in the previous four years (in order to give time for SAFEs to convert to equity rounds). It seems virtually certain that this will fall further next year, in line with the continued decline in funds being raised in recent years.

The venture capital industry is dependent on a steady stream of new firms entering the market, both to ensure a competitive environment with options for LPs, but also because emerging managers tend to offer differentiated investing and an appetite for the newer and more idiosyncratic ideas that are the fuel of the innovation economy.

The Odin Times is brought to you by Odin.

We let anyone, anywhere launch and run a private investment firm online, and work with over 10,000 VCs, angels and founders globally.

You can launch an SPV or fund vehicle in less than a day.

Quantifying Outperformance

What’s notable about emerging manager performance is not that it significantly beats the market average (the difference is fairly marginal) but rather how consistently the outperformance occurs across datasets from institutional LPs and market data aggregators.

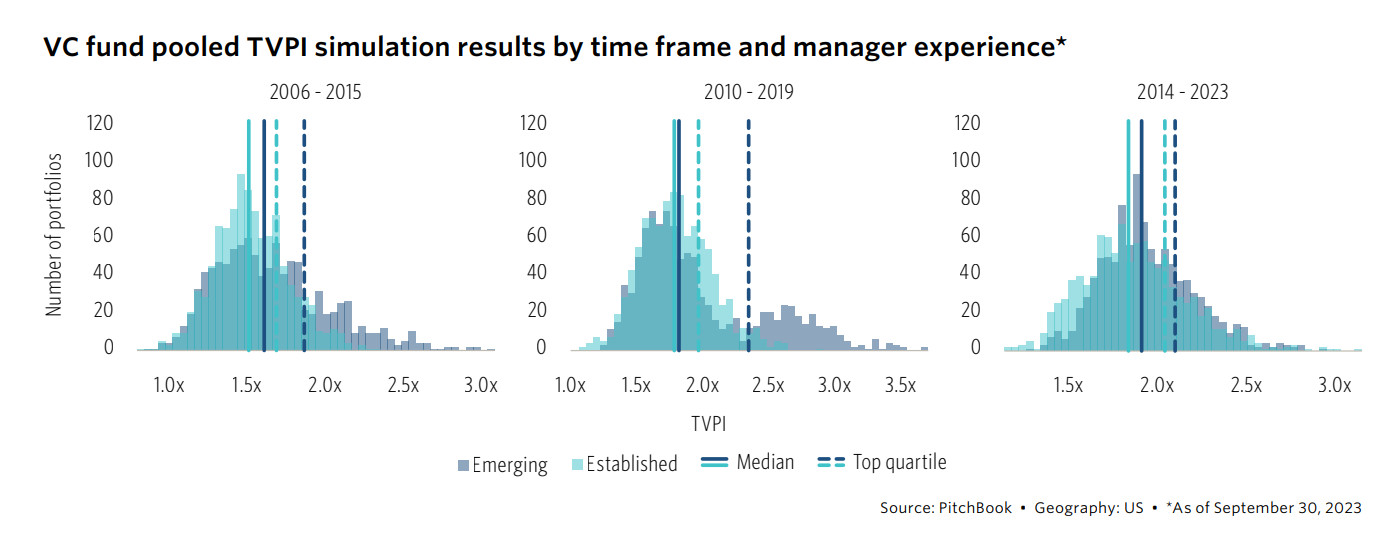

“In our simulation, between 2010 and 2019, if a dollar was contributed to only funds run by an emerging manager, LPs had a better chance of getting a higher return.”

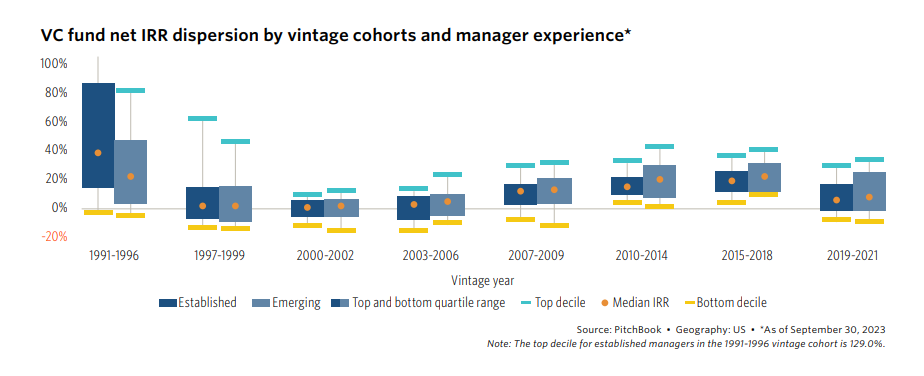

Pitchbook’s examination of four different strategies (buyout, real estate, private debt, venture capital) found that emerging manager performance was generally attractive, particularly in venture capital. Unsurprisingly, they found that this outperformance was combined with a wider dispersion (worse underperformance, greater outperformance), as untested managers deliver broadly improved median and top quartile performance with greater volatility.

“In our experience investing across approximately 180 partnerships, emerging managers have outperformed relative to their established counterparts.”

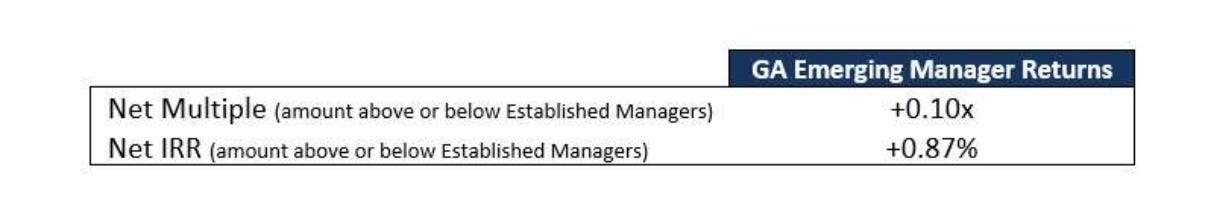

Data on 180+ partnerships from Greenspring Associates, a venture capital firm with an LP strategy, also found outperformance in their emerging manager portfolio. The difference was small (+0.87% in net IRR), but again contrasts the expectation that more established managers ought to outperform.

Indeed, Greenspring Associates warn specifically about “the decay of brand”, with the reputation of a firm being tied to the past - echoing the common investing maxim, “past performance is not indicative of future results”.

(Greenspring Associates defines emerging managers as firms with one or two funds, rather than the common definition of one to three funds.)

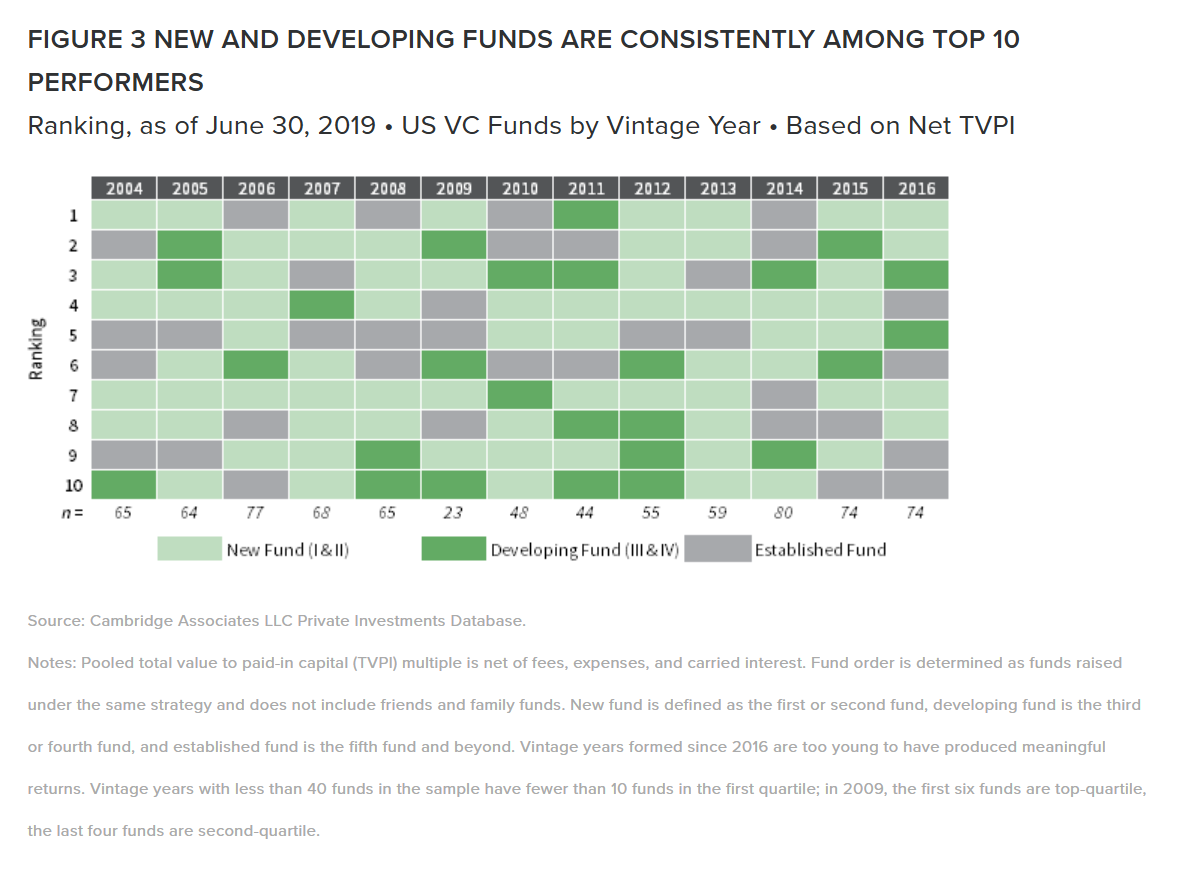

“Top returns are not confined to a few dozen companies. As Figure 3 shows, new and developing fund managers consistently rank as some of the best performers.”

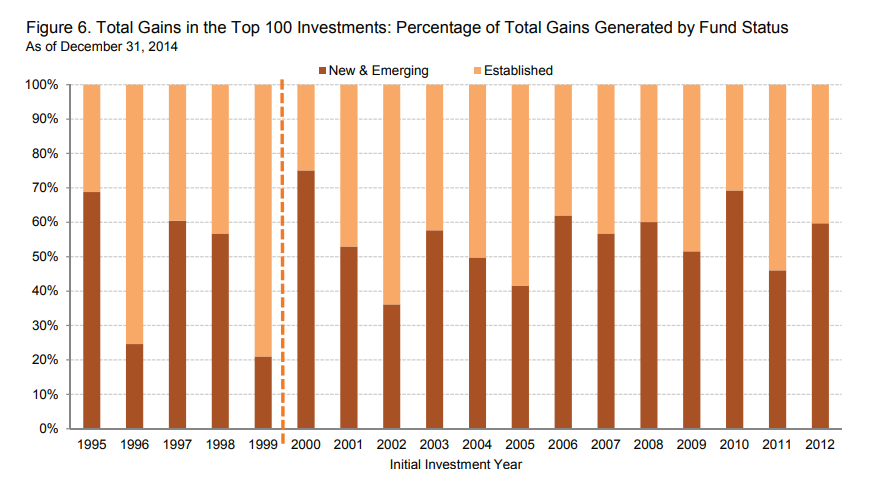

Cambridge Associates data reinforces the case for allocation to emerging managers. Their research examines the top outcomes each year (rather than median or top quartile IRR) and the percentage of total value generation.

One key finding: the idea of concentration of returns in a small group of VC funds is a myth. It belongs to the pre-dotcom era. There are more meaningful exits nowadays, and there has been an increase in the number of firms involved in those exits vs. the 90s.

“For the last 10 years, 40%–70% of total gains were claimed by new and emerging managers, a clear signal to investors to maintain more constant exposure to this cohort”

(Cambridge Associates uses the definition of “new and developing/emerging” managers as firms with one to four funds, rather than the common definition of one to three funds.)

Why Emerging Managers Outperform

The data is compelling, but what explains it? There are a number of reasons why emerging managers might outperform their established peers:

Scale

Emerging managers are likely to raise small funds ($10M-30M), rather than incumbents who leverage their track record to raise larger funds ($100M+). Fundamentally, it is easier to deliver larger multiples on smaller amounts of capital, giving these emerging managers a mathematical advantage.

Compensation

Another consequence of fund size is the balance of compensation incentives. While larger funds may drive more fee based motivation (focusing on the guaranteed 2% management fees), smaller funds are more incentivised by the 20% carry (focusing on the profit share from successful investments). This creates stronger alignment with finding good exits and efficient returns, rather than scaling and accelerating capital deployment.

Proximity

Emerging managers often raise a fund to address a particular opportunity they have identified, perhaps based on professional experience or angel investments, indicating some ‘edge’ over the market. Established investors, on the other hand, have moved further away from their background or original theses and often develop ‘strategy drift’.

Focus

Established firms, with larger teams and more staff in adjacent functions, simply have more to worry about. Emerging managers (particularly solo GPs and small partnerships with a solid backoffice solution) may be more focused on investing. This is comparable to the advantage that startups have over incumbents, making the most of their size to be nimble and responsive.

Value

It’s often assumed (outside of “spintout GPs” from larger firms) that emerging managers don’t have the network to access “hot” deals, so LPs are happy for them to pursue experimental strategies and novel theses. By targeting less competitive parts of the venture market, emerging managers end up making investments with stronger economics. They avoid the trap of “Money chasing deals” (their proximity to a specific opportunity space also helps here).

Weathering Colder Markets

“We observed the widest gap between median IRRs in the 2010-2014 group (4.5%). During this period, the private market gradually emerged and recovered from a financial meltdown. During and shortly after the GFC, there was a pullback in LP commitments to venture. [...] Our simulation results suggest that emerging managers that secured LP commitments during this harsh fundraising climate outperformed by investing in nascent, high-quality startups with fund structures that ensured the winners had a disproportionate amount of impact on the overall fund return.”

- Pitchbook Analyst Note: Establishing a Case for Emerging Managers

Another point in favour of emerging managers is the extent to which their performance is less correlated to the wider fundraising market and macroeconomic concerns. The target of their investment, early-stage companies building specialised solutions, aren’t large enough to be impacted by market fluctuations or more challenging exit conditions.

Indeed, the analysis from Pitchbook suggests that emerging managers offer an effective hedge against systematic risks in venture capital. This aligns with research that shows that “centrally located” firms (i.e. well networked incumbents) see a temporary performance edge in hot markets where gaining access to competitive deals is potentially more valuable. However, in cooler markets this “central location” becomes a negative, as consensus related deals are at risk of collapsing in value when this systematic risk blows up.

Options on Outperformance

Overall, there’s a substantial amount of data supporting the potential of emerging manager performance, and they serve a clear strategic role in LPs’ allocation strategy.

First, by providing a hedge against market-related headwinds that tend to have more influence on larger firms. Backing early-stage firms solves part of this problem, but truly unenmeshed emerging managers are the main source of alpha in venture capital.

Second, for the same reason that VCs like to invest early, you are effectively buying a call option on future potential. If you skip the first fund, and the performance is impressive, you’ll have a much harder time getting access to the second fund.

It’s also clearly critical, for anyone in venture capital, that the “base” is well funded. Emerging managers exist primarily to make sure that capital is distributed to opportunities across all industries and markets.

The coverage they provide, combined with an appetite for idiosyncrasy, helps create a fertile environment for innovation, for the testing and refinement of ideas, for the development of new platforms and - in some cases - new industries. Without this, the whole downstream funding ecosystem will compete over a smaller pool of opportunity, and humanity will be worse off.

Emerging manager or LP? Get in touch