Y Combinator: Progress Machine (1/2)

The chance to invest in YC's S22 batch, and an analysis of the firm's success.

Hi folks, Patrick Ryan here from Odin. We are building a better way for people to invest together.

We are partnering with Fundament, an incubator and angel syndicate led by Jeremy Hindle, to offer the Odin network the opportunity to invest in 10 selected companies from the Y Combinator Summer 2022 (S22) batch.

More details available via the application link above.

Y Combinator is the most successful startup accelerator in the world.

They were the first investors in Airbnb, Coinbase, Stripe, Instacart, Reddit, DoorDash, Dropbox, Ginkgo Bioworks, OpenSea, Deel, Brex, Scale AI and numerous other unicorns.

To date, at least 68 companies from YC have gone on to be valued at over a billion dollars (probably closer to 90 now).1

The current list of their 271 “top companies”2 (criteria: recent valuation of > $150m) has a combined official value of at least $600B (but probably closer to $900B).

With a total portfolio of 3,860 companies at the time of publication, YC has an average value per startup of ~$233m. The unicorn hit rate in each batch that YC accelerates is ~5%.3

This piece of writing is split into two parts:

The data on the incredible outlier performance of YC’s portfolio.

The factors that make YC a “progress machine” with the potential to do much more than simply drive financial returns.

Today (surprisingly) we will focus on part 1.

Background

I’m not going to deep dive on the full history of YC - you can read Paul Graham’s own account here.

But in short, in 2005 three exited founders and one of their wives decided early stage VC sucked and they were going to fix it. They resolved to start a new type of VC firm. It would make more, smaller investments, invest super early, and back young hackers, not suits.

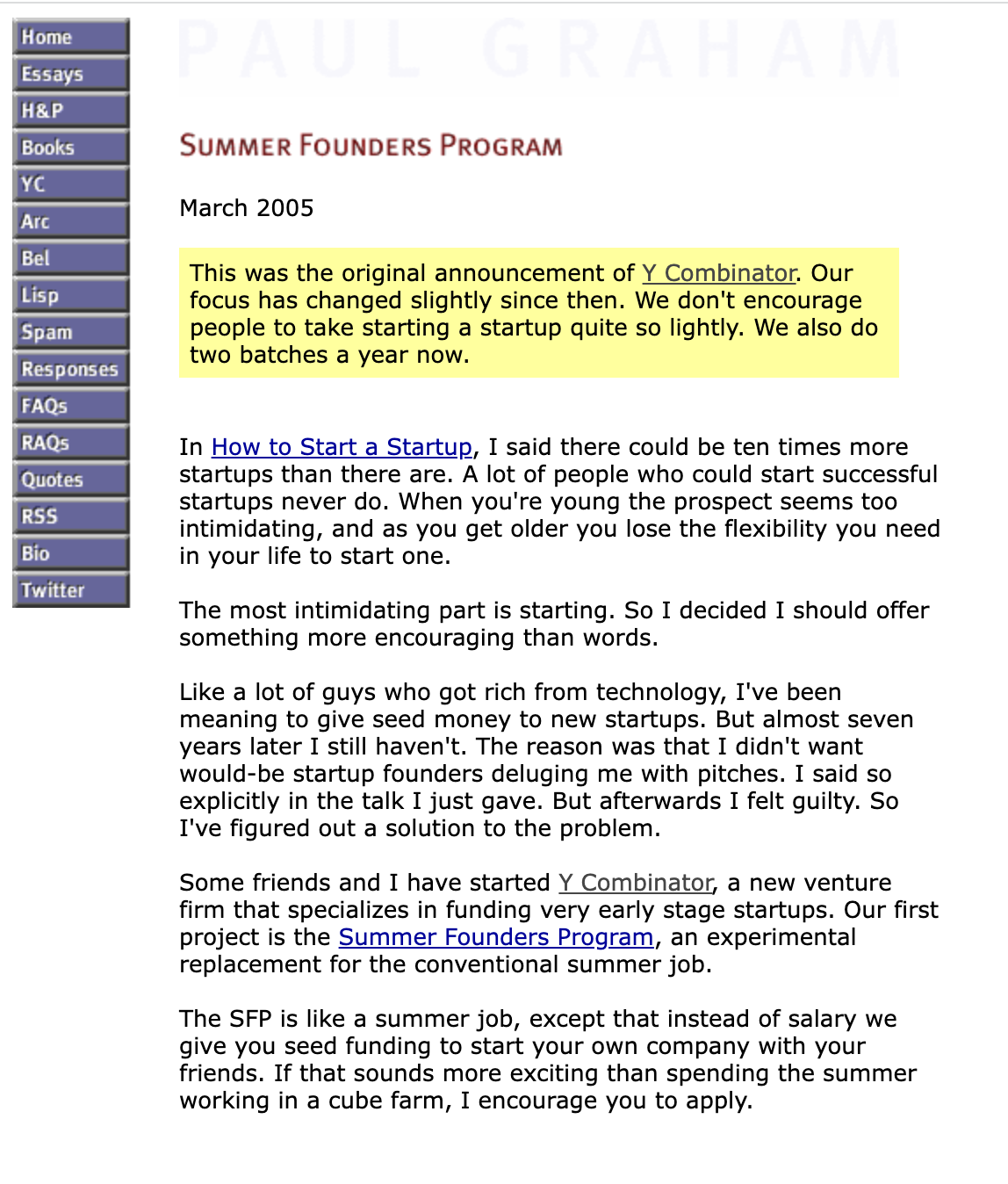

Here’s the very first advert for YC 2005, from PG’s blog:

Fast forward 17 years.

My napkin calculations estimate YC’s DPI (distributed to paid in capital ratio) for their 2005 - 2013 vintages at ~320x.

That’s a 31,900% portfolio / fund—level return. In cash terms, they turned ~$11.2m of invested capital into ~$3.6B.

Short of PG telling me the exact number, this is guesswork. But there is decent data out there to base these estimates on.

Here’s how I got to there:

Running the Numbers

Over the years the Y Combinator deal has evolved, but they’ve always tended to take a 6 - 7% stake.

In their very first batch, they invested ~$20,000 per company. It stayed this way until 2014, when it was increased to $120k.

From 2011 - 2014, various VC’s (Yuri Milner, Khosla) automatically invested in every company in YC batches, but YC still got their 6-7% for ~$20k during that time.

So until 2013, their entry price was very low. It has varied since then, and is now $125k for 7%, plus an additional $375k in the next round, on “most favoured nation” (MFN) terms (i.e. at the best valuation possible).

We’ll ignore the question of pro-rata / follow-on for the purposes of simplicity in this analysis. YC do follow their investments now, but they didn’t used to.

By the time a company gets to exit, you can expect a dilution of about ⅔ on average.4

If we were to assume that YC therefore owned ~2.2% on average of every company it had ever backed, and imagined they had never sold any of their holdings, they’d be sitting on ~$19 Billion in NAV (net asset value) today.

As of writing, that would be from a total of ~$438 million in capital deployed, so their portfolio would be up about 43x overall, over a 17 year period, even though 80% of the cash has been deployed in just the last 5 years.

Now, of course we should assume that they partially or wholly liquidated a lot of their holdings before they reached this NAV (via M&A, shortly after IPO, or maybe in late stage secondaries).

Even if we assume the total value for their equity plus cash from exits is ~2x less, at ~$9.5B, they’d still be up about 21x overall. This would still put them in the top 1% of VC’s, according to data from Cambridge associates.5

But that’s the low end estimate.

Crunchbase ran the numbers on some of YC’s big exits in 20206. I’ve added data for 2021, giving us a clearer idea of how their first vintages (investments from 2005 - ~2013) fared.

Crunchbase conservatively estimated the cash generated by exits in 2020 alone as between $1B and $2B, mainly from two companies: AirBnB and Doordash.

That means the return on those two investments was ~25,000x to ~50,000x (2.5 - 5 million percent, a number so large it doesn’t really compute).

If we add in the previous M&A activity with disclosed valuations (only a small percentage of total exits, which were mostly for undisclosed sums) and take the middling case, YCombinator delivered about $1.7B in cash by 2020 across all exits.

Now let’s add their TEN public offerings (via IPO’s and SPACs) in 2021. In brackets, you can see the average market cap around the time the company went public (or shortly after):

Coinbase (~$60B)

Gitlab (~$15B)

Gingko Bioworks (~$15B)

Amplitude (~$6B)

Matterport (~$5B)

Embark Trucks ($3.7B)

Weave (~$1.2B)

Pardes Biosciences (~$0.85B)

Momentus Space ($0.8B)

Lucira Health (~$0.38B)

If they sold recently after all of these companies went public, then their ~2.2% stake would be worth ~$2.4B.

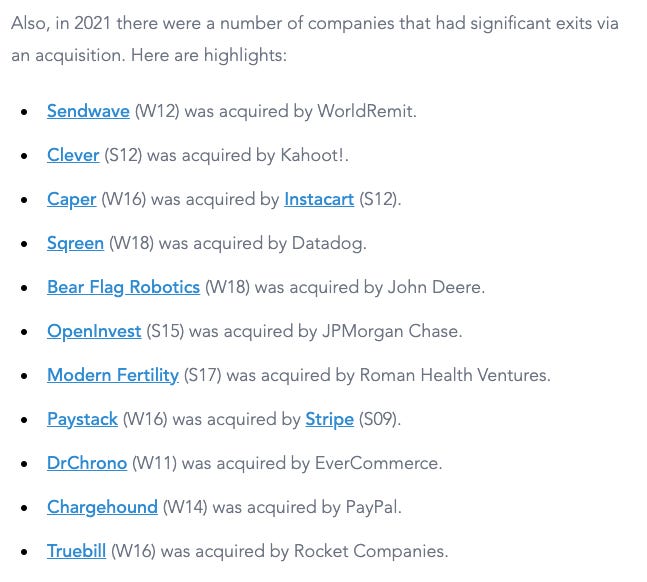

That’s $4.1B IN CASH that YC has generated in the last two years, and we aren’t counting any of the numerous private acquisitions7 they had in 2021:

90% of this value (~3.6B) was generated on investments made prior to 2013. Between 2005 and 2013 YC only deployed ~$11.2m, so they generated very roughly a 320x cash on cash return on capital deployed. That’s DPI, not TVPI.

That’s ~242x - 320x better than the average DPI delivered by a VC in the USA over that time period (1 - 1.32x), according to data from Cambridge Associates.8

They achieved all of this in a 15 year total holding period for the 2005 - 2013 portfolio, with three quarters of the capital deployed from 2010 onwards.

So their IRR for that time period was absolutely through the roof (probably 90% or more IRR for 10 consecutive years).

The Blueprints of Success

How has an organisation so small in relative terms - even today, they list < 100 employees on their site - created so much value over such a short period of time?

There are countless factors.

If you trawl through writing from YC’s founders, partners and alumni, as well as pieces of research from VCs, journalists and bloggers, five key ideas emerge:

Curation

Focus

The Power of Networks

Luck & timing

Heresy

In my next post, we will explore them in more detail.

P.R.

Risk Warning

Investing in start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. Odin is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via Odin once you are registered as sufficiently sophisticated. This content is for informational purposes only and should not be considered investment advice.

Join Odin Limited is an appointed representative of Aldgate Advisors Limited, which is authorised and regulated by the Financial Conduct Authority (No. 763187).