Y Combinator: Progress Machine (2/2)

The chance to invest in YC's S22 batch, and part 2 of my analysis of the organisation's success.

Hi folks, Patrick Ryan here from Odin. We build tools for people to invest together in startups and funds.

We are partnering with Fundament, an incubator and angel syndicate led by Jeremy Hindle, to offer the Odin network the opportunity to invest in 10 - 15 selected companies from the Y Combinator Summer 2022 (S22) batch.

More details available via the application link above.

Last Wednesday, I broke down the data that indicates Y Combinator turned ~$11.2m of invested capital into ~$3.6B.*

Today, I’m going to delve into five factors that have helped drive this success.

Here’s the tl;dr:

Curation: YC is very selective. Everyone they work with is incredibly smart and ambitious.

Focus: the YC program helps founders to focus on what matters (their customers and growing quickly).

The Power of Networks: YC becomes more valuable to its alumni as it grows, and more attractive to new founders as well. It is able to drive faster product adoption for companies it backs, channel more capital to its founders and also helps them to lock out competitors. The size and strength of its network makes it probably the most powerful company in Silicon Valley.

Luck and timing: some of the key things that have made YC successful were accidents. They also made many of their best investments in a unique time window, at the start of one of the longest bull runs in history. We may not see such a long bull run again for a while.

Heresy: many of YC’s investment strategies - indexing, “black swan farming”, and education - are pretty unusual for a venture firm. This contrarianism has worked in their favour.

I conclude by asking a simple question - what’s next for Y Combinator?

As you’ll see, I think it may still be very early days for the progress machine.

*Note: Some people have made fair points about IPO lockup periods and the fact that MOIC would be a more accurate word to use here than DPI (since I didn’t account for overheads).

Perhaps my calculations are also a little optimistic - but the fact remains - YC has done some crazy numbers.

1. Curation

Y Combinator has roughly a 1.5% - 3% acceptance rate for the 10,000 or so applications they now receive for each batch.

By keeping standards incredibly high, they keep their hit rate high and their brand strong.

In recent years, some have argued that YC’s seal of approval has lost its shine - quality, they feel, has decreased as batch sizes have increased. It is interesting to note the drop in the batch size from S21 (390) to S22 (205).

The firm has stated that this is a response to market conditions - but it may well be that they are seeking to protect their most coveted asset - their value as a curator.

2. Focus

“It’s simply a result of the age-old equation: smart people + focus = good things. YC can’t make you smart, but it can, and does, teach you to focus solely on the metrics that are going to make you successful as an organization.” - Oleg Rogynskyy, CEO of People.ai (YC S16)1

The education piece of Y Combinator is actually relatively hands off. You get a few hours a week of dinners and face time with partners. The guidance founders get from partners usually comes down to one thing:

“Go back, talk to your users, build for them. If you don’t have users, iterate and talk to people until they become users”.

This laser focus on the customer is something that Jeff Bezos is also famous for.

“It doesn’t matter to me whether we’re an internet play, what matters to me is do we provide the best customer service? Internet, shminternet.”

Customer focus leads to faster growth. And as Paul Graham will tell you, that’s all a startup is really about.

The time-bound nature of YC’s program, culminating in Demo Day, where you pitch to a room full of Silicon Valley’s top VC’s, also gives founders a clear deadline. This drives further focus.

3. The Power of Networks

YC is probably the most powerful organisation in Silicon Valley. It has the ability to shut VC firms out of deals and even move markets. This is all thanks to the strength of its network.

Overcoming adversity together

The gruelling shared experience of applying for and going through the YC program an essential part of its strength as an organisation.

People who have experienced this share a powerful bond with one another. This loyalty scales to thousands people they’ve never met before - YC’s other portfolio founders. Portfolio founders are willing to mentor and fund new recruits. Many have made a lot of money and have significant clout in Silicon Valley. This creates a virtuous cycle that is very hard to compete with once it builds momentum.

What’s more, thanks to the quality of the people in YC’s network, by extension you are two degrees of separation from practically anyone of influence in the world of technology.

Helping quality entrepreneurs from across the USA (and now around the world) to tap into the dense network of Silicon Valley’s elite is a positive-sum game where everyone wins. New members get access to capital and talent, and existing members get access to dealflow.

YC have further doubled down through proprietary platforms like Bookface, Hacker News and Startup school. These platforms further strengthen the bonds between their alumni, extend their reach and attract more entrepreneurs into their orbit.

The network effects compound in a number of ways that make YC very hard to catch up with…

Success begets success

YC benefits from “availability bias”, like many other successful VC’s.

Since they have backed so many quality companies, more quality founders know about them and seek them out. They associate YC’s past success with a higher probability of future succcess, and so YC gets the pick of the bunch. This means more success, and the cycle repeats ad infinitum.

Faster adoption of products

It is no coincidence that almost 50% of YC’s unicorns are B2B software companies, with another ~25% in fintech. Their first customers are the businesses around them.

The Collisons, for example, famously set up Stripe on the computers of other founders in their YC batch. Stripe is now the payments infrastructure for half of the internet.

If you invest in YC-backed companies, you will see that they often bank with Brex (YC W17, now valued at $12.3B), manage their cap table with Pulley (YC W20, backed by Founders Fund, General Catalyst and Stripe) and sign documents with Hellosign (YC W11, acquired by Dropbox (YC S07)).

“Locking out” competition

Through the unique combination of growth hacks, influence, capital, information and scale that their network offers founders, YC de-risk their investments.

This is because they help network effects businesses reach critical mass faster.

One of the key factors for success in a company that benefits from network effects is the speed at which you reach “critical mass”. YC’s alumni network helps the companies in their portfolio (B2B in particular) to reach critical mass faster, becoming the winners in what Fred Wilson calls “Winner Takes Most” markets.

And that means monopoly profits - just like the Mob.

Note: Ryan Breslow’s claims are pretty far-fetched and largely unsubstantiated. But it is a funny read.

4. Luck and Timing

The “batched” nature of YC is what allowed it to create network effects in the first place. But this wasn’t really planned…

“Initially we didn't have what turned out to be the most important idea: funding startups synchronously, instead of asynchronously as it had always been done before. Or rather we had the idea, but we didn't realize its significance. We decided very early that the first thing we'd do would be to fund a bunch of startups over the coming summer. But we didn't realize initially that this would be the way we'd do all our investing. The reason we began by funding a bunch of startups at once was not that we thought it would be a better way to fund startups, but simply because we wanted to learn how to be angel investors, and a summer program for undergrads seemed the fastest way to do it. No one takes summer jobs that seriously. The opportunity cost for a bunch of undergrads to spend a summer working on startups was low enough that we wouldn't feel guilty encouraging them to do it.” - Paul Graham, “How Y Combinator Started”2

Their timing was also impeccable. Post dotcom crash, it was incredibly hard to raise money. This was compounded by the great recession in 2008. Valuations were therefore low and YC was an attractive deal for founders, even at ~$20k for 6%, given the success rate with follow-on funding.

Nowadays, there are way more VC’s competing for deal access. YC are investing $125k for a similar stake to an investment of $20k only 10 years earlier.

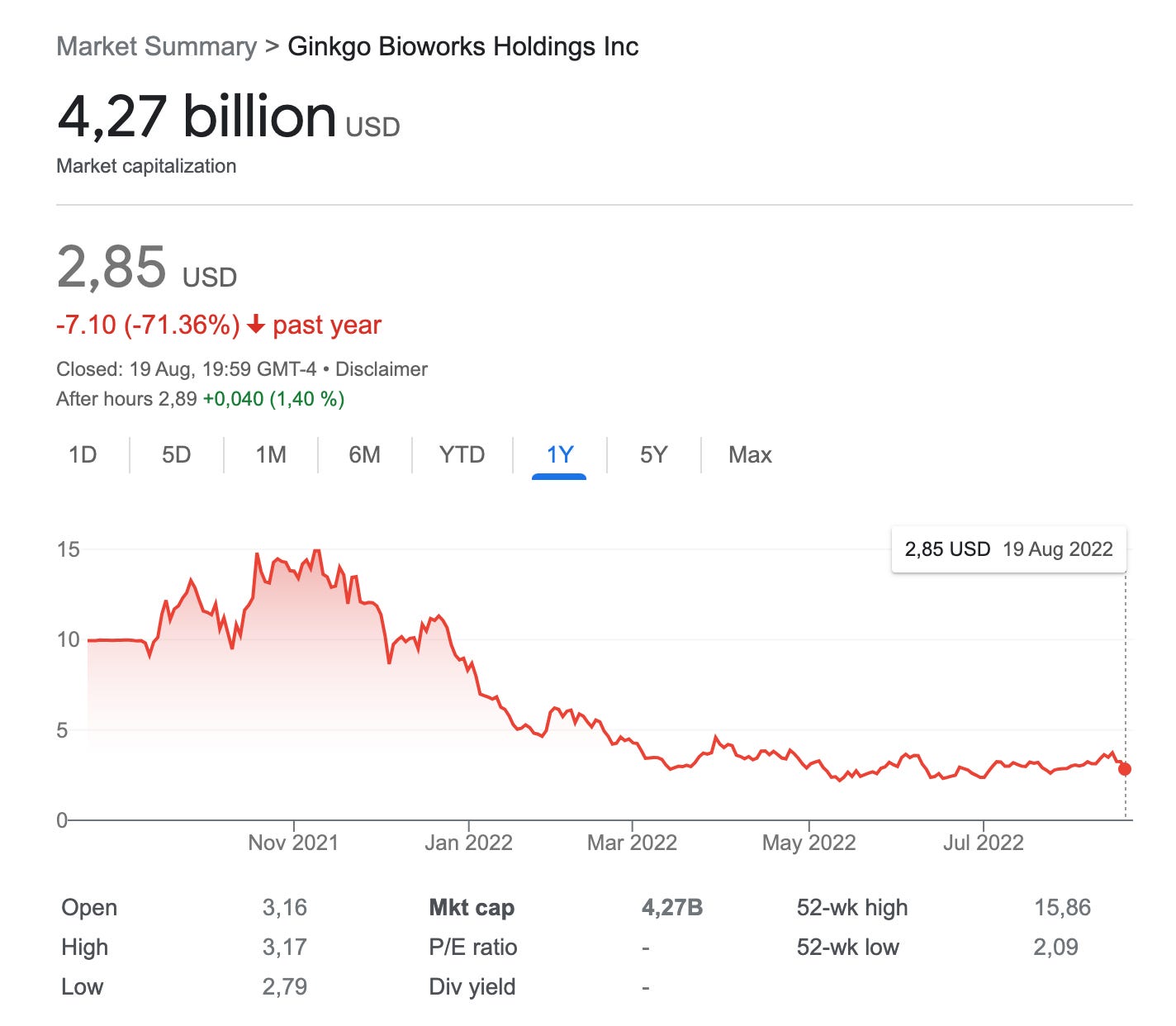

They got in near the bottom on those early deals, and from 2020-2021 they got out near the top of a QE-fuelled bubble. Many of their 2021 public listings are now down 60% -70% or more from last year’s highs:

5. Heresy

Seeing value where others do not is the source of financial upside.

This is also a good way to think about progress. Many great scientists and thinkers, from Socrates to Galileo, were considered heretics by their peers. They believed things others considered absurd, unacceptable, or even punishable by death.

There are three strategies that YC has deployed since its inception that are most certainly “non-consensus”:

Black Swan Farming

Education

Indexing

Black Swan Farming

“The two most important things to understand about startup investing, as a business, are (1) that effectively all the returns are concentrated in a few big winners, and (2) that the best ideas look initially like bad ideas.”

Paul Graham - “Black Swan Farming”

PG realised that when a domain expert proposed something that sounded insane, the probability of it being a big winner was significantly higher than if it sounded sane.

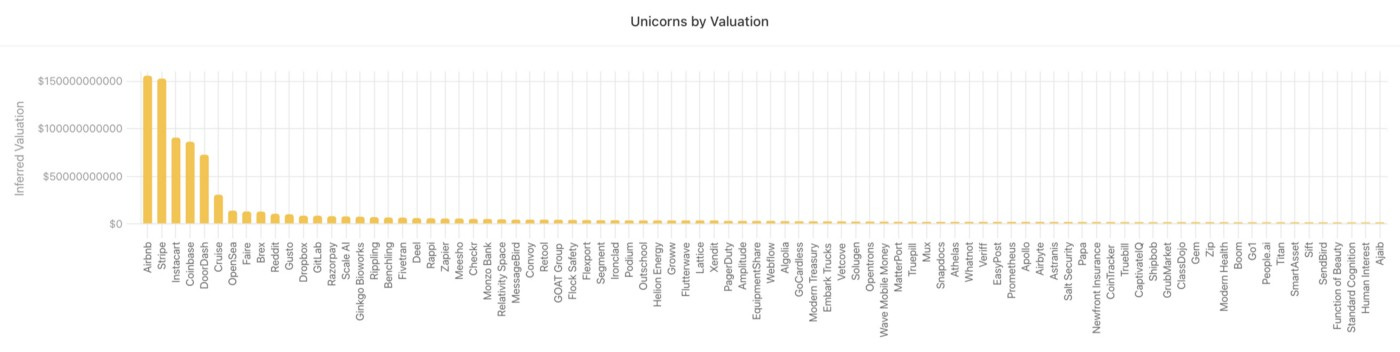

This is important, because the big winners are the only thing that matters. Even amongst YC’s unicorns, the top 10 have created 2/3 of all the value the firm has generated.

So in startup investing it’s actually smarter to take a punt on insane ideas than to go with bets that seem safer.

Education

When YC first started, Paul Graham had felt for some time that VC’s should be taking bets on younger founders, and funding “hackers, not suits”. Why?

Younger people have less to lose. In an asset class where taking big risks is encouraged, this is valuable. Provided they are teachable, you can potentially leapfrog the presupposed need for experience when starting a company.

It is easier to teach a great software engineer to do business than it is to teach a great businessperson to write software.

Untapped potential. Since very few firms were willing to take a bet on these people, it was possible to invest at a lower price, meaning more upside. All they needed was some coaching.

Many pieces of wisdom we now see as platitudes in startup land - “do things that don’t scale”, “get to default alive”, “talk to your users” - are mantras from YC’s gospel of startup education.

It seems obvious that this should work in retrospect, but even today very few VC firms think about how they support founders with education.

Geoff Ralston describes YC as “Crispr For Startups” - through education, they alter the company’s “DNA” and increase its survival probability in the Darwinian world of the free market.

Indexing

The whole business model of venture capital is predicated on the ability of the fund manager to pick out winners; needles in haystacks.

To this day, most VC’s tend to have very concentrated portfolios, of 15 - 25 companies per fund. They make big bets on a small number of companies. They charge relatively high “management fees” - ongoing cash fees - for the hands-on support they (supposedly) provide to investee companies (plus carried interest; a share of the profits on exit).

YC’s strategy is pretty much the opposite. They build very large portfolios of small bets, and outsource the support to their network.

In fact, just like the public markets, 95% of investors in startups would be better off taking YC’s approach and indexing, according to data from AngelList’s research team:

“We did do some simulations on what indexing at seed actually looks like over human timescales. Over a ten-year investment window, indexing beats 90-95% of investors picking deals, even when those investors have some alpha on deal selection. So the idea that there are some terrific seed investors that soundly beat indices is not inconsistent with our results.”

What makes YC so unique is that they seem to have managed to index a cross section of the top quartile or so of companies, at a much lower entry price than anyone else. So they get the returns of a top-decile VC, with the reduced risk of indexing.

What’s next for YC?

It will be interesting to see what the next 10-15 years hold for Y Combinator in terms of exit value. It is highly unlikely we’ll see the sorts of multiples that they delivered in their first ~10 years again soon.

That being said, new opportunities abound.

Technology has gone global.

YC are expanding into new sectors, and geographies, deploying more cash. and funding ~10x the number of companies they did in 2010.

And their pricing power remains significant. Thanks to all the value they create for founders, their ability to dictate price vs. the rest of the market is improving over time:

Given the power of the network effect that YC benefits from, if they have generated $900B in value from ~100 portfolio companies in the last ~15 years, then why not $9 Trillion in value from ~1000 companies in the next ~15?

Business is about two things - how much value you create, and what percentage of that value you manage to capture.

Progress is about the first part of that equation only. Even if YC’s multiples start to flatten out as they scale, there is so much value still to be created.

This extends beyond the companies they directly back. Alumni have gone on to run incredibly influential companies like Pinterest, OpenAI and Mercury, and build successful VC firms like Initialized Capital.

This is what makes Y Combinator special. It creates so many interesting and well-aligned ripples around itself that some inevitably become waves over time.

YC may well turn out to be much more than a successful venture firm.

It has the potential to become one of the most important drivers of progress in modern history.

P.R.

Risk Warning

Investing in start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. Odin is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via Odin once you are registered as sufficiently sophisticated. This content is for informational purposes only and should not be considered investment advice.

Join Odin Limited is an appointed representative of Aldgate Advisors Limited, which is authorised and regulated by the Financial Conduct Authority (No. 763187).